Morning Market Update - 20 October 2020

Cutcher & Neale

19 October 2020

17 July 2023

minutes

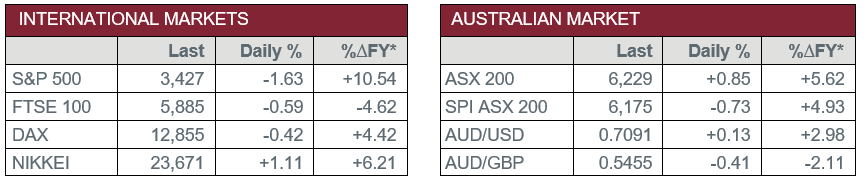

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – CHINA – Gross Domestic Product for the September quarter was up 4.9% on the same period last year, following a rise of 3.2% for the June quarter. However, GDP growth was below expectations for a 5.2% rise.

- Tuesday – AUS – RBA Meeting Minutes

- Tuesday – CHINA – PBoC Interest Rate Decision

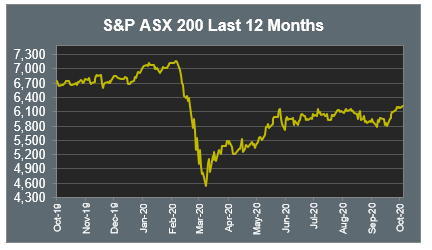

Australian Market

The Australian sharemarket rose 0.9% yesterday, as all sectors except for REITs closed higher. The Information Technology and Health Care sectors were amongst the best performers. CSL and Sonic Healthcare added 1.7% and 1.0% respectively.

The Financials sector also strengthened, as the big four banks all rose between 0.6% and 1.1%, led by Commonwealth Bank. Fund managers were weaker, Magellan Financial Group and Australian Ethical Investment fell 2.7% and 2.8% respectively.

The Materials sector was lifted by mining heavyweights; Fortescue Metals and BHP added 1.1% and 0.7% respectively, while Rio Tinto eked out a 0.1% gain. South32 gained 4.3% after the company reinstated its share buyback program and maintained its FY21 production guidance.

Crown Resorts was one of the weakest performers, down 8.2%, after it was revealed the casino operator faces further regulatory investigations from AUSTRAC in relation to potential money laundering at its Melbourne casino.

The Australian futures market points to a 0.73% fall today, driven by weaker overseas markets overnight.

Overseas Markets

European sharemarkets closed slightly weaker Wednesday, with the broad based STOXX Europe 600 down 0.2%. Coronavirus headlines still dominated as tightening of restrictions continued amid surging new infections. Banking stocks were stronger; Deutsche Bank rose 1.7%, Barclays added 1.5% and Lloyds Bank gained 0.4%. Airlines were amongst the best performers; Air France-KLM gained 7.3%, while easyJet and Ryanair rose 4.8% and 4.4% respectively.

US sharemarkets also finished lower overnight, with the Communication Services, Energy and Information Technology sectors the weakest performers. Alphabet, Apple and Microsoft all lost between 2.4% and 2.6%, while Intel bucked the trend to rise 0.8% following reports the company is nearing a deal to sell its NAND flash memory to a South Korean company for ~US$10 billion. Financial services also underperformed; MasterCard and PayPal fell 2.3% and 2.2% respectively, while Visa was down 1.6%.

By the close of trade, the Dow Jones fell 1.4%, the S&P lost 1.6% and the NASDAQ slipped 1.7%.

CNIS Perspective

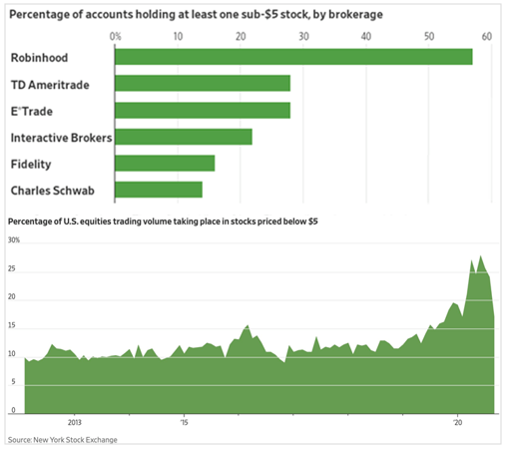

In the current COVID environment, it’s important to note that economic and market fundamentals aren’t the only factors driving the market.

Trading in speculative stocks with low share prices has surged since COVID, fuelled by a huge influx of individual investors using zero commission investing apps and online brokerage.

Over the past six months, more than 25% of the shares traded in the US stock market were in companies with a share price below $5.

This has doubled from the same time last year.

This probably seems like a lot of fun at the moment for the punters, but one can only think it will end in tears at some stage!!

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.