Morning Market Update - 6 August 2021

Cutcher & Neale

06 August 2021

17 July 2023

minutes

