Cutcher's Investment Lens | 1 - 5 December 2025

Cutcher & Neale Wealth Management

07 December 2025

07 December 2025

minutes

Weekly recap

What happened in markets

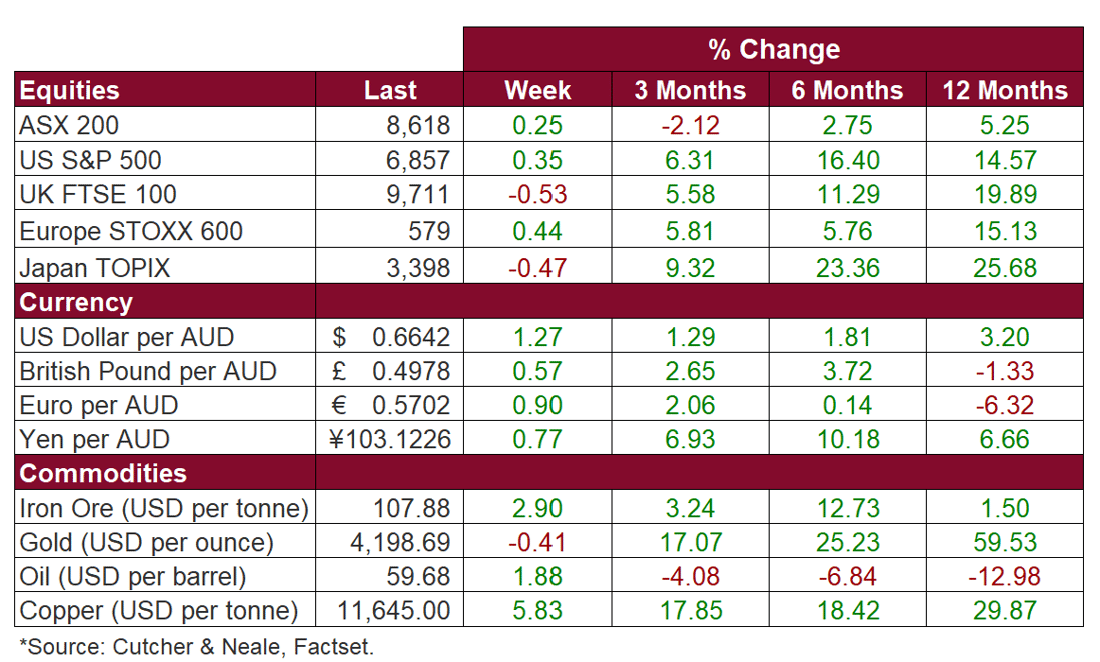

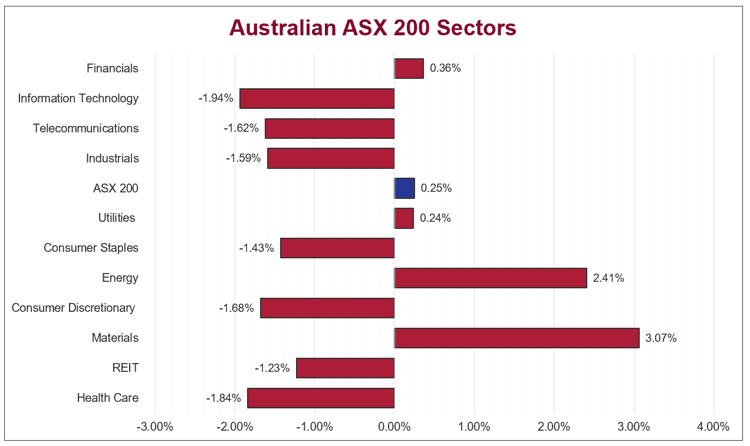

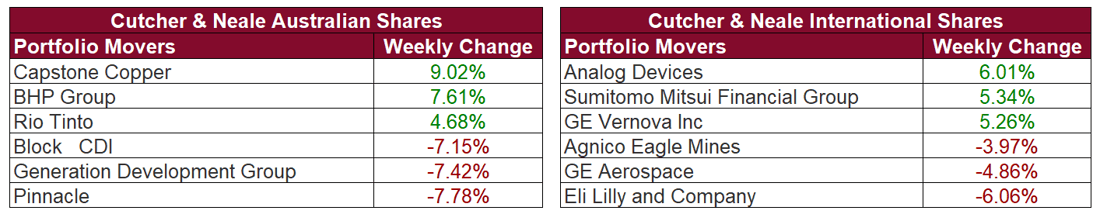

The Australian sharemarket rose 0.3% last week, marking a four-session winning streak as investor sentiment improved on stronger commodity prices and resilience in key domestic sectors. The Materials sector (+3.1%) led gains, supported by strength across copper, lithium, and iron-ore miners, while the Energy sector (+2.4%) benefited from higher oil prices. The Financials sector (+0.4%) also contributed, aided by broad gains across the major banks. As the two heaviest-weighted sectors on the ASX 200, Materials and Financials provided most of the uplift, offsetting declines in rate-sensitive and defensive sectors, including the Health Care (-1.8%) and Information Technology (-1.9%) sectors.

