Morning Market Update - 15 December 2021

Cutcher & Neale

14 December 2021

17 July 2023

minutes

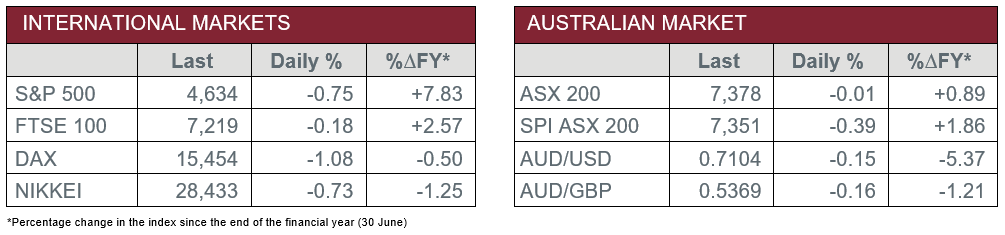

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Conditions and Confidence – Conditions rose two points to 12, while Confidence fell by eight points to 12.

- Tuesday – EUR – Industrial Production rose 1.1% in October, following a 0.2% fall last month.

- Wednesday – US – Retail Sales

- Wednesday – UK – Consumer Price Index

Australian Market

The Australian sharemarket closed relatively flat yesterday, as gains in the Materials and Financials sectors were overshadowed by losses in the Consumer Staples sector.

Woolworths led the losses in the Consumer Staples sector, as the company closed the session 7.7% lower. The company announced their first half earnings would be significantly lower due to the impact of COVID-19. Coles and Wesfarmers followed suit, as they lost 2.7% and 2.3% respectively.

The Information Technology sector also lost ground. Afterpay investors voted in favour of the takeover by Square, however the company’s share price fell 4.1%. Appen and Xero bucked the downward trend to rise 1.2% and 0.6% respectively.

The Financials sector added 0.2%, as the major banks were mixed. Commonwealth Bank was the worst performer of the big four, as it lost 0.5%, while NAB dropped 0.1%. ANZ lifted 0.4% and Westpac gained 0.5%.

The Australian futures market points to a 0.39% decline today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets closed lower overnight, as Omicron worries continue to weigh on investors. The Information Technology sector lost ground; ASML Holdings lost 1.3%, while Infineon Technologies shed 2.1%. Automakers were also weaker, as BMW conceded 1.7% and Volkswagen lost 0.4%, while Renault closed the session 1.3% lower.

The major miners enjoyed gains, as London-listed BHP and Rio Tinto added 0.8% and 2.2% respectively, while Glencore lifted 1.1%. By the close of trade, the German DAX slipped 1.1% and the STOXX Europe 600 fell 0.7%, while the UK FTSE 100 shed 0.2%.

US sharemarkets also closed the session in the red on Tuesday, as the high-flying growth stocks weakened as a result of increased Omicron jitters and further inflationary worries. The Information Technology sector was the worst performer; Fortinet lost 4.8%, Microsoft dropped 3.3% and Google’s parent Company, Alphabet, slipped 1.2%.

The Financials sector was among the best performers during trading yesterday, as investors moved towards more defensive sectors. Charles Schwab gained 1.8% and Bank of America added 1.3%, while Goldman Sachs and JP Morgan lifted 1.1% and 0.8% respectively.

By the close of trade, the Dow Jones lost 0.3% and the NASDAQ fell 1.1%, while the S&P 500 dropped 0.8%.

CNIS Perspective

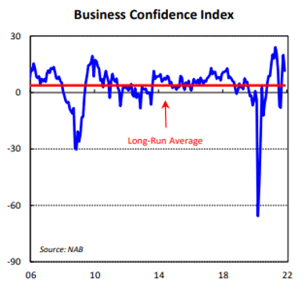

Consumer spending is the backbone of developed countries’ economic growth.

As we have seen already post lockdown, the pent-up amount of household savings is starting to be spent and already triggered improved GDP and higher inflation numbers.

Yesterday’s business confidence survey results confirm the recovery is on its way and the retail sector is looking forward to continued strength in economic growth.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.