Morning Market Update - 13 October 2020

Cutcher & Neale

12 October 2020

17 July 2023

minutes

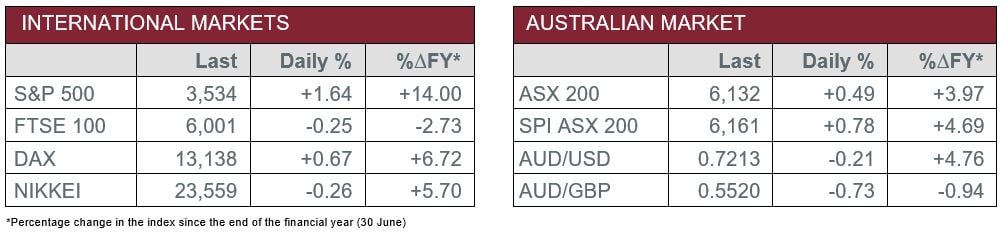

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – US – Consumer Price Index

Australian Market

The Australian sharemarket lifted yesterday for a sixth consecutive day. The ASX 200 rose 0.5%, led by the Information Technology and Financial sectors.

The Information Technology sector was the strongest performer, up 3.0%. Link Administration, which was Monday’s top market performer, jumped 25% after the company received a takeover offer from Pacific Equity Partners. Zip Co lifted 5.2% and Xero rose 1.3%, while Appen and Afterpay both gained 2.8%.

Financial stocks were among the best performers as all the big banks closed higher. ANZ led the gains, up 2.0%, while Westpac gained 1.9%, NAB lifted 1.6% and Commonwealth Bank rose 1.3%. Officials of Commonwealth Bank announced that more customers have resumed loan repayments amid the COVID-19 pandemic, with the number of loans deferred falling by 45,000.

The Energy sector weighed on the market as global oil prices dropped. Whitehaven Coal slumped 5.7% following reports Chinese authorities have advised steel mills to cease importing Australian coal. Beach Energy and Oil Search both fell 1.4%, while Woodside Petroleum slipped 0.2%.

The Materials sectors also closed weaker yesterday, dragged lower by the mining heavyweights; Rio Tinto and Fortescue Metals dropped 0.9% and 0.5% respectively, while BHP fell 0.4%. Gold stocks were stronger; Evolution Mining added 3.7%, Newcrest Mining gained 1.7% and Northern Star rose 0.5%.

The Australian futures market points to a 0.78% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets reached a five-week high on Monday as concerns regarding rising COVID-19 cases were offset by continued hopes of greater US fiscal stimulus. The broad-based STOXX Europe 600 and the German DAX both lifted 0.7%, however, the UK FTSE 100 slipped 0.3% after the UK government imposed a tiered system of new restrictions. The Financials sector underperformed; Barclays slipped 1.3% and Lloyds Bank fell 0.6%, while Deutsche Bank bucked the trend to close 0.2% higher.

US sharemarkets also closed higher overnight, led by a rally in Information Technology stocks. Apple jumped 6.4% ahead of its widely anticipated iPhone 12 launch today, while Twitter added 5.1% after the company received an upgrade from Deutsche Bank. Facebook rose 4.3% and Alphabet added 3.6%, while NVIDIA and Microsoft gained 3.4% and 2.6% respectively. The Consumer Discretionary sector also enjoyed gains; Amazon rallied 4.8% ahead of its Prime Day shopping event today and tomorrow, while Alibaba reached a new 52-week high during Monday’s trading, closing up 2.4%.

By close of trade on Monday, the Dow Jones gained 0.9% and the S&P 500 lifted 1.6%, while the NASDAQ added 2.6%.

CNIS Perspective

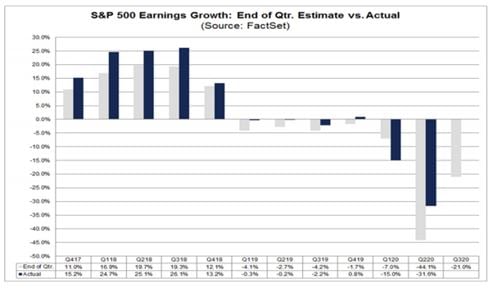

US third quarter earnings season kicks off this week, with expectations of a 21% decline in earnings for the S&P 500. This would follow a second quarter earnings decline of 31.6%, which was dominated by a pandemic that has created an uneven playing field, where some companies thrive, and others sink.

While US stock indexes have set record highs and the big tech names and online retailers have outperformed, many other industries and individual companies are grappling with deteriorating sales and earnings, as economic growth has slumped across the globe.

US stock markets continue to show a lot of optimism, however, there is still uncertainty for many US corporates.

It will be interesting to analyse the performance of actual earnings relative to estimates for Q3 over the next few weeks and the outlook (if any is provided) for Q4.

Investors may be more focused on the rate of change in the earnings decline, rather than how far earnings are falling.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.