Morning Market Update - 2 February 2021

Cutcher & Neale

01 February 2021

17 July 2023

minutes

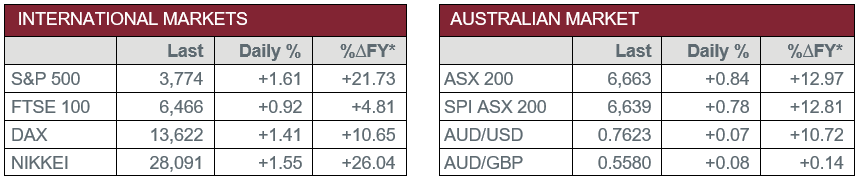

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – EUR – Unemployment Rate remained unchanged at 8.3% in December, as expected.

- Monday – US – Markit Manufacturing PMI edged higher from 59.1 in December, to 59.2 in January.

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Gross Domestic Product

Australian Market

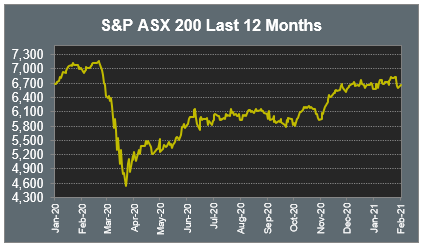

The Australian sharemarket ended its three-day losing streak to close up 0.84% yesterday, driven by solid gains in the Health Care and Materials sectors. CSL Limited climbed 2.3%, while mining heavyweights BHP and Rio Tinto added 1.3% and 0.9% respectively.

Travel stocks were mixed, after the Western Australian Government announced over the weekend a five-day lockdown in Perth following a positive COVID-19 test by a quarantine security guard. Flight Centre and Webjet fell 2.6% and 1.9% respectively, while Qantas rose 0.4% and Sydney Airport was flat.

Lithium producers surged in the Materials space; Pilbara Minerals rose 11.8% and Galaxy Resources strengthened 5.6%, while goldminer Newcrest Mining increased 2.1%. Northern Star and Saracen Mineral gained 0.9% and 0.6% respectively, after both companies reaffirmed little impact is expected to their WA mining operations from the five-day Perth lockdown.

Engineering group Worley was a major drag on the market, down 10.9%, following the announcement of the company’s latest half yearly results, which were negatively impacted by COVID-19 and currency movements.

The Australian futures market points to a 0.78% rise today, being driven by broadly stronger international markets overnight.

Overseas Markets

European sharemarkets rebounded on Monday, despite a 9.6% fall in German retail sales in December. Infrastructure giants CRH, Eiffage and Vinci all strengthened, ending the session up 2.0%, 3.2% and 1.8% respectively, while HelloFresh gained 2.4% The UK FTSE 100 rose 0.9%, the broad based STOXX Europe 600 gained 1.2% and the German DAX lifted 1.4%.

US sharemarkets also rose overnight, boosted by Technology heavyweights Amazon (+4.3%) and Alphabet (+3.6%), with both companies set to report earnings early this week, while Microsoft rose 3.3% and Apple added 1.7%. GameStop plunged 30.8% as brokerages removed some trading restrictions. Tesla shares leapt 5.8% after an analyst more than doubled his price target on the electric-car maker, while silver miners surged after the commodity broke above US$30 an ounce for the first time since 2013. By the close of trade, the NASDAQ strengthened 2.6%, the S&P 500 gained 1.6% and the Dow Jones added 0.8%.

CNIS Perspective

If you have been reading the recent financial news, you could be forgiven for thinking the sharemarket has turned into a video game. The ‘GameStoppers’, those retail investors trading through social media forums, are coordinating on mass to target huge, short bets taken by hedge funds. The short positions held by these hedge funds consists of stock that has effectively been borrowed from the stock owner (for a fee) and sold on the sharemarket, giving the borrower of the stock a short position in a listed company. It is a prediction that the stock price will fall and the holder of the short position will realise a profit. These positions are required to be registered with the stock exchange to provide public transparency.

If the stock price doesn’t fall, the short positions will eventually need to be covered (bought back) and this can exacerbate the move higher. This is known as a ‘short squeeze’. However, retail traders on these social media platforms aren’t focused on company fundamentals, rather they are just targeting stocks with significant short positions. As a result, these ‘flash mobs’ can now influence share price movements on Wall Street at any given time.

The US market watch dog, the SEC, is looking into whether laws have been broken such has market manipulation by those encouraging trades on Reddit. The retail traders, who see themselves as heroes, believe the real villains are the billionaire hedge fund managers who have had their influence on share prices for far too long.

Whatever happens in this ongoing saga, hedge funds will think twice before shorting stock, as there are now 7 million people on the popular Reddit app following the Wallstreetbets thread. Suppose they each have US$5,000, that equates to US$35 billion of dry powder currently sitting on the sideline.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.