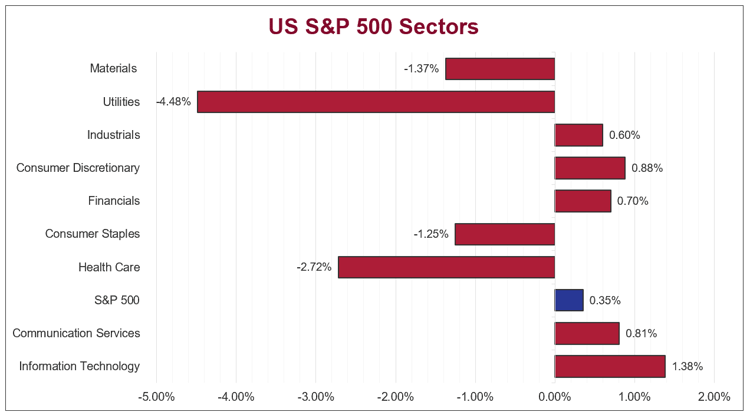

US sharemarkets posted modest gains last week, as the S&P 500 rose 0.4% and the NASDAQ gained 0.9%. The advance extended November’s momentum, supported by optimism ahead of this week’s Federal Reserve meeting, where markets are pricing a 90% probability of a 0.25% rate cut. The Energy sector (+1.4%) led performance, driven by higher oil prices, while the Information Technology sector (+1.4%) also contributed, supported by strength in semiconductor and AI-related companies. In contrast, the Utilities sector (-4.5%), Health Care sector (-2.7%), and Consumer Staples sector (-1.3%) underperformed as higher bond yields weighed on defensive areas of the market.

European sharemarkets showed a modest recovery last week, as the STOXX Europe 600 advanced 0.4%. Gains were led by the Retail sector (+5.1%), which saw strong performance, followed by the Automobile & Parts sector (+5.5%), the Basic Resources sector (+3.2%), and the Technology sector (+2.7%). Moderate gains were also recorded across the Banks sector (+0.7%), the Financial Services sector (+0.4%), and the Energy sector (+0.4%). Offsetting these gains, the Travel & Leisure sector (-1.3%), the Utilities sector (-1.0%), and the Telecommunications sector (-0.9%) declined, while the Health Care sector (-0.2%) was little changed. Overall, strength in cyclical sectors helped lift European equities for the week, offsetting weakness across defensives.

Stock & sector Movements

What caught our eye

A Spending Spree or a Warning Sign?

It’s not often that household spending jumps more than expected and it’s cause for concern, but here we are.

The latest data shows that Australians loosened the purse strings in October, with the Monthly Household Spending Indicator up 1.3%, more than double the market forecast. Annual growth now sits at 5.6%, the highest since mid-2023.

We think the Reserve Bank of Australia (RBA) will be watching this closely and with some unease. Particularly after the upward surprises in inflation recently. The engine is humming maybe too loudly.

Spending was strong across all categories, with discretionary items like clothing, household goods and dining out leading the charge. Notably, essentials like food and health still grew, but at a slower clip. Promotional events likely helped, but even adjusting for that, the momentum looks real.

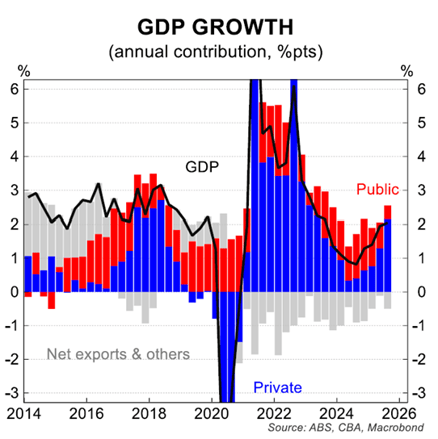

Last week we also got news that GDP rose 0.4% in Q3 2025, a touch below consensus. Annual growth is now running at 2.1%, suggesting the economy is hitting what CBA economists call its “current speed limit”. Spare capacity is disappearing, productivity is inching up and business investment is gaining traction.

It’s also worth noting that household disposable income rose 1% in the quarter, and the savings rate is sitting at a healthy 6.4%, meaning people feel like they can spend and they are. Strong increases in property prices over the past few months also likely helped, as the ‘wealth effect’ kicked-in and boosted homeowner confidence.

So, what’s the catch?

It’s inflation. Again.

The RBA will likely welcome the economic resilience, but with some apprehension. More spending means more demand and when demand is strong, businesses are more likely to pass on price increases. With the labour market still tight and unit labour costs rising 5.4% over the year, the conditions for stickier inflation are present.

Following recent economic data, the RBA is now expected to hold the cash rate steady in December and possibly through 2026. The grinch that is inflation has almost certainly stolen a Christmas interest rate cut. The tone has now markedly shifted, with some even predicting interest rates increases next year.

What this means for investors

For now, markets are pricing in stability, but the balance of risks is tilting. Strong household spending is a double-edged sword in that it supports growth, but also fans inflation. That’s especially relevant for interest rate sensitive parts of the market.

Public spending is expected to moderate, while private investment reaccelerates. The speed and combination of which is expected to either help or hurt inflationary pressure.

For investors, this is a moment to stay the course and remain diversified. Inflation and the RBA may not be done with us yet. We’re watching the upcoming inflation data closely. If it surprises to the upside, brace for a louder conversation around interest rate hikes early in the new year.

The week ahead

Locally, the RBA is expected to hold the cash rate steady at Tuesday’s meeting, though any hawkish commentary or indication that inflation risks remain elevated could reignite expectations of future rate hikes.

Overseas, the US Federal Reserve will announce their monetary policy decision on Wednesday. There is optimism regarding the chance of a rate cut, with around a 90% chance of a 0.25% reduction, potentially influencing markets to propel in the coming weeks.

A comprehensive investment strategy and strong asset allocation can assist with maximising the benefits and minimising the risk across your portfolio as part of achieving your individual goals and objectives. Supported by our dedicated investment team, we focus on communicating market developments and investment opportunities to our clients in a timely manner. We take the time to fully understand both your current financial position and goals. Then we tailor a comprehensive investment strategy to match and implement it on your behalf.

.png?width=352&name=Investment%20SnapShot%20Header%20-%20July%202025%20(1).png)