Morning Market Update - 19 November 2021

Cutcher & Neale

18 November 2021

17 July 2023

minutes

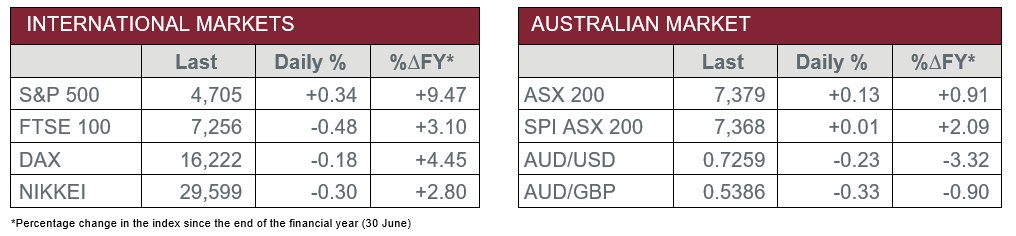

Pre-Open Data

Key Data for the Week

- Thursday – US – Initial Jobless Claims fell by 1,000 to 268,000, versus expectations of 260,000.

- Friday – UK – Retail Sales

Australian Market

The Australian sharemarket closed relatively flat on Thursday, as gains in REIT (1.2%), Health Care (1.1%) and Consumer Staples (1.0%) were offset by losses in the Financials (-0.6%) and Energy (-1.5%) sectors. The local market managed to claw back losses made early in the session, following mixed results in overseas markets on Wednesday, due to persistent inflationary pressure.

Most major energy companies softened, as global oil prices extended their retreat to below US$80 a barrel. Key movers included Woodside Petroleum (-1.7%), Santos (-2.1%) and Oil Search (-1.9%). The Materials sector (0.3%) was mixed, as index heavyweights BHP (0.2%) and Rio Tinto (0.7%) firmed, while gold miner Evolution Mining surged 9.7%, after it announced a $1 billion purchase of Queensland’s Ernest Henry copper-gold mine from Glencore.

Numerous companies held Annual General Meetings on Thursday, which led to mixed performances. Standouts included Sonic Healthcare (3.0%) and property developer Goodman Group (1.8%), which contributed to gains made in their respective sectors.

The Financials sector weakened for a second day, down 0.6%, as concerns were raised about bank profitability after Commonwealth Bank reported weaker than expected profit a day earlier. The primary concern for investors was tightened net interest margins, the difference between what a bank pays depositors and what it charges customers. Commonwealth Bank slid further, down 1.6%, while ANZ (-1.3%), Westpac (-1.0%) and NAB (-0.7%) also lost ground.

The Australian futures market points to a relatively flat open today.

Overseas Markets

European sharemarkets closed lower on Thursday to break a six day rally, as commodity related stocks broadly weakened ~2.0%, amid soft oil and metal prices. Oil stocks suffered, as crude prices fell due to concerns over a supply surplus, given the prospect that China might release strategic fuel reserves. These concerns overshadowed stronger than expected earnings and accommodative monetary policy, which had helped push the market to record highs recently. By the close of trade, the UK FTSE 100 and STOXX Europe 600 both fell ~0.5%, while the German DAX edged 0.2% lower.

US sharemarkets were somewhat mixed overnight, as the S&P 500 (0.3%) and NASDAQ (0.5%) reached record highs, while the Dow Jones inched 0.2% lower. The Information Technology sector (1.0%) was a key performer, driven higher by chip designer NIVDIA (8.3%), after it presented stellar Q3 2021 earnings results. This fed through to its major supplier, Taiwan Semiconductor Manufacturing Company, which was up 3.6%. Meanwhile, Apple gained 2.9%, as investors digested news around the accelerated development of its electric and self-driving cars. Another notable mover included ecommerce giant Amazon, which surged 4.1%.

CNIS Perspective

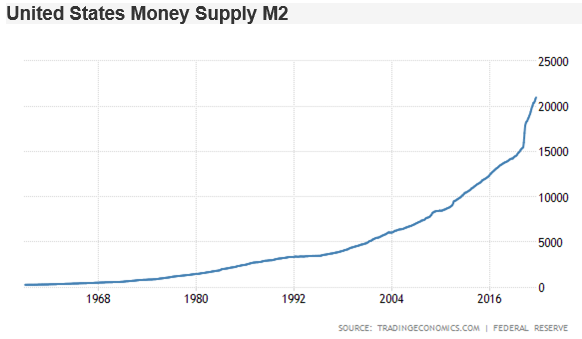

There is an undeniable bubble feel to equity markets and several other asset classes, with the main reason being accommodative central bank policy. Despite the ominous inflation data, central banks continue to increase money supply, pushing sharemarkets to record highs. The US Federal Reserve has been injecting US$120 billion per month since last December via bond purchases. However, starting this month, the Fed is tapering that amount by US$15 billion per month. It will still be flooding the system with cash, but at a slower pace. However do not fear, the US Treasury has more money with Biden's Build Back Better spending, which if passed, will result in another US$1.75 trillion to come.

The M2 is a calculation of the economy’s money supply. It measures the amount of cash and other easily convertible assets that are in bank accounts and savings deposits, alongside money market securities. Currently the US M2 is at a record US$21 trillion, with personal savings also at a record US$2.8 trillion. This is great for US sharemarkets, reflected in Q3 2021 earnings growth and margin expansion, which smashed analyst expectations and was a powerful catalyst for recent index highs.

Whilst there are pockets of irrational exuberance that can be seen in cryptocurrencies and electric vehicle start-ups at present, there is still a record amount of cash in liquid assets that can fuel economic and earnings growth, as well as price and asset inflation. Don’t fight the Fed!

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.