Morning Market Update - 9 July 2021

Cutcher & Neale

09 July 2021

17 July 2023

minutes

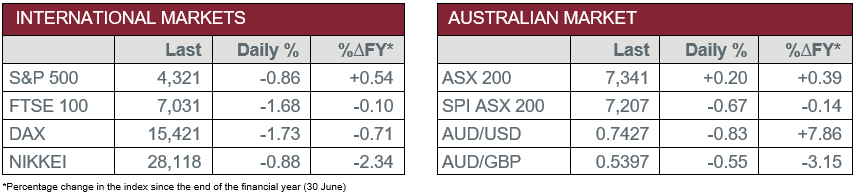

Pre-Open Data

Key Data for the Week

- Thursday – US – Jobless Claims increased to 373,000 for the week, from 371,000 the previous week.

- Friday – CHINA – Consumer Price Index

- Friday – UK – Trade Balance

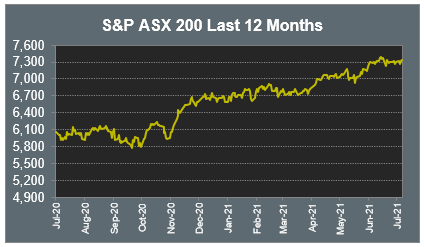

Australian Market

The Australian sharemarket gained 0.2% yesterday in a mixed session of trade. The Information Technology sector led the gains, up 1.3%, followed by Consumer Staples, which added 1.1%.

The Materials sector was lifted by gains among mining heavyweights; BHP added 1.8%, while Fortescue Metals and Rio Tinto added 0.7% and 0.1% respectively. However, gold miners were weaker; Newcrest Mining and Evolution Mining both lost 1.1%, while Northern Star Resources slipped 0.4%.

Buy-now-pay-later providers were among the strongest performers; Afterpay lifted 3.0% and Sezzle rose 6.3%, while Zip Co rallied 13.7% after reports a strategic investor took a 4.0% stake in the company. Artificial intelligence company Appen added 2.1%, while accounting software provider Xero slipped 0.4%.

The Financials sector closed 0.1% lower as all the major banks weakened. ANZ led the losses, down 0.7%, and NAB fell 0.4%, while Westpac and Commonwealth Bank fell 0.3% and 0.2% respectively. Fund managers were mixed; Australian Ethical Investment rose 1.2% and Challenger lifted 0.5%, while Magellan Financial Group gave up 3.9%.

The Industrials sector rose 0.6%, as Sydney Airport gained 2.9% on rumors of a rival bid from a Macquarie consortium, while Auckland Airport lifted 1.0%.

The Australian futures market points to a 0.67% fall today.

Overseas Markets

European sharemarkets weakened on Thursday in the worst session in two months, as concerns regarding economic growth and the spread of new COVID-19 variants continued to rise. Banking stocks eased; Deutsche Bank lost 3.1% and Barclays gave up 2.8%, while Lloyds Bank and HSBC fell 2.5% and 1.8% respectively. Mining stocks also closed lower; Anglo American shed 4.1% and Rio Tinto lost 2.9%, while BHP slid 1.5%.

By the close of trade, the German DAX, UK FTSE 100 and STOXX Europe 600 all closed 1.7% lower.

US sharemarkets were also lower overnight, with all sectors closing in the red. The Financials sector was the main laggard, down 2.0%. PagSeguro Digital gave up 7.9% and BlackRock fell 2.7%, while Visa and MasterCard lost 1.4% and 0.9% respectively.

The Information Technology sector shed 0.9%; NVIDIA closed down 2.3% and Facebook slipped 1.4%, while Spotify and Apple fell 1.1% and 0.9% respectively. Renewable energy stocks also closed lower; SolarEdge Technologies dropped 1.5% and Enphase Energy lost 1.2%, while NextEra Energy slipped 0.3%.

By the close of trade, the S&P 500 eased 0.9% and the Dow Jones lost 0.8%, while the NASDAQ fell 0.7%.

CNIS Perspective

The European Central Bank (ECB) have issued a new policy framework on its inflation target, aiming for slightly higher inflation than previous, as the eurozone region struggles to emerge from COVID-19.

The ECB have stated they will aim to keep inflation at 2% over the medium term, instead of the current target of just below 2%, and would allow room to overshoot its target as required.

The ECB’s policy change is the first in nearly 20 years, and represents a compromise between conservative policy makers in the northern countries like Germany, who tend to worry about high inflation, compared to those nations in the south, such as Italy, who are more concerned about weak economic growth.

The ECB were criticised for increasing interest rates prematurely in both 2008 and 2011, just before the eurozone fell into recession. A higher inflation target signals a longer period of loose monetary policy, which should provide additional stimulus to the economy and promote economic growth.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.