Morning Market Update - 23 February 2021

Cutcher & Neale

22 February 2021

17 July 2023

minutes

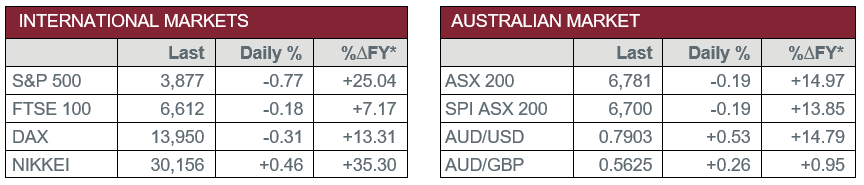

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – US – Chicago National Fed Activity Index rose to 0.66 in January, up from 0.52 in December.

- Tuesday – EUR – Consumer Price Index

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – US – Consumer Confidence

Australian Market

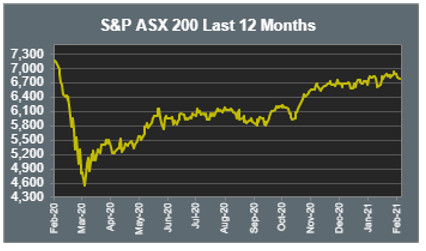

The Australian sharemarket eased 0.2% yesterday, as all sectors, except Materials, closed weaker. The Health Care sector saw the largest decline, down 2.2%, while the Consumer Discretionary, Information Technology and Telecommunications sectors all lost over 1.0%.

The Financials sector closed 0.4% lower, weighed down by the major banks. NAB led the losses, down 2.2%, while Westpac lost 1.5%, Commonwealth Bank gave up 0.7% and ANZ slipped 0.4%. Macquarie Group bucked the trend to gain 3.4% after the investment bank upgraded its short-term outlook for FY21. Bank of Queensland entered a trading halt yesterday after the company announced it looks to purchase ME Bank for $1.3 billion through a capital raising.

Travel stocks enjoyed strong gains as Australia commenced its COVID-19 vaccine rollout program. Webjet jumped 8.9% and Flight Centre climbed 7.2%, while Qantas added 4.3% and Sydney Airport gained 1.3%.

The Materials sector was lifted by gains among the mining heavyweights. Rio Tinto gained 3.6%, while BHP and Fortescue Metals rose 3.3% and 3.2% respectively. Goldminers also closed higher; Newcrest Mining lifted 0.5%, while Northern Star gained 2.7% and Evolution Mining closed up 2.9%.

The Australian futures market points to a 0.19% fall today.

Overseas Markets

European sharemarkets slid on Monday, led by losses in the Information Technology and Consumer Discretionary sectors. Travel and leisure stocks advanced overnight after British Prime Minister Boris Johnson announced a phased plan to end the country’s lockdown. Airbus lifted 4.4% and German airline Lufthansa added 3.4%, while International Airlines Group climbed 7.5%.

By the close of trade, the STOXX Europe 600 slipped 0.4% and the German DAX lost 0.3%, while the UK FTSE 100 fell 0.2%.

US sharemarkets were mixed overnight, as rising bond yields and prospects of higher inflation sparked valuation concerns. The Information Technology sector gave up 2.3%; Spotify lost 4.0% and NVIDIA fell 3.8%, while Apple and Microsoft slipped 3.0% and 2.7% respectively. The Financials sector outperformed to close up 1.0%. Bank of America and Morgan Stanley lifted 1.8%, while JP Morgan Chase added 0.9%. Financial services were mixed; MasterCard and Visa gained 2.3% and 1.8% respectively, while PayPal lost 4.6%.

By the close of trade, the Dow Jones lifted 0.1%, while the S&P 500 and NASDAQ closed down 0.8% and 2.5% respectively.

CNIS Perspective

Janet Yellen, US Secretary of the Treasury, is no stranger to implementing economic stimulus. Under her reign as Federal Reserve Chair, she oversaw record stimulus that saw the US economy recover from the GFC.

Her comments over the weekend when it comes to her latest challenge, the COVID-19 recovery, remind us of her proactive attitude, as she reiterated “the need to go big on coronavirus relief”.

In addition, the Federal Reserve’s Monetary Policy Report reiterated bond buying is set to continue.

These policy stimuli suggest “Don’t fight the Fed” will be ringing in our ears for some time to come.

The stronger than expected earnings season so far is a tailwind to the current S&P 500 performance, with 83% of S&P 500 companies having reported, the earnings growth of 3.2% has exceeded the 8.8% decline estimated prior to the start of the earnings season.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.