Cutcher's Investment Lens | 9 - 13 February 2026

-1.png)

Cutcher & Neale Wealth Management

15 February 2026

15 February 2026

minutes

Weekly recap

What happened in markets

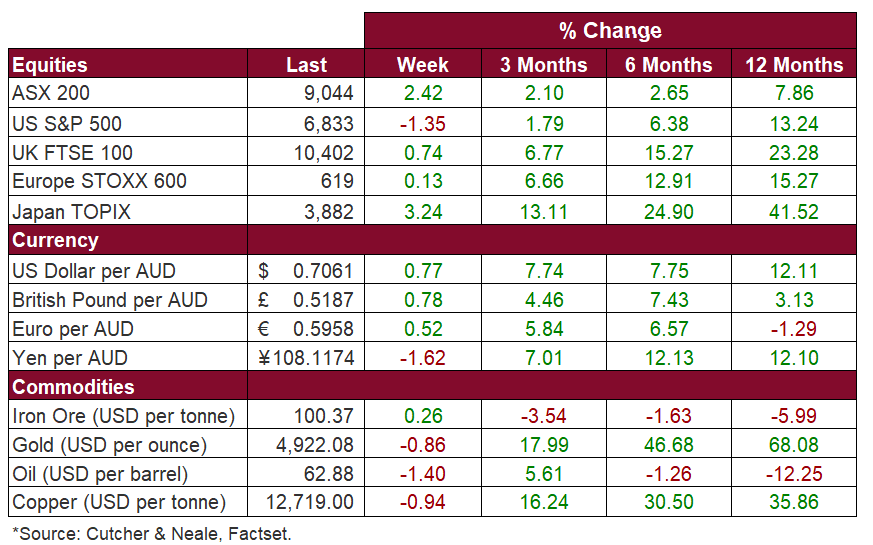

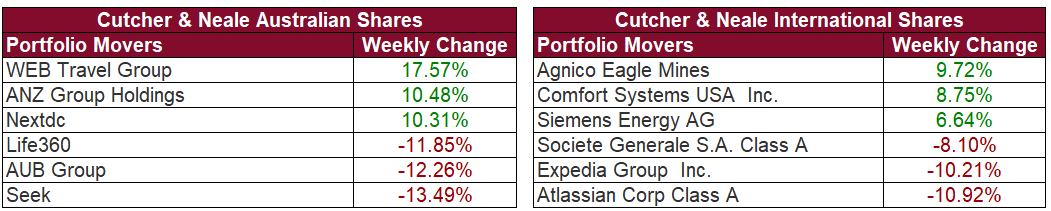

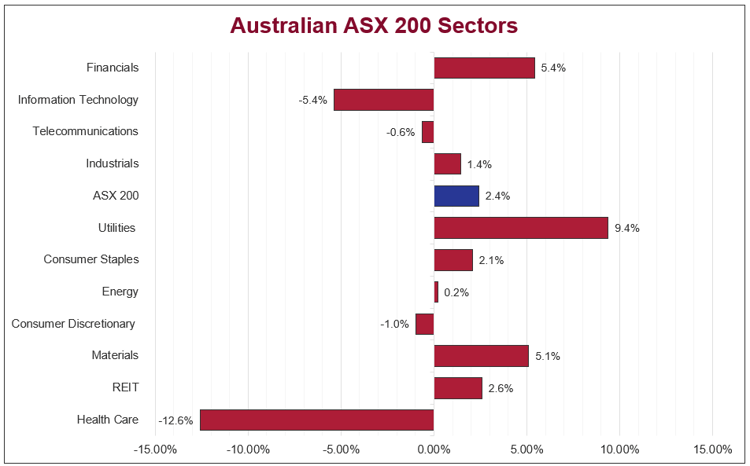

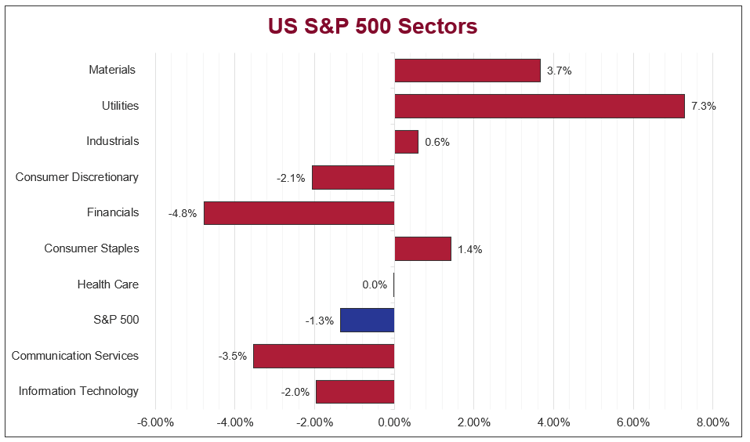

The Australian sharemarket posted its strongest weekly performance in roughly ten months, with the ASX 200 rising 2.4%, led by the Utilities (+9.4%) and Financials (+5.4%) sectors, which paced gains as defensive and yield-oriented sectors attracted demand amid volatility. The Materials sector (+5.1%) also contributed strongly, while the REITs (+2.6%) and Consumer Staples (+2.1%) sectors added modest upside. The Industrials (+1.4%) and Energy (+0.2%) sectors saw smaller gains, while the Telecommunications (-0.6%) and Consumer Discretionary (-1.0%) sectors lagged. The Information Technology (-5.4%) and Health Care (-12.6%) sectors were weakest. Overall, rotation into defensives and Financials helped offset sharp weakness in IT and Health Care.

