Morning Market Update - 1 February 2021

Cutcher & Neale

31 January 2021

17 July 2023

minutes

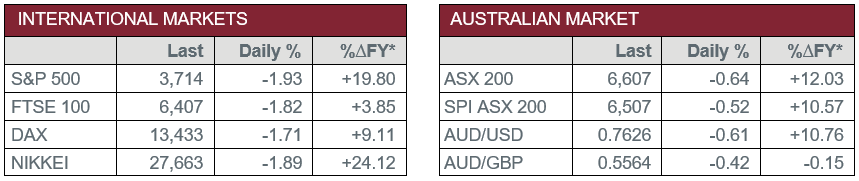

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – EUR – Unemployment Rate

- Monday – UK – Markit Manufacturing PMI

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Gross Domestic Product

- Wednesday – AUS – Building Permits

- Wednesday – EUR – Consumer Price Index

- Thursday – EUR – Retail Sales

- Thursday – UK – BoE Interest Rate Decision

- Friday – AUS – Retail Sales

- Friday – US – Unemployment Rate

Australian Market

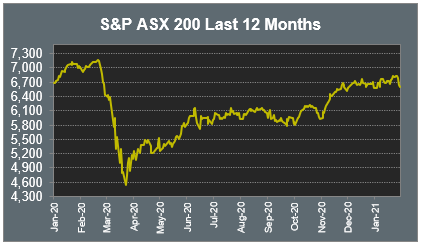

The Australian sharemarket closed lower for a third consecutive session on Friday, down 0.64%, as the local ASX 200 continued to be negatively impacted by events in the US, where retail investors continued to pile into companies like GameStop. In response, US hedge funds are forced to reduce their exposure in some of their more profitable holdings in order to cover their mounting losses from short positions taken in companies expected to struggle. Despite weakness late in January, the ASX 200 closed up 0.31% for the month.

The majority of Friday’s losses came from the Energy, Financials and Materials sectors. Iron ore miners fell in response to a 5.6% fall in the commodity on Thursday night; mining heavyweights BHP and Rio Tinto dropped 1.6% and 3.0% respectively, while Fortescue Metals lost 3.9%. The big four banks all gave up between 1.5% and 2.1%, with ANZ the worst performer.

The company reporting season resumes this week, with BWP Trust, CIMIC, Credit Corp, Nick Scali and Temple & Webster among those set to announce their latest earnings results.

The Australian futures market points to a 0.52% fall today, being driven by broadly weaker international markets on Friday.

Overseas Markets

European sharemarkets tumbled on Friday, weighed down by growing concerns towards the slow roll-out of COVID-19 vaccines and the ongoing fallout from the retail trading frenzy in the US. Despite the European’s medicines regulator’s approval of AstraZeneca and Oxford University’s COVID-19 vaccine for people over the age of 18 on Friday, the region urgently needs more vaccine doses in order to expediate its inoculation programme, with AstraZeneca, Moderna and Pfizer all facing difficulties in delivering shipments to the bloc, as the region continues to come under attack from a new strain of the coronavirus. The broad based STOXX Europe 600 slid 1.9%, the German DAX slipped 1.7% and the UK FTSE 100 dropped 1.8%.

US sharemarkets also closed lower on Friday, as focus remained on the retail trading frenzy, with steep gains recorded for heavily shorted stocks, including GameStop (67.9%) and AMC (53.7%). However, technology heavyweights Alphabet (-1.5%), Apple (-3.7%), Facebook (-2.5%) and Microsoft (-2.9%) all closed weaker. By the close of trade, the Dow Jones and NASDAQ both lost 2.0%, while the S&P 500 index dropped 1.9%.

CNIS Perspective

Welcome back to our daily Morning Market Update for 2021. We trust you have had a relaxing Christmas New Year break and we wish you all the best for the new year.

The question on everybody’s lips is “how will financial markets perform this year?”

Unfortunately, this is a tough one to answer given current state of play with COVID-19. Any answer is predicated on the success of the vaccination program being rolled out globally. Any hiccup in the program would most likely send financial markets into a 2020 style sell-off.

Should the program be effective, markets should behave quite favourably given the enormous level of government and central bank stimulus that has been, and will continue to be, injected into the global economy.

With interest rates so low, and likely to remain low for quite some time, this stimulus will continue to be funded by ongoing debt that aims to generate economic growth sooner rather than later.

While the vaccination program may have question marks over it, there’s little doubt stimulus packages will continue to be rolled out, which should be a key factor in underwriting a reasonable performance during the year.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.