Pre-Open Data

Key Data for the Week

- Monday – EUR – Retail Sales

- Tuesday – US – Consumer Price Index

- Wednesday – EUR – Industrial Production

- Thursday – AUS – Consumer Inflation Expectations

- Thursday – EUR – Consumer Price Index

- Thursday – US – Retail Sales

- Friday – CHINA – Gross Domestic Product

Australian Market

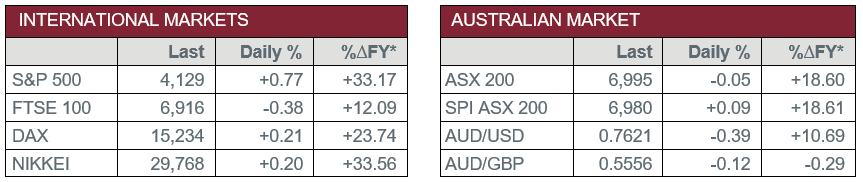

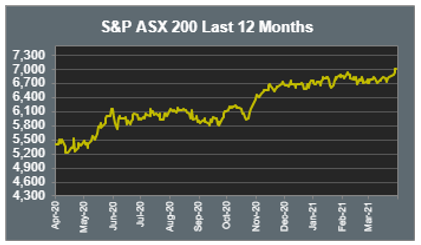

The Australian sharemarket closed down 0.1% on Friday, after reaching post-pandemic heights in its best week since early February. In the week shortened by Easter, the Australian sharemarket rallied to post a 2.4% gain, following advances in overseas markets.

Despite the positive news surrounding a ‘travel bubble’ with New Zealand, the travel sector closed weaker on Friday. Corporate Travel Management fell 3.0%, Flight Centre lost 2.7%, Sydney Airport slipped 1.6% and Webjet finished the session 2.5% lower.

The Financials sector closed relatively flat, with NAB and Westpac the best performers of the big four banks, up 0.3% and 0.2% respectively. The Banks have all enjoyed a stellar run of late, lifted higher by the possibility that inflation could return sooner than expected.

The mining heavyweights recorded a slight loss on Friday with BHP (-0.3%), Fortescue Metals Group (-0.5%) and Rio Tinto (-0.3%) all dragging the sector lower. Goldminers Northern Star and Newcrest Mining bucked the downward trend, adding 1.1% and 1.0% respectively.

The Australian futures market points to a 0.09% rise today.

Overseas Markets

European sharemarkets marked their longest consecutive weekly winning streak since November 2019, lifted higher as hopes of an economic recovery outweighed any doubts of a lagging COVID-19 vaccination program. The STOXX Europe 600 lifted 0.1%, while the German DAX added 0.8% to reach an all time high, with investors focusing on the monetary and fiscal policy provided by their Government and their progressing rollout of the COVID-19 vaccination.

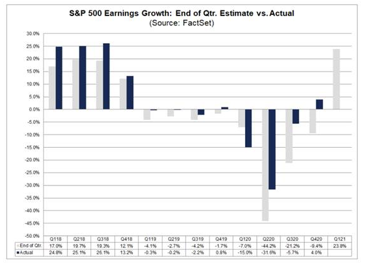

US sharemarkets advanced on Friday as investors disregarded fears of inflation that had been present following President Joe Biden’s extensive stimulus package. Amazon recorded a 2.2% gain as warehouse workers in Alabama failed to form a union after the company had been union-free for more than two decades. Technology giants also rose; Apple added 2.0%, Microsoft gained 1.0% and Alphabet climbed 0.9%. All eyes will be on the US sharemarket this week as reporting season gets underway with Goldman Sachs, JP Morgan and Wells Fargo set to start proceedings this Wednesday.

By the close of trade, the NASDAQ gained 0.5% and the Dow Jones rose 0.9%, while the S&P 500 strengthened lifted 0.8%, to hit a record closing high.

CNIS Perspective

Last week US Federal Reserve Chair Jerome Powell stated there is significant headway to be made within the economy before reaching its targets on unemployment and inflation, meaning there is ‘slack’ in the economy for further growth.

Bond yields have also stabilised in recent weeks as fears of a near-term policy shift in interest rates have cooled, prompting investors back into growth stocks, such as the big technology companies, that benefit from a low interest rate environment.

However, the most important factors to the economic recovery are the vaccine rollout and stimulus measures, both of which have made significant progress.

To date, 170 million Americans have received at least one dose of the vaccine and this is key to job creation as the economy continues to re-open.

With an extraordinary amount of stimulus being poured into the US economy, it appears the US is on track for continued economic recovery, leading to strong corporate earnings.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.