Morning Market Update - 17 June 2022

Cutcher & Neale

16 June 2022

17 July 2023

minutes

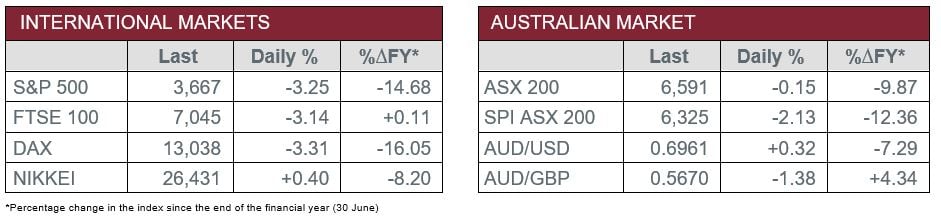

Pre-Open Data

Key Data for the Week

- Thursday – UK – BoE Policy Meeting – The cash rate was raised by 0.25%, to 1.25%.

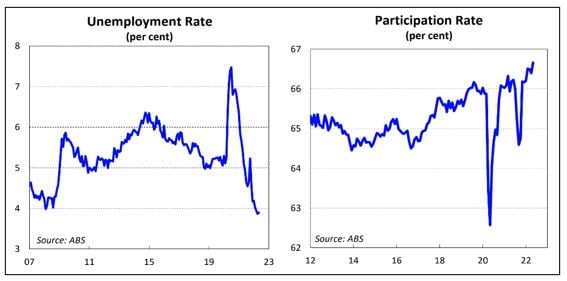

- Thursday – AUS – Unemployment Rate held steady at 3.9%, as the increase in the participation rate offset the rise in jobs.

- Friday – EUR – Consumer Price Index

Australian Market

The Australian sharemarket inched 0.2% lower on Thursday, despite gains earlier in the session, initially propelled ahead by a strong performance by international markets on Wednesday night. The afternoon decline was partly attributable to employment data, which showed the labour market remains tight. Ultimately, this was interpreted by market participants as meaning the RBA may need to become more aggressive in tightening monetary policy to get inflation under control.

Seven of the eleven industry sectors closed in the red, while the REITs (1.5%), Telecommunications Services (0.5%), Energy (0.5%) and Materials (0.4%) sectors outperformed. Notable gainers included Goodman Group (2.4%), Telstra (1.3%), Whitehaven Coal (4.3%) and Northern Star Resources (2.5%).

In company news, Link Group plunged 10.4%, after the Australian Competition and Consumer Commission expressed concerns about its $2.9 billion takeover by Dye & Durham. BHP Group reported it would retain its Mt Arthur thermal coal mine in the Hunter Valley, to be shutdown fifteen years ahead of schedule, as it failed to find a buyer. The Reject Shop surged 19.0% after it told the ASX it was looking into a share buyback program and appointment of Phil Bishop as its new Chief Executive from 11 July.

In other news, it was reported that China is seeking to consolidate its iron ore imports via a new centrally controlled group. The proposal has been brought forward by the China Iron and Steel Association and involves state-owned groups like China Minmetals, Aluminium Corporation of China and Baowu.

The Australian futures market points to a 2.13% fall today.

Overseas Markets

European sharemarkets extended losses on Thursday, as they fell to their lowest level in sixteen months, amid inflation and growth concerns. Losses were widespread, as the Energy (-3.7%), Financials (-2.6%) and Basic Materials (-3.9%) sectors all declined. Shell (-5.2%), Barclays (-4.4%) and London listed Rio Tinto (-3.3%) were key detractors. By the close of trade, the STOXX Europe 600 lost 2.5%, while the German DAX and UK FTSE 100 both fell between 3.1%-3.3%.

US sharemarkets tumbled on Thursday, as concern around a recession was front of mind for market participants. According to JPMorgan Chase & Co. strategists, the S&P 500 movements of late implies an 85% chance of a US recession. All industry sectors were in negative territory, with the cyclical Energy (5.6%), Consumer Discretionary (-4.8%) and Information Technology (-4.1%) sectors the main detractors. Notable movers included mega cap growth companies Apple (-4.0%), Microsoft (-2.7%), Meta Platforms (-5.0%) and Tesla (-8.5%). By the close of trade, the Dow Jones shed 2.4%, the S&P 500 gave up 3.3% and the NASDAQ dropped 4.1%.

CNIS Perspective

Data released yesterday showed the Australian unemployment rate held near a 50-year record low of 3.9% in May.

Some economists were expecting the rate to drop lower, and despite the workforce adding over 60,000 jobs for the month, this was offset by the participation rate (those in work or looking for work) rising to a record high of 66.7%.

The labour market is exceptionally tight, and the RBA deems ‘full employment’ to sit between high 3% to low 4%. It is therefore likely that wages growth will start to materialise more quickly, and recent business surveys suggest the ability to attract new workers is becoming increasingly difficult.

If the labour market continues to tighten (which economists are expecting) the importance of a rise in labour supply becomes more pronounced.

A solution to the supply side may be through the resumption of overseas migration back to its pre-pandemic level sooner rather than later.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.