Morning Market Update - 27 August 2021

Cutcher & Neale

26 August 2021

17 July 2023

minutes

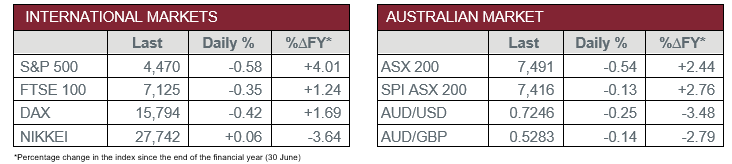

Pre-Open Data

Key Data for the Week

- Thursday – US – Initial Jobless Claims rose by 4,000 to 353,000 last week, higher than the expected 350,000.

- Friday – AUS – Retail Sales

- Friday – UK – Nationwide House Prices

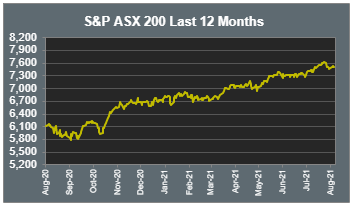

Australian Market

The Australian sharemarket fell 0.5% on Thursday, as lower than expected earnings were reported. Artificial intelligence data services company, Appen, plummeted 21.4%, after it reported FY21 profits halved. Link Group, another data services company in investment administration, was the other major laggard, down 12.6%, after it reported a 6.0% decline in revenue.

Travel related stocks continued their recovery yesterday as Qantas added 3.5%, despite reporting a $2.35 billion pre-tax loss for the year. Other key movers included Flight Centre (4.0%), Helloworld Travel (2.9%), and Webjet (0.7%).

Woolworths closed up 0.4% after it announced a $2 billion share buyback, alongside an increased dividend. This came on the back of slightly better than expected full-year results, despite the continued struggle of its Big W division.

The Financials sector closed flat yesterday after mixed results. Only one of the big banks closed ahead, Commonwealth Bank, as it inched up 0.7%. Fund managers were more volatile as Magellan Financial Group continued its descent, down 2.9%. On the other hand, Australian Ethical Investment surged 4.0% as it reported stellar FY21 results. Operating revenue was up 18%, net profit after tax was up 19%, and group funds under management soared to $6.07 billion, a 50% increase.

The Australian futures point to a 0.13% decline today.

Overseas Markets

European sharemarkets closed lower, as the STOXX 600 shed 0.3%, alongside the German DAX and the UK FTSE 100, which both lost 0.4%. The markets were dragged down by weakened mining, financial and travel-related stocks.

US sharemarkets declined as concern grew over mixed economic data and the potential shift in Federal Reserve policy. This came after hawkish comments made by Fed officials which hinted around a plan to begin the tapering of its open market operations. The S&P 500, Dow Jones and NASDAQ all fell between 0.5-0.6%. All sectors, except Real Estate (0.1%), declined; Energy conceded the most down 1.5%.

Weaker performers included biotechnology company, Illumina, which lost 3.4%, Shopify, down 2.4%, and Mastercard, which conceded 1.7%. On the other hand, gainers included Fortinet and CrowdStrike, both ahead 1.3% and 3.3% respectively.

CNIS Perspective

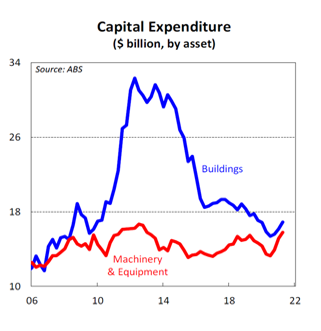

Leading up to the most recent lockdowns, the backdrop and outlook for Australian business investment was strong. Business confidence was at all-time highs, profitability was growing strongly, and tax incentives implemented by the Federal Government were encouraging investment.

These factors underpinned a 4.4% increase in capital expenditure for the June quarter, which followed robust growth of 3.0% and 6.0% in the December and March quarters respectively.

There was solid growth in spending on both buildings, up 4.6%, and machinery and equipment spending, 4.3% higher. Capital expenditure has now recovered to be above the pre-pandemic level in December 2019.

With lockdowns continuing, and a rush to fully vaccinate at least 70% of the population before reopening, business conditions have inevitably taken a tumble, and it is likely some businesses have halted investment for the time being.

However, despite the weak short-term outlook, economists expect the economy will rebound quickly upon reopening and the upward trend in capital expenditure will continue.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.