Pre-Open Data

Key Data for the Week

- Thursday – AUS – Private Capital Expenditure fell by 2.2% in the September quarter, impacted by prolonged lockdowns.

- Friday – AUS – Retail Sales

- Friday – UK – Nationwide House Prices

- Friday – CHINA – Industrial Profits

Australian Market

The Australian sharemarket inched 0.1% higher on Thursday, after mixed company news and announcements. Kogan held its Annual General Meeting, to which investors were seemingly unconvinced, as the share price fell 4.3%. Meanwhile, Fisher & Paykel Healthcare improved, up 4.6%, after it reported a slight decline in profit and revenue alongside its NZ$700 million capital expenditure plan. Other notable news included EML Payments’ (31.3%) announcement that previous regulatory concerns from the Central Bank of Ireland had been resolved.

The Information Technology (2.4%) sector was a major standout, which bolstered the local market. Key movers included Afterpay (4.2%) and lithium battery innovator Novonix (11.9%).

The price of iron ore rose by 2.9%, to US$102.75 a tonne, which strengthened miners. BHP rose 1.0%, while Rio Tinto and Fortescue Metals Group lifted between 1.6-1.8%. The Materials sector closed 0.9% higher.

The Financials sector was a primary laggard, down 0.9%, after all major banks closed lower. Losses were led by Commonwealth Bank (-1.5%), followed by ANZ (-0.9%), Westpac (-0.8%) and NAB (-0.5%). Macquarie Group extended losses further, down 0.7%.

The Australian futures point to a flat open today.

Overseas Markets

European sharemarkets rose on Thursday, as investors favoured defensive sectors like Utilities (1.8%) amid concerns around increased COVID-19 cases across the region. The Utilities sector also benefited from Germany’s move toward greater climate protection via an accelerated coal exit and expansion of renewable energy investment. Technology stocks closed higher for the first time this week, broadly up 0.6%, after higher interest rate expectations impacted the valuation of growth orientated stocks. By the close of trade, the German DAX, UK FTSE 100 and STOXX Europe 600 all rose between 0.3-0.4%.

US sharemarkets were closed for Thanksgiving, and will be open for a shortened session on Friday. Fundstrat Global provided some commentary on the S&P 500 this month, noting strength in the Consumer Discretionary, Information Technology and Materials sectors. Meanwhile, the ‘fourth wave’ of COVID-19 has raised concerns around lockdowns, which has weakened travel and leisure stocks.

Canadian sharemarkets were open on Thursday, which saw most sectors advance. Notable movers included cryptocurrency related stocks Bitfarms (3.2%) and Galaxy Digital (5.4%), alongside renewable energy provider Vestas Wind Systems (5.5%).

CNIS Perspective

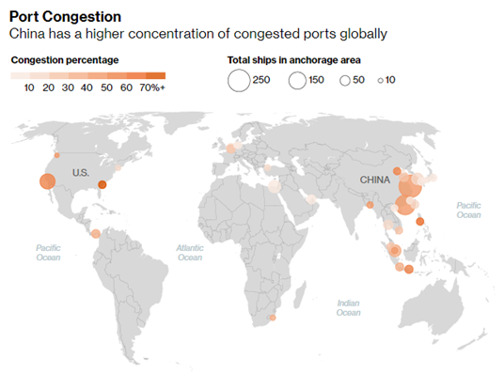

We have previously written about global supply chain issues, resulting from COVID-related factory closures to energy shortages, port capacity constraints and shortages of truck drivers.

China’s increasing and extreme ‘COVID Zero’ policies are now standing in the way of a full recovery for the shipping industry and prolonging the supply chain crisis. The latest restrictions at China’s ports target Chinese crew, requiring them to quarantine for three weeks before their return to China, another two weeks at the port of arrival, and two more weeks in their province before they can reunite with their families.

Ship owners and operators are managing these restrictions by shifting the burden to the workers onboard, however, Chinese authorities won’t allow more than three Chinese seafarers on a flight to the mainland, so their return home can be stretched to months after they’ve signed off from vessels.

Anglo-Eastern, one of the world’s largest ship management companies, said this week that 555 of its 16,000 active crew are overdue for relief, and nearly 60 have been on ships for more than 11 months, the maximum mariners are allowed by international law to be on board.

Supply chain disruptions don’t show signs of abating and, according to a new Oxford Economics survey of 148 businesses, nearly 80% of respondents said they expect the supply crisis still has scope to worsen.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.