US sharemarkets fell last week, with the S&P 500 down 1.3%, led by losses in the Financials (-4.8%), Communication Services (-3.5%), Information Technology (-2.0%), and Consumer Discretionary (-2.1%) sectors. Tech and communication stocks fell on caution around AI spending and high capital costs, while banks faced ongoing sector-specific headwinds. Defensive and cyclical sectors, including Utilities (+7.3%), Materials (+3.7%), Energy (+1.9%), and Consumer Staples (+1.4%) helped limit losses. Moderating inflation data fuelled expectations of Federal Reserve rate cuts, supporting rotation into defensive and cyclical sectors that offset persistent mega-cap tech weakness.

European sharemarkets were broadly flat last week, with the STOXX Europe 600 up 0.1%. The Utilities (2.3%), Telecommunications (4.0%), Basic Resources (4.0%) and Energy (3.7%) sectors led gains, supported by defensive demand, commodity strength, and corporate earnings updates. In contrast, the Banks (-5.5%), Travel & Leisure (-1.8%), and Retail (-1.2%) sectors lagged, weighed down by AI-related disruption concerns, margin pressures, and softer consumer activity. Forward-looking indicators in the UK and Eurozone were mixed but stabilising, while inflows into European equities over the past two weeks helped mitigate broader risk-off sentiment amid political and macro uncertainty.

Stock & sector Movements

What caught our eye

SaaS on the Back Foot, Semis in the Spotlight

There’s been a meaningful rotation happening in markets lately. Software-as-a-Service (SaaS) companies, long the poster children of growth investing, are now facing real questions about how they fit into a world increasingly shaped by artificial intelligence (AI). Meanwhile, semiconductor companies, the enablers behind the AI boom, are enjoying a very different market reception.

This calendar year-to-date SaaS companies like Monday.com, Adobe, Atlassian, ServiceNow and HubSpot have seen falls of over 30%. Valuation multiples have compressed, with forward revenue expectations being reset lower. The software sector recently reached its most “oversold” technical level in years, even more so than during the 2000 tech wreck.

So, what’s changed?

So, what’s changed?

A few things are converging. First, generative AI tools are lowering the barriers to building competing software. This puts pressure on those with less differentiation. Second, many enterprise customers are slowing headcount growth, which weakens a key growth lever for seat/headcount-based software providers. Third, AI agents are starting to take on more tasks independently, raising questions about whether traditional user-facing software will remain as central as it once was.

That’s not to say all software is vulnerable. There’s still a meaningful difference between simple apps and more embedded platforms. The latter, especially those serving regulated industries or offering complex integrations, are proving more resilient. We expect the market will reward this nuance in time, favouring software related companies with a defensible competitive position and better growth visibility.

On the other hand, more cyclical semiconductors have somewhat ironically become the ‘safe’ part of the tech trade. Fuelled by ongoing AI investment from the likes of Microsoft, Meta, Alphabet (Google) and Amazon, chipmakers are benefiting from clearer earnings visibility and strong demand. Companies exposed to memory, storage and AI chips have seen outsized gains over the past year, as we’ve written about recently.

What this means for our portfolios

At Cutcher & Neale, we’ve held relatively few SaaS names and more semiconductor companies. So far this has been fortuitous. That said, given AI’s disruptive potential, we don’t see this as a time for complacency.

We still see value in select software companies, particularly those with strong cash flows, customer stickiness and a clear roadmap for how they’ll use AI to enhance their offerings. But we’re mindful that recovery in the software sector may take time and not all will make it through intact or unscathed. On the semiconductor side, we’re aware that current enthusiasm for “AI infrastructure” could eventually run ahead of fundamentals. So, while we maintain exposure to in this space, we’re conscious of not overextending.

Ultimately, the AI story is still unfolding. Our focus remains on balancing growth opportunity with risk discipline, backing companies that we believe are positioned well and can adapt, not just ride the trend.

The week ahead

Locally, focus will be on wages and jobs data, including the Wage Price Index and January labour force figures, as markets watch for signals on potential future RBA rate decisions. Earnings season continues, with major miners, banks, and retailers reporting results.

Overseas, investors will be watching key US economic data, including inflation, spending, and growth indicators, alongside corporate earnings, as they could influence Federal Reserve policy and broader market sentiment.

A comprehensive investment strategy and strong asset allocation can assist with maximising the benefits and minimising the risk across your portfolio as part of achieving your individual goals and objectives. Supported by our dedicated investment team, we focus on communicating market developments and investment opportunities to our clients in a timely manner. We take the time to fully understand both your current financial position and goals. Then we tailor a comprehensive investment strategy to match and implement it on your behalf.

.png?width=352&name=Investment%20SnapShot%20Header%20-%20July%202025%20(1).png)