How Higher Tax On Higher Super Funds Could Affect You

Samuel Arnott, Partner, Superannuation

17 October 2023

07 March 2024

minutes

On 3 October 2023, the Albanese Government released draft legislation on its previously announced plan to reduce tax concessions available to individuals with superannuation balances above $3 million from 1 July 2025.

The draft legislation, which has been put up for consultation, proposes to insert a new Division 296 into the Income Tax Assessment Act 1997. It aims to impose an additional 15% tax on “earnings” corresponding to an individual’s Total Superannuation Balance (TSB) that exceeds $3 million for an income year.

This means that, while your regular super earnings already attract a 15% tax rate, earnings above the $3 million threshold will incur an additional %15 tax.

An individual’s TSB is the combined total of all their superannuation interests, not the totals of separate accounts. Therefore, the $3 million threshold will be applied on a per-individual basis, not a per-super fund basis.

The government has not changed its position from the original announcement in February 2023. The most controversial aspects of the proposal remain:

- The inclusion of unrealised capital gains in the calculation of earnings

- No indexation of the $3m threshold

- No refund of tax paid when the earnings are negative

How will the “superannuation earnings” be calculated?

The earnings will be measured by calculating the difference in an individual’s TSB at the end of the year compared with the TSB at the start of the year, with adjustments made for net contributions and withdrawals. Only the proportion of earnings corresponding to the part of the TSB that exceeds $3 million will attract the additional tax of 15%. Importantly, this formula for calculating earnings also captures unrealised capital gains, which means that some individuals may be required to pay tax on unrealised capital gains.

No tax refunds will be issued for years where the calculation results in negative super earnings and the ‘loss’ can only be carried forward and used to offset earnings in future years.

CASE STUDY

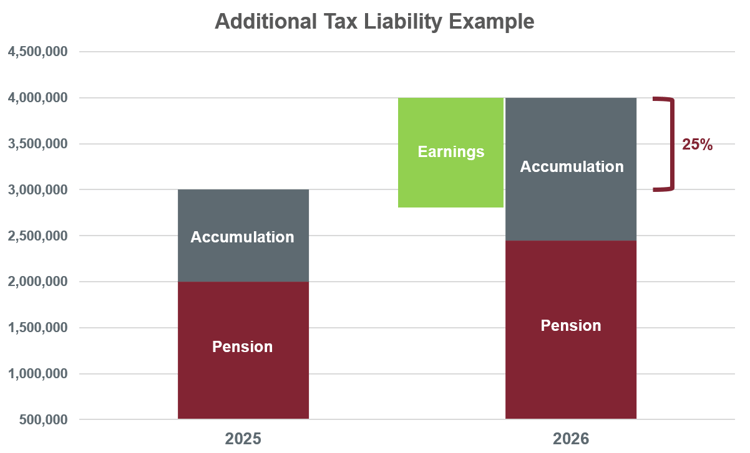

Elizabeth is 68 years old and retired. She has a superannuation balance of $3 million as at 30 June 2025 which grows to $4 million by 30 June 2026. She draws down $200,000 during the year and makes no additional contributions to the fund.

This means Elizabeth’s calculated earning are:

$4 million - $3 million + $200,000 = $1.2 million

The proportion of earnings corresponding to funds above $3 million is:

($4 million - $3 million) ÷ $4 million = 25%

Therefore, the additional tax liability for 2025-26 FY is:

15% × $1.2 million × 25% = $45,000

This is in addition to the 15% tax already paid on the earnings below $3 million.

How will the tax be payable?

Similar to the operation of the current Division 293 tax regime, individuals will have the option to pay their Division 296 tax either by releasing amounts from their super fund(s), by paying it from outside of the super system, or a combination of the two.

If an individual holds multiple super accounts, they can choose which fund(s) to release the money from.

Are certain individuals excluded from paying the tax?

Per the draft legislation, the following categories of individuals will be excluded from paying the tax:

- Child recipients of superannuation income streams at the end of the income year

- Individuals who have a structured settlement contribution made in respect to them as a payment for a personal injury at the end of the income year, or any year prior

- Individuals who have died before the last day of the income year

It is important to recognise that, at this point, the new tax is a proposal only and is subject to a consultation process and then a Parliamentary process.

The tax is proposed to start from 1 July 2025 and there is always a chance that the Government may further refine or amend the proposed legislation. Regardless of any changes made, super will continue to be a highly tax-effective structure to accumulate wealth for retirement.

If you would like more information regarding the proposed legislation or need help optimising your superannuation fund management, our expert advisors can help. Get in touch with us today to find out how.

Related Articles

Changes to Tax on Superannuation Announced

Sam is the Partner of Cutcher & Neale's Superannuation Division. He believes that with continual changes to Superannuation, it's essential to stay ahead and develop tactical strategies for our clients to ensure their wealth is protected and secured.

With a wealth of knowledge and experience, Sam takes a hands-on, personal approach to ensure our clients have the very best plans in place from the very beginning.