Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – EUR – Markit Manufacturing PMI

- Tuesday – US – Markit Manufacturing PMI

- Tuesday – US – Consumer Confidence

- Wednesday – AUS – Construction Work Done

- Wednesday – US – Gross Domestic Product

- Thursday – EUR – ECB Monetary Policy Meeting

- Thursday – US – Initial Jobless Claims

- Friday – EUR – Consumer Confidence

Australian Market

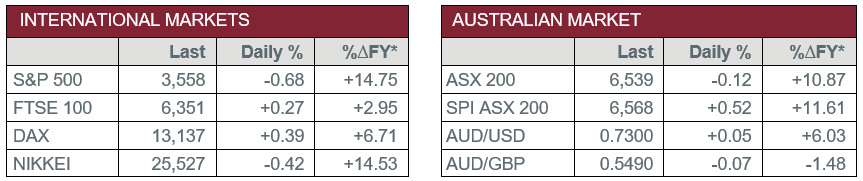

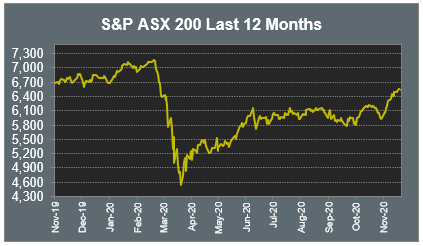

The Australian sharemarket eased 0.1% on Friday, while the local market rose 2.1% over the course of the week to record a third consecutive week of gains.

Commonwealth Bank led the gains for the Financials sector, up 1.4% to hit an eight-month high, after APRA wound back its requirement for the bank to hold $1 billion in risk capital to $500 million. For the week, Commonwealth Bank climbed 9.4%, ANZ and Westpac both added 8.6%, while NAB rose 5.3%.

The Energy sector was the weakest performer as no stock in the sector recorded gains. Oil Search slipped 5.1% after receiving multiple broker downgrades, while Santos lost 1.3% and Woodside Petroleum fell 0.6%.

The Materials sector was mixed; Rio Tinto added 0.5%, BHP lost 1.0% and Fortescue Metals closed flat.

The Australian futures market points to a 0.52% rise today.

Overseas Markets

European sharemarkets closed higher for the week, as vaccine optimism offset concerns about worsening coronavirus trends. Data showed Europe is now recording more coronavirus deaths than during its April peak, as the World Health Organization warned of a tough six months ahead for Europe. By the close of trade, the broad based STOXX Europe 600 rose 0.5% to gain 1.2% for the week.

US sharemarkets weakened on Friday as the Dow Jones and S&P 500 lost 0.7% and 0.8% for the week, while the NASDAQ rose 0.2%. The Information Technology sector was weighed down by heavyweights Alphabet, Apple, Facebook and Microsoft, all down between 1.0% and 1.2% on Friday. Financial services companies were mostly weaker; MasterCard fell 3.3% and Visa lost 1.8%, while PayPal bucked the trend to add 0.9%.

CNIS Perspective

A holiday shortened week in the US will be packed with a raft of economic data to be released.

This week will see back to back releases including; third-quarter gross domestic product, initial jobless claims, trade balance, durable goods orders, new home sales and consumer sentiment data, as well as minutes from the Federal Reserve’s November meeting and the outlook for additional stimulus measures.

However, what will be of more interest this week is ‘Black Friday’ and the associated buying frenzy that we often see each year.

In a traditional year, the five-day period between Thanksgiving and Cyber Monday marks the unofficial start to the holiday shopping season and is a major source of revenue for retailers.

However, will 2020 see the same results? During a year that has repeatedly tested the resilience of retailers, Black Friday has turned into a bit of a wildcard.

Factors such as increased online shopping over the past several months as a result of the pandemic, the timing of Amazon Prime Day and the overall reduction in consumer spending as a result of economic and job uncertainty, may play a role in this weekend’s sales figures.

The success of the Amazon Prime Day, which has been estimated to have generated more than US$7 billion in sales, is being touted as evidence consumers may have already started their Christmas shopping.

Predictions are also mixed as to how many consumers will shop at bricks and mortar stores given the recent uptick in the number of COVID-19 cases.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.