Cutcher's Investment Lens | 8 - 12 December 2025

Cutcher & Neale Wealth Management

14 December 2025

14 December 2025

minutes

Weekly recap

What happened in markets

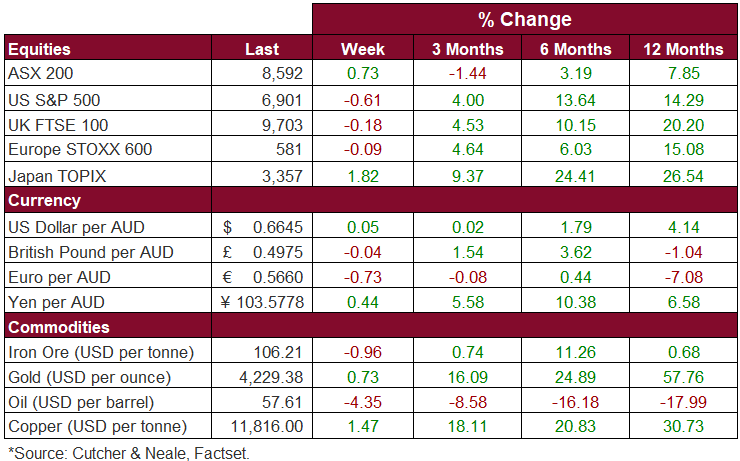

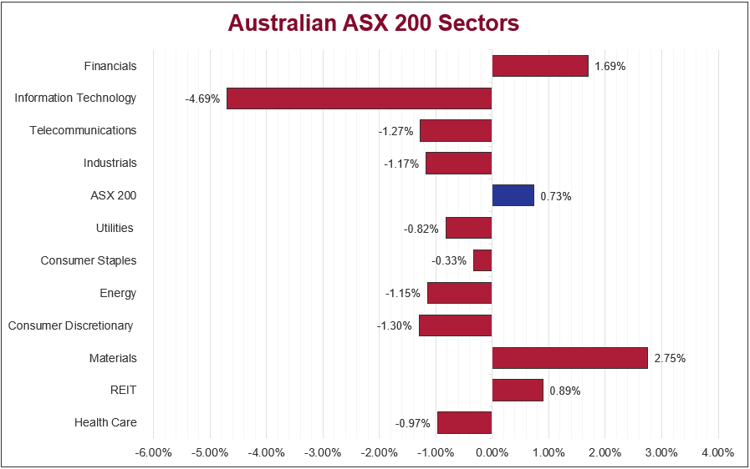

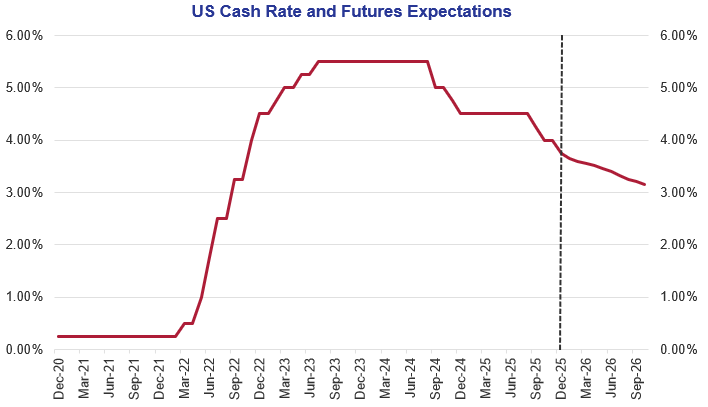

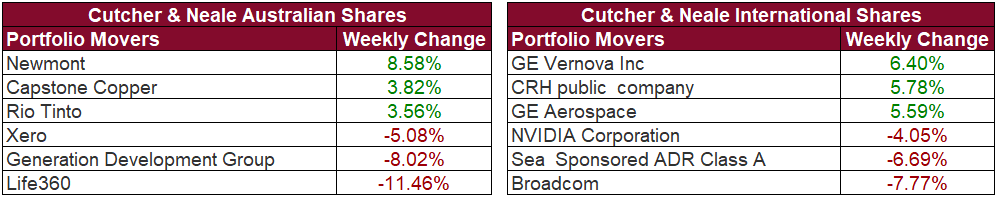

The Australian sharemarket continued to gain momentum, adding 0.7% last week. Positive performance came late in the week, after the market had its best day in 3 weeks on Friday. Whilst eight of the eleven sectors finished lower, the Materials (2.8%) sector did much of the heavy lifting, with broad gains across all miners, in particular gold and copper. Stock specific performers were Newmont (8.6%), Capstone Copper (3.8%) and Rio Tinto (3.6%). Conversely, a hawkish RBA, softer than expected employment data and a sell-off in AI related names held the market back.

US sharemarkets all closed lower last week. The main theme shaping performance was the cyclical rotation out of big tech as AI momentum continued to stall. The Communication Services (-3.2%), Information Technology (2.3%) and Utilities (-1.05%) sectors all finished lower, overshadowing the other areas of the market. AI giants Broadcom and Oracle both reported positively last week, beating guidance, however it still was not enough for investors, as the stocks gave up 7.8% and 12.7% respectively. On the other hand, a bright spot on the market was materials building giant CRH, which rallied 5.8%, after announcing they will be joining the S&P 500 Index from 22 December 2025.

