Morning Market Update - 01 March 2021

Cutcher & Neale

28 February 2021

17 July 2023

minutes

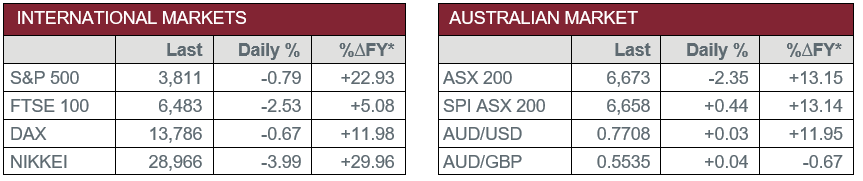

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – AUS – TD Securities Inflation

- Monday – UK – Markit Manufacturing PMI

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Consumer Price Index

- Wednesday – AUS – Gross Domestic Product

- Wednesday – EUR – Producer Price Index

- Thursday – AUS – Retail Sales

- Thursday – EUR – Retail Sales

- Friday – US – Unemployment Rate

Australian Market

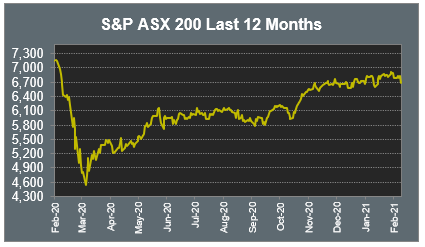

The Australian sharemarket tumbled on Friday to register its worst session since early September, as investors looked towards rising yields in the bond market to meet their investment needs. The local ASX 200 closed down 2.35% for the day, dragged lower by the Information Technology and Consumer Discretionary sectors, which gave up 5.3% and 3.2% respectively. However, despite Friday’s losses, the Australian sharemarket gained 1.0% for February.

The Information Technology sector was weighed down by buy now pay later heavyweight Afterpay, which plummeted 11.0% after the company resumed trading following an announcement it would raise $1.5 billion via its convertible notes offer. Fellow competitors Zip Co and Splitit dropped 5.0% and 3.8% respectively.

Harvey Norman slipped 1.1% after it reported a 116.0% rise in first half earnings, boosted by a 25.0% lift in total aggregated sales, as demand for furniture, electrical and whitegoods remains strong following the COVID-19 pandemic.

Kogan.com slid 10.4%, despite the company announcing a 89.0% lift in revenue to $414 million and an increase to its dividend.

The Australian futures market points to a 0.44% rise today.

Overseas Markets

European sharemarkets fell on Friday, as investors realised profits in technology and resources stocks in response to concerns over rising inflation and interest rates, following a rise in bond yields. The German DAX slipped 0.7%, the broad based STOXX Europe 600 gave up 1.6% and the UK FTSE 100 lost 2.5%.

US sharemarkets were mostly lower on Friday. However, Airbnb rose 13.3% after the company announced Q4 bookings were better than expected and that it expects gross bookings to return to y/y growth in Q1. Technology heavyweights Alphabet (0.3%), Amazon (1.2%), Apple (0.2%), Facebook (1.2%), Microsoft (1.5%) and Spotify (1.4%) all posted gains, which offset losses by payment services companies MasterCard (-0.2%) and Visa (-0.6%). The Dow Jones closed down 1.5% and the S&P 500 fell 0.5%, however, the NASDAQ climbed 0.6%.

CNIS Perspective

Warren Buffett told his Berkshire Hathaway shareholders in his closely followed annual letter that it was best to avoid the fixed-income, or bond market, at the moment. Optimism around a global expansion has rekindled concerns about a spike in inflation, which sent bond prices lower and simultaneously, yields of those bonds higher. Whilst many investors can grasp this economic reasoning for the bond market, why the stock market is falling when the economic outlook appears in good shape is a relationship often misunderstood.

For one, the understanding of the ‘risk-free rate of return’ is important. This is the theory that to properly measure the real risk of an investment such as stocks, they should be rated against an investment that has zero risk such as government bonds. Whist the ‘risk-free rate of return’ does not truly exist, as every investment, even government bonds, carry a small amount of risk. When a professional investor considers an investment, it will be measured against what is on offer relative to the ‘risk free rate of return’. The higher the risk-free rate, the less attractive riskier assets become.

This re-rating of stocks is in response to the Australian 10-Year Government Bond’s significant yield increase from less than 1.0% at the start of January to 1.7% today, and the US 10-Year Treasury Bond yield having a similar move over the same time period from 0.9% to 1.4%.

While in historical terms the yields are still very low, in percentage terms these yield increases are sharp and significant, we are now witnessing its flow on effect into the sharemarket.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.