Morning Market Update - 13 November 2020

Cutcher & Neale

12 November 2020

17 July 2023

minutes

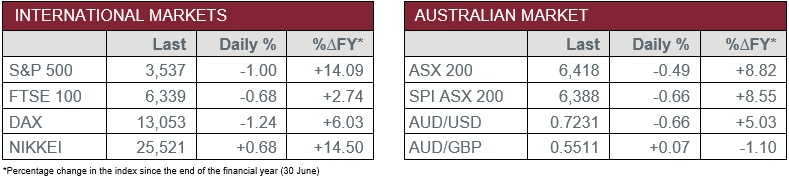

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Thursday – UK – Gross Domestic Product rose 15.5% in Q3, while annualised GDP was -9.7%, both below expectations.

- Thursday – US – Consumer Price Index fell 0.2% to 0.0% for October. Annual Consumer Price Index fell to 1.2%.

- Friday – EUR – Gross Domestic Product

Australian Market

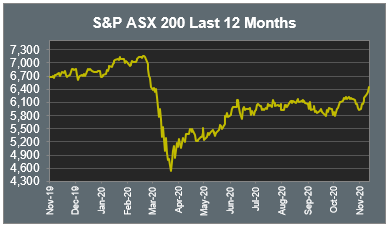

The Australian sharemarket fell 0.5% yesterday, to snap a five-session winning streak and close lower for only the second time in November. The Financials sector was amongst the weakest performers, dragged lower by the big four banks; ANZ, Commonwealth Bank and Westpac fell between 1.1% and 1.9%, while NAB lost 2.4% after the company traded ex-dividend.

The Materials sector also underperformed. Mining heavyweights BHP and Rio Tinto slipped 1.1% and 0.7% respectively, while Fortescue Metals Group slumped 4.3%.

The Telecommunications sector outperformed. Telstra rose 3.0% after the company proposed a further restructuring of the company, looking to split the business into three separate entities. The new divisions proposed are InfraCo Fixed, holding its infrastructure assets, InfraCo Towers, covering its mobile towers and ServeCo, which will look after customers and product development.

Wesfarmers lifted 2.5% after the company provided a trading update. Strong sales growth was the theme, with its Bunnings and Officeworks divisions’ sales up 25% and 23% respectively over the four months to 31 October.

The Australian futures market points to a 0.66% fall today, driven by weaker overseas markets overnight.

Overseas Markets

European sharemarkets were weaker on Thursday, with the Financials and Energy sectors underperforming after recent strong sessions. The Industrials sector also underperformed; Airbus, Veolia and Vinci all fell between 2.1% and 2.8%. By the close of trade, the broad based STOXX Europe 600 was down 0.9%.

US sharemarkets also closed lower overnight, with all sectors in the red. Coronavirus cases continued to surge to new highs, while new restrictions were back in focus as New York introduced stricter social distancing rules. The Energy, Materials and Financials sectors were amongst the weakest performers. Bank of America lost 2.5%, Goldman Sachs fell 1.7% and JP Morgan slipped 1.3%. Financial services companies also weakened; MasterCard, PayPal and Visa all lost between 1.2% and 1.9%, while technology companies Alphabet, Apple and Microsoft all slipped between 0.1% and 0.5%.

By the close of trade, the Dow Jones and S&P 500 fell 1.1% and 1.0% respectively, while the NASDAQ slipped 0.7%.

CNIS Perspective

Australia’s Consumer Confidence is back at levels last seen before the nationwide lockdown in March, driven by tax cuts and lower interest rates. Reports this week from the Westpac Index of Consumer Sentiment noted a remarkable comeback following the October Federal Budget, with the index rising 11.9% in October to 105.0. Elsewhere, the NAB Business Confidence Index rose from -3.8 points to a 17-month high of +4.7 points in October, as the economy showed more encouraging signs.

This Consumer Confidence is likely to support spending leading into the Christmas season, as Australian households, armed with record-low mortgage repayments, savings and government income support, are showing increased appetite for making a major household purchase. The ANZ-Roy Morgan measure of whether it was a ‘good time to buy a major household item’ surged 10% to 13.3 points last week, the highest level since early March. The timing couldn’t be better for Australian retailers, which are gearing up for the major online shopping events of Black Friday and Cyber Monday at the end of November.

The Australian Government is hoping this likely consumer spending surge will help support employment, which continues to lag the overall economic recovery. Employment indices are still indicating businesses are not willing to increase headcount, which, unless addressed by government policy or a change in business practices, will prevent a full recovery.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.