European sharemarkets inched lower last week, weighed down also by the AI sell-off. The other main story was rates repricing, after a European Central Bank board member said she was comfortable with markets betting the next move in rates is higher, which sent bond yields higher. In sector performance, the Banks enjoyed the higher yields, adding 1.9%, while Travel & Leisure advanced 2.3%, thanks to strong company reports. In other news, French Prime Minister Lecornu secured a narrow win in favour of his social security budget, which will see €4.5B transferred from the state budget to social security.

Stock & sector Movements

What caught our eye

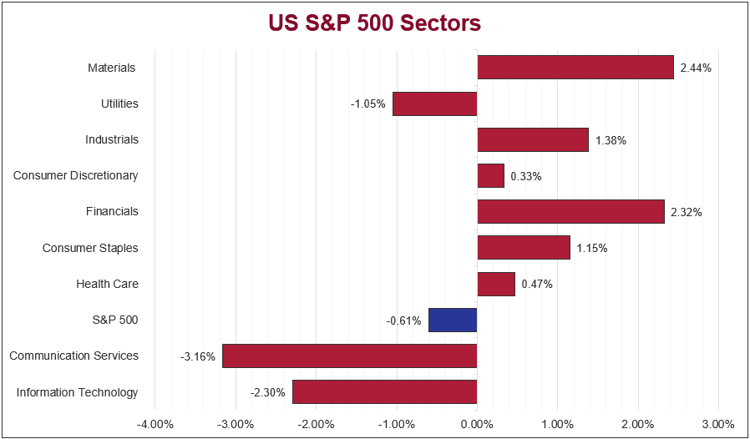

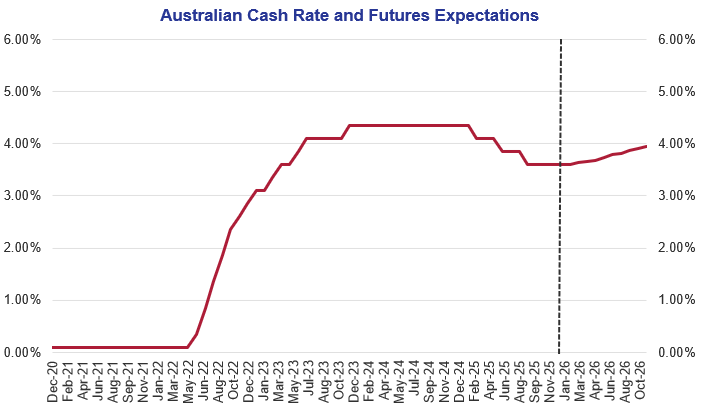

Global central banks took different paths this week. In Australia, the Reserve Bank kept the cash rate on hold at 3.60% but delivered its most hawkish guidance of the year. In the United States, the Federal Reserve cut rates again by 0.25% for a third consecutive meeting, yet signalled it may now pause as inflation progress stalls and the labour market softens.

Federal Reserve: Another cut but a more cautious stance

The Fed lowered the funds rate to a range of 3.50% to 3.75%. Policymakers acted in response to evidence that job growth has slowed more sharply than earlier figures suggested, with unemployment rising to 4.40% and upcoming revisions likely to show weaker hiring. The decision also revealed significant division within the committee, with three officials dissenting, including those preferring no move and those advocating a larger cut.

Despite easing again, the Fed communicated a higher threshold for further action. Its updated projections still show only one rate cut in 2026. Chair Jerome Powell noted that rate hikes are not being considered but future decisions will be determined by incoming data. Markets, which had anticipated a more dovish shift, now expect a slower pace of easing and are focused on labour market updates and inflation readings early next year.

The Fed also announced the resumption of Treasury purchases to stabilise funding markets as bank reserves tighten. This is a technical measure intended to support market functioning rather than stimulate economic activity.

RBA: On hold at 3.60% with a stronger warning on inflation risks

The RBA’s decision to leave rates unchanged was widely expected, but the tone was far more hawkish. Underlying inflation has risen again in recent months and sits above levels seen across many advanced economies. At the same time, private demand has strengthened, housing activity continues to firm, and unit labour costs remain elevated. The Bank now judges that inflation risks have tilted to the upside.

Governor Michele Bullock was clear that a rate cut was not considered. The Board did discuss conditions that could justify a rate hike in 2026 and reiterated that it will act if inflation proves more persistent.

Inflation data due in January will now be critical. Softer trimmed mean results would support the case for staying on hold, while stronger readings could bring the possibility of a February rate hike into view. Although many forecasters still expect rates to remain unchanged through 2026, the balance of risks has shifted toward tightening.

Key takeaway for investors

The Fed is nearing the end of its easing phase while the RBA is edging closer to tightening rates. Both central banks are now highly data dependent and are signalling that rate cuts are no longer imminent.

The week ahead

In Australia this week, the Federal Government will unveil the 2025-26 Mid-Year Economic and Fiscal Outlook, which is expected to show an underlying budget deficit of $32 billion.

Overseas, in the US, nonfarm payroll data is expected to show the unemployment rate lift from 4.4% to 4.5%, while retail sales are set to increase 0.2% and monthly CPI is forecast to sit at 3.0% for November.

A comprehensive investment strategy and strong asset allocation can assist with maximising the benefits and minimising the risk across your portfolio as part of achieving your individual goals and objectives. Supported by our dedicated investment team, we focus on communicating market developments and investment opportunities to our clients in a timely manner. We take the time to fully understand both your current financial position and goals. Then we tailor a comprehensive investment strategy to match and implement it on your behalf.

.png?width=352&name=Investment%20SnapShot%20Header%20-%20July%202025%20(1).png)