Morning Market Update - 15 November 2021

Cutcher & Neale

14 November 2021

17 July 2023

minutes

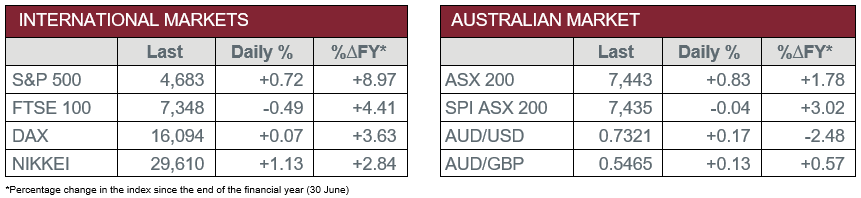

Pre-Open Data

Key Data for the Week

- Monday – UK – ILO Unemployment Rate

- Monday – EUR – Gross Domestic Product

- Tuesday – US – Retail Sales

- Tuesday – US – Consumer Price Index

- Tuesday – AUS – Wage Price Index

- Wednesday – EUR – Consumer Price Index

- Wednesday – US – Building Permits

- Thursday – US – Initial Jobless Claims

- Thursday – UK – Retail Sales

Australian Market

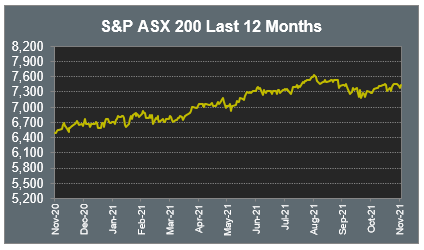

The Australian sharemarket advanced 0.8% on Friday in a strong session of trade. The Materials sector led the gains, up 2.3%, followed by the Information Technology and Energy sectors, which added 1.8% and 1.4% respectively. However, over the week, the local ASX 200 gave up 0.2%.

Mining heavyweights posted gains on stronger iron ore prices; Rio Tinto rallied 3.4% and BHP lifted 2.8%, while Fortescue Metals closed up 1.9%. Gold miners were mixed; Evolution Mining added 1.0%, while Northern Star Resources and Newcrest Mining slipped 0.2% and 1.8% respectively.

Health Care was the only sector to close weaker; Sonic Healthcare slipped 0.5%, Ramsey Health Care fell 1.3% and Fisher & Paykel Healthcare lost 3.2%, however, CSL bucked the trend to gain 0.2%.

All four major banks closed higher; Commonwealth Bank added 0.9%, ANZ and NAB both rose 0.7%, while Westpac lifted less than 0.1%. Fund managers also enjoyed gains; Australian Ethical Investment and Magellan Financial Group both added 2.8%, while Challenger closed up 0.3%.

Overseas Markets

European sharemarkets were mixed on Friday. The Energy sector was the main laggard as BP fell 0.7% and Royal Dutch Shell lost 0.5%. The Materials sector was mixed; Rio Tinto added 0.7%, however, BHP slipped 0.5%.

By the close of trade, the German DAX eked out a 0.1% gain and the STOXX Europe 600 rose 0.3%, however, the UK FTSE 100 closed 0.5% lower.

US sharemarkets were stronger on Friday. The Information Technology sector was among the top performers; Alphabet gained 2.0%, while Spotify and Apple both rose 1.4%. The Consumer Discretionary sector also advanced; Shopify rallied 12.0%, while Amazon closed 1.5% higher.

Financial services stocks enjoyed gains; PagSeguro Digital added 3.7% and PayPal lifted 3.1%, while Visa and BlackRock rose 0.8% and 0.6% respectively. By the close of trade, the Dow Jones rose 0.5% and the S&P 500 added 0.7%, while the NASDAQ lifted 1.0%.

CNIS Perspective

NFTs or Non-Fungible Tokens have exploded in growth, generating more than US$10 billion in sales for the September quarter, a 700% increase from the previous quarter, according to DappRadar, a market tracker. While many investors are bullish on the alternative asset and can see many use cases, there are also the detractors mocking NFTs for being worthless JPEGs.

NFTs can be anything, including art, collectibles, music and real estate. Non-Fungible just means they cannot be exchanged for an identical asset such as dollars, Bitcoins or gold, as they are examples of fungible assets. The key concept with NFTs is that they allow creators and owners of data to have digital property rights over that data or creation.

An example of this is musicians and the idea of disrupting music platforms such as Spotify, who has 8 million musicians/creators on their platform. Currently, only 14,000 of these 8 million, or less than 0.2%, make more than the median wage, US$50,000 per year, from their Spotify earnings. Using NFTs of their own music, the artist can sell directly to their fans, bypassing the traditional platforms. Musicians will then get a cut each time their work is resold via smart contracts, no trust or middleman required.

Similar to musicians, artists can digitise and control their work, validated by the blockchain. When their pieces are resold, they get a cut. There are many more examples of what has become known as Web 3.0, where the possibilities of blockchain technology is seeking to remove the intermediary and return the power back to the artist or creators. These are very early days and we are far from seeing mass adoption of this technology, however, the possibilities are very exciting.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.