Pre-Open Data

Key Data for the Week

- Monday – EUR – Consumer Confidence

- Monday – US – Pending Home Sales

- Monday – AUS – Company Profits

- Tuesday – AUS – Building Approvals

- Tuesday – EUR – Consumer Price Index

- Tuesday – US – Consumer Confidence

- Wednesday – AUS – Gross Domestic Product

- Wednesday – US – Markit Manufacturing PMI

- Thursday – AUS – Trade Balance

- Thursday – US – Unemployment Rate

- Friday – US – Unemployment Rate

- Friday – EUR – Retail Sales

Australian Market

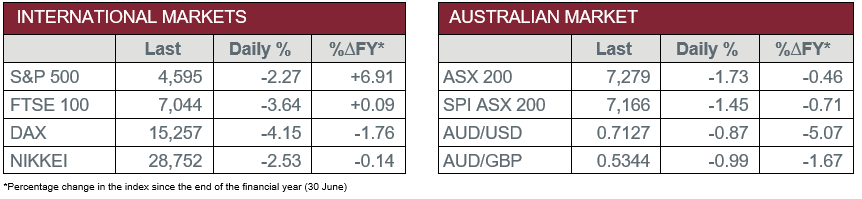

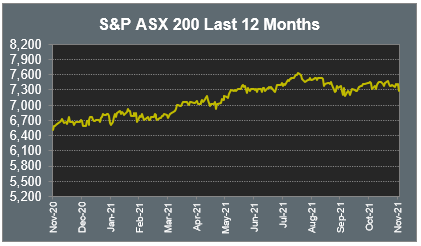

The Australian sharemarket eased 1.7% on Friday, as all sectors closed lower. Market weakness followed concerns a new COVID-19 variant may hinder reopening progress, as nations immediately reimposed travel restrictions. Over the week, the local ASX 200 fell 1.6%, its third consecutive week of losses.

The Energy sector slid 4.6% on Friday as a result of weaker oil prices, with concerns the new COVID-19 variant will impact demand. Santos slid 4.8%, while Woodside Petroleum and Oil Search gave up 5.1% and 5.5% respectively.

The Information Technology sector shed 2.3%, weighed down by artificial intelligence company Appen, which tumbled 18.8% following a broker downgrade. Buy-now-pay-later providers also closed lower; Sezzle lost 7.4% and Zip Co fell 5.0%, while Afterpay slipped 2.4%.

The Australian futures market points to a 1.45% fall today.

Overseas Markets

European sharemarkets weakened on Friday, as the STOXX Europe 600 gave up 3.7%, its worst session since June 2020. Travel and leisure stocks tumbled as the UK suspended travel from six countries in southern Africa; International Airlines Group gave up 14.6% and German airline Lufthansa shed 12.8%, while easyJet lost 12.1%. The Energy sector saw sharp losses; BP fell 7.5% and Royal Dutch Shell lost 5.7%. By the close of trade, the UK FTSE 100 eased 3.6%, while the German DAX slid 4.2%.

US sharemarkets also fell on Friday. Travel stocks tumbled as the US also imposed travel restrictions on nations in southern Africa; cruise line operator Carnival Corp lost 11.0% and United Airlines shed 9.6%, while Delta Airlines and Boeing fell 8.3% and 5.4% respectively. The Health Care sector was the strongest performer; Moderna climbed 20.6% and Pfizer gained 6.1%, while Danaher Corporation lifted 2.7%.

The Information Technology sector closed weaker; NVIDIA gave up 3.6% and Apple fell 3.2%, while Alphabet and Microsoft lost 2.7% and 2.4% respectively. However, Spotify bucked the trend to close up 0.6%. By the close of trade, the NASDAQ gave up 2.2%, while the S&P 500 and Dow Jones lost 2.3% and 2.5% respectively. Over the week, the Dow Jones fell 2.0% and the S&P 500 closed down 2.2%, while the NASDAQ shed 3.5%.

CNIS Perspective

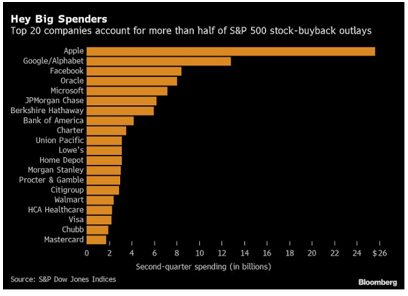

Buybacks are once again booming for US mega-cap stocks, particularly with the FAANG and Microsoft, the S&P 500 heavyweights that make up 25% of the bellwether index. The third quarter of 2021 has beaten the previous buyback record set in the 4th quarter of 2018, which was just after former US President Donald Trump slashed US corporate tax rates.

The effect of the billions of dollars spent by companies on repurchasing their shares at current levels is a cause for concern as it supports equity markets at lofty valuations, which may create a level of investor complacency. This is especially true given the very large contribution of FAANG and Microsoft to the total performance of the S&P 500 in recent years.

While it is perfectly legitimate for companies to buy their own shares, this should not be perceived by investors as the healthiest source of demand for shares, particularly when the companies in question exert such a strong influence on broad market index returns.

The elevated valuation levels of these companies make it difficult to argue that better use of the companies’ capital could not be found, such as R&D, acquisitions etc.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.