.png)

Accounting Packages for Lawyers

Established in 1953, we specialise in the provision of advisory services for legal practitioners at all stages of their career. With a deep understanding of the accounting and wealth-building requirements of the legal industry, we can partner with you to help you achieve your financial goals.

We can help you with:

- Commencing your legal practice

- Legal practice structuring

- Strategies for buying your business premises

- Effective practice service entities

- KPI Development and Assistance

- Tax deductible debt strategies

- Succession planning

- Tailored superannuation strategies

- Retirement planning

- Estate planning

- General and personal insurance

- Asset protection

- Salary packaging

- Xero Advice

- Cloud based record keeping

- Managing your tax compliance obligations

- Trust account audits

Your duty accountant & advisor - do you have a question for us?

As a NSW Law Society member we offer you a complimentary general advice consultation up to 1 hour with one of our trusted accounting and financial advisors. Whether you need advice on taxation services, superannuation, legal practice services or more, we’ll make sure you meet with the right advisor for your needs.

New to profession

Graduate - $59 + GST per annum*Professional - $149 + GST per annum

- Tax return prepared and lodged.

- Personally tailored wealth creation strategies.

- Expert advice on salary packaging.

- Access to in-house finance team.

- Strategies to get into your first, or next home sooner.

- Low cost - Low entry balance flexible superannuation.

*Graduate pricing for the first three years then reverts to professional pricing.

New to practice

$400 + GST per month*- Advice regarding the most optimal structure.

- Establishment of business entities.

- Registration of ABN, GST and PAYGW as required.

- Setup with business Xero file and training package.

- Quarterly management reports.

- Assistance with lodgement of quarterly BAS.

- Preparation of pre year-end tax and strategy plan.

- Preparation of financial statements and tax returns.

- Personally tailored wealth creation strategies.

- Access to our in-house finance specialists with professional specific finance and insurance packages.

- Personal strategy and budget to get into your first, or next home sooner.

- Two meetings a year with your dedicated client advisor to ensure your financial goals remain on target.

*One entity - first three years

New to partnership

$600 + GST per annum*- Tax return prepared and lodged.

- Cashflow budget of tax payments on the transition to partner from employee.

- Personally tailored wealth creation strategies.

- Access to our in-house finance specialists with professional specific finance and insurance packages.

- Personal strategy and budget to get into your first, or next home sooner.

- One meeting a year with your dedicated client advisor to ensure your financial goals remain on target.

*Individual partner only

TERMS AND CONDITIONS

Additional costs will be as follows:- $100 per rental property (usually $200)

- $100 per CGT event excluding business sales (usually $150)

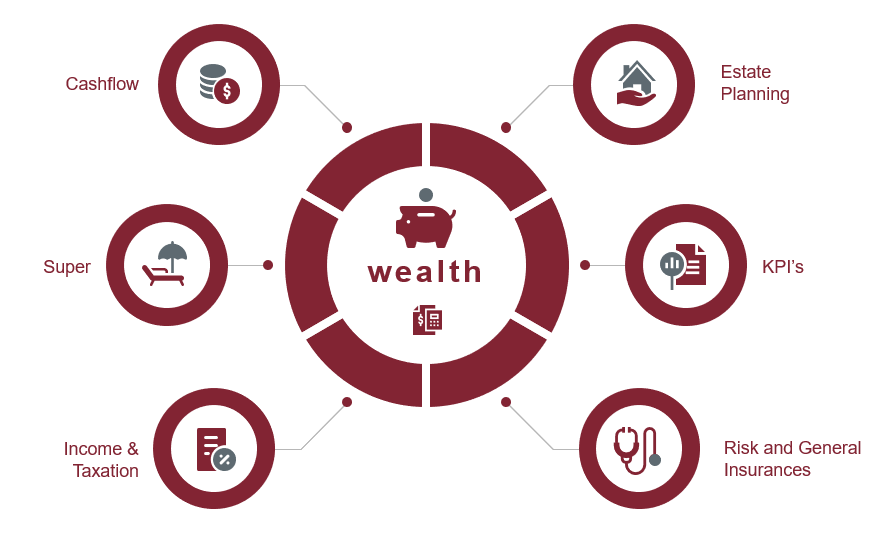

7 Pillars for Success

As a firm we have 70 years of experience in providing the highest quality compliance and advisory services to our clients. We take the time to look at the bigger picture, working with you as a trusted advisor over the long term, to help you meet your goals at every stage of your wealth creation and maximization journey.

Our services not only take the stress away from your income tax and compliance, we consider your strategic objectives when structuring your business - whether you’re starting, you’ve outgrown your current structure, or are looking to downsize or exit.

Your journey is important to us, and offer services which assist you along the way, whether monitoring performance and Key Performance Indicators, producing management reports, or protecting your business and wealth from disruption through reviews of your insurances and risk exposure.

Superannuation is critical to growing your wealth toward retirement, our services assist you with your self-managed superfund compliance and investments, including planning for the end, assisting you in planning your estate, so that when the time comes, everything has been thoroughly considered and your wishes are known, well thought out and recorded.

Insights and News

As well as offering education and advice via the NSW Law Society publications, we offer practice management tips and information and updates on legal accounting along with advice from our industry experts in our publication: The Legal Brief.

We also publish several other publications including the Super Sleuth, Business Digest and our daily investment updates.

Meet your team of legal accounting professionals

Amber Ling

Partner

Partner

Amber Ling

BCom, CA, Cert.IV FMB, Dip. FP

Amber prides herself on taking the time to understand the individual needs and objectives of each and all of her clients, and believes in building long-term client partnerships. She takes a personalised approach in helping her clients grow their businesses and reach their financial goals.

Amber joined Cutcher & Neale in 2003, and has over 20 years’ experience in accounting and financial services. This experience has allowed her to gain a deep understanding of all matters relating to tax, superannuation and finance, which enables her to be a trusted financial confidante for her clients.

Jace Pedonese

Partner

Partner

Jace Pedonese

BCom, CA, CTA, Cert.IV FMB, Dip FP, SSAud®

Jace has always been driven to provide tailored and insightful advice to his clients, seeing him become an integral party in achieving their personal and business goals.

Jace joined the firm in 2005 and has over 20 years' experience in the taxation and business services field. By immersing himself within the industry, he has developed a deep understanding of the financial and operational issues that face businesses and, as a result, provides tailored solutions to bring the best possible outcome to his clients.

Jace takes a holistic approach, allowing him to plan for all aspects of his clients personal finances including their practice / business, investments and superannuation.

Matthew Edmonds

Associate

Associate

Matthew Edmonds

BCom, Dip FP, Cert IV FMB, CA

Matt is an Associate of our Accounting and Taxation Services division and has over 15 years’ experience in the taxation and business advisory field assisting clients across a wide range of industries.

Matt enjoys working closely with clients to help them achieve their personal and business goals. He believes in a holistic approach to advising clients, putting their goals front and centre and working together to achieve the best outcomes.