Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Confidence and Conditions – Confidence edged up to -5, while Conditions were higher to 14.

- Tuesday – US – Consumer Price Index rose 0.1%, to 0.3% in August.

- Wednesday – AUS – HIA New Home Sales

- Wednesday – EUR – Industrial Production

Australian Market

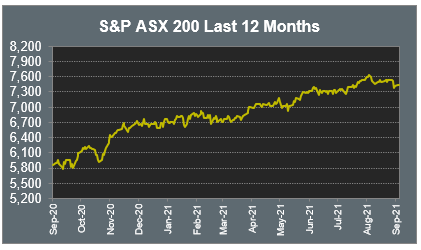

The Australian sharemarket enjoyed its third consecutive day of gains, as the Reserve Bank Governor stated that interest rates will not rise until 2024. This resulted in a late rally on the ASX, which closed the session 0.2% higher.

The Energy sector was the best performer on the market, up 4.5%. Beach Energy added 7.2% and Santos lifted 5.2%, while Woodside Petroleum jumped 6.2%.

Gains in the big four banks led the Financials sector 0.4% higher during the day’s trade. Commonwealth Bank, Westpac and ANZ all added 0.3%, while NAB lifted 0.2%. Fund managers were mixed; Challenger gained 1.6%, while Magellan Financial Group and Australian Ethical Investment conceded 1.0% and 12.8% respectively.

The Industrials sector was the main underperformer yesterday, after it shed 1.1%. The largest detractor was container transport group, Brambles (-8.3%), as the company forecasted profits to improve by only one or two percent this financial year. The airports also lost ground; Sydney Airport slipped 1.7% and Auckland International Airport shed 0.4%.

The Australian futures point to a 0.57% fall today, driven by weaker overseas markets.

Overseas Markets

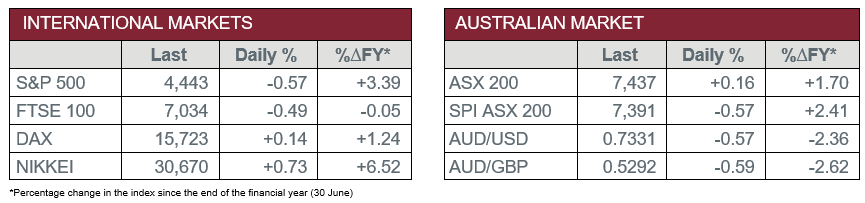

European sharemarkets closed relatively flat overnight. The Materials sector weakened, as iron ore prices continue to fall; London-listed BHP and Rio Tinto lost 2.7% and 2.0% respectively, while Glencore dropped 1.1%. The Financials sector also lost ground, as Barclays conceded 0.5%, ING Group lost 0.6% and Deutsche Bank lost 0.8%.

By the close of trade, the STOXX Europe 600 lost less than 0.1% and the UK’s FTSE 100 slipped 0.5%, while the German DAX gained 0.1%.

US sharemarkets weakened on Tuesday as the likelihood of corporate tax rate increases reduced investor sentiment. The indices rallied initially following the release of the Consumer Price Index report, however all ended the session in the red. The Financials sector was among the worst performers, as Bank of America lost 2.7% and Goldman Sachs Group fell 1.4%. The Information Technology sector was mixed; Microsoft added 0.9%, while Apple dropped 1.0%.

By the close of trade, the NASDAQ lost 0.5%, while the S&P 500 fell 0.6% and the Dow Jones closed 0.8% lower.

CNIS Perspective

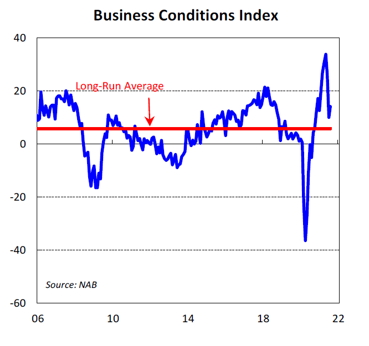

While it’s almost certain the Australian economy will record negative GDP in the September quarter, optimism going into the 4th quarter is growing for when the economy hopefully re-opens.

Following large declines in Business Confidence and Conditions in July, it was pleasantly surprising to see the index improve slightly in August.

Business Conditions and Confidence have remained much more resilient this year than in the early stages of the pandemic last year, reflecting strong momentum in the economy heading into the recent lockdowns and confidence the vaccine rollout will see an end to lockdowns.

This will place the economy in a good position to recover once restrictions ease and hopefully see a significant rebound in GDP in the December quarter.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.