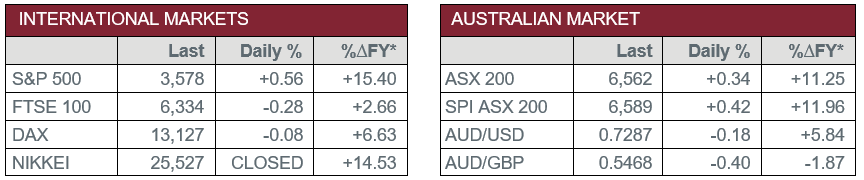

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – EUR – Markit Manufacturing PMI was 53.6 for November, above expectations for 53.1, however, down 1.2 points from October.

- Tuesday – US – Markit Manufacturing PMI

- Tuesday – US – Consumer Confidence

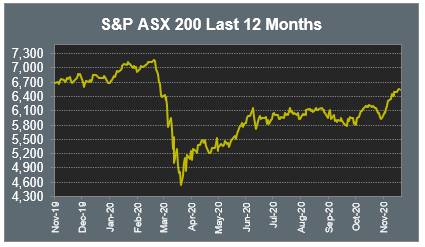

Australian Market

The Australian sharemarket rose 0.3% yesterday, in a mixed session of trade. The Energy and Materials sector saw the strongest gains due to firmer commodity prices. Oil Search, Woodside Petroleum and Santos all rose between 1.6% and 4.8%, while mining heavyweights BHP, Rio Tinto and Fortescue Metals all added between 1.5% and 3.9%.

The Financials sector weakened as the big four banks were mostly lower; ANZ and Commonwealth Bank slipped 0.3% and 0.5% respectively, while NAB closed flat and Westpac rose 0.1%. Macquarie Group gained 2.2%, while fund managers were also mixed; Magellan Financial Group fell 1.6% and Australian Ethical Investment added 3.1%. Insurance Australia Group slumped 6.0% after the company completed a $650 million capital raise.

CSL rose 1.0% to help lift the Health Care sector, while Sonic Healthcare and Ramsay Health Care fell 1.9% and 1.2% respectively.

Travel stocks rose following the lifting of the NSW and Victoria borders. Qantas and Sydney Airport rose 1.7% and 1.2% respectively. Qantas said it could see domestic capacity increase to 60% of pre-COVID levels by Christmas with the easing of border restrictions.

The Australian futures market points to a 0.42% rise today.

Overseas Markets

European sharemarkets closed lower on Monday, with the broad based STOXX Europe 600 down 0.2%. HelloFresh fell 5.9% after the company announced it is set to acquire US meal kit provider, Factor75, for approximately US$277 million, while other consumer stocks Nestlé and Tesco both slipped 2.1%. Industrials were mixed as Eiffage and Vinci rose 1.8% and 0.7% respectively, while Veolia and CRH lost 0.8% and 1.3% respectively.

US sharemarkets rose overnight with vaccine optimism the catalyst, overshadowing renewed US-China trade tensions as the Trump administration is pushing for new hardline measures against Beijing. Payment providers outperformed as MasterCard, PayPal, and Visa all lifted between 2.1% and 4.2%. Technology stocks underperformed; Apple led the declines, down 3.0%, Facebook slipped 0.5% and Alphabet lost 0.4%, while Spotify bucked the trend to rise 3.4%.

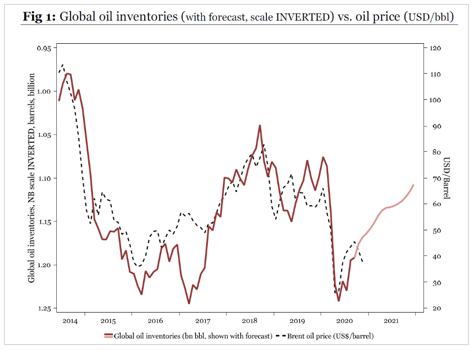

CNIS Perspective

The price of oil has been subdued most of the year and while it’s acknowledged there are a number of moving parts in the oil supply and demand equation, there are three top level themes that should result in an ongoing escalation of the oil price next year.

i) OPEC has maintained a strong supply discipline for quite some time and shows no signs of compromising its current stance. Since May, OPEC has shown high compliance with their production quotas and pushed back the timing of their planned supply increases.

ii) A possible full recovery in global demand next year, or at least in the second half of the year, with an effective vaccine triggering the release of pent up demand for travel and normalisation of transport activity in 2021.

iii) Evidence US oil production growth will remain relatively weak in 2021, as US fracking companies have recorded a sharp fall in capital expenditure this year. This suggests subdued production in US oil until at least mid-2021.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.