Morning Market Update - 20 May 2022

Cutcher & Neale

19 May 2022

17 July 2023

minutes

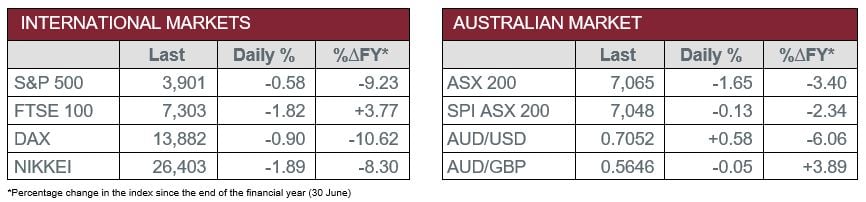

Pre-Open Data

Key Data for the Week

- Thursday – AUS – Unemployment Rate fell to 3.9%, in line with market expectations, to its lowest level since 1974.

- Friday – JAPAN – Consumer Price Index

- Friday – UK – Retail Sales

Australian Market

The Australian sharemarket broadly fell 1.7% on Thursday, led lower by anxiety about inflation, which was sparked in overseas markets on Wednesday night. Consumer related stocks were sold-off, as investors expect higher costs to diminish profit margins. Notable detractors included Wesfarmers (-7.8%), JB Hi-Fi (-6.6%), Woolworths (-5.6%) and Coles (-3.4%).

By the close of trade, all sectors closed in the red except the Health Care (0.1%) sector, which held its ground. Losses were led by the Consumer Staples and Consumer Discretionary sectors, which both lost between 3.0%-4.0%. The Information Technology (-2.7%), Financials (-1.8%) and Materials (-1.7%) sectors were also key laggards.

The major banks all finished lower, as ANZ led losses (-2.2%) and the other banks all fell between 1.0%-1.6%.

In company news, private equity company KKR & Co affirmed its $20 billion offer of $88 per share for Ramsay Health Care was on track. It is anticipated the firm will submit a binding bid early next month after further due diligence. Meanwhile, Woodside Petroleum shareholders provided a 98.7% approval vote for its $63 billion merger with BHP.

Other notable movers in the session included buy now pay later companies Zip Co (-3.9%) and Sezzle (-2.5%). Both stocks have fallen more than 88% over the past 12 months.

The Australian futures market points to a relatively flat open today, down 0.13%.

Overseas Markets

European sharemarkets softened on Thursday, as inflation worries raised profitability concerns around food and beverage stocks, which led losses, broadly down 3.4%. Notable movers in the group included Nestlé (-5.0%), Unilever (-1.0%) and Tesco (-1.2%). Other key detractors included major banks Barclays (-1.2%) and Lloyds Banking Group (-0.8%). By the close of trade, the STOXX Europe 600 (-1.4%), German DAX (-0.9%) and UK FTSE 100 (-1.8%) all declined.

US sharemarkets fell on Thursday, as investors weighed economic growth prospects against cost pressures and tightening monetary policy. 8 out of 11 sectors finished lower, with the Consumer Staples (-2.0%) and Information Technology (-1.1%) sectors were the key detractors. On the other hand, the Materials (0.7%) sector was the best performer. Notable movers included Apple, which was down 2.5%, and Netflix, which advanced 3.6%. Meanwhile, online payment providers were also mixed, as Visa lost 1.3% and PayPal gained 5.3%. By the close of trade, the Dow Jones and S&P 500 dipped between 0.6%-0.8%, while the NASDAQ edged 0.3% lower.

CNIS Perspective

Following on from last Friday’s observation about the sluggish sales of Bin 128 to China, it is another example of how important China has become to wine sales for Australian wine makers.

Penfolds’ Bin 389, aka the Baby Grange, is now also on sale. The 2018 vintage, which was released in August 2020, has obviously been sitting in stock waiting for export to China and now needs to be moved.

Bin 389 is now on sale for $77 a bottle compared to $94 last year. The 2018 vintage should have been a big hit in China given 2018 is the best set of numbers you can find in China.

2018 converts to ‘Easy certain for sure rich’ in Chinese numerology. Maybe not so for Penfolds!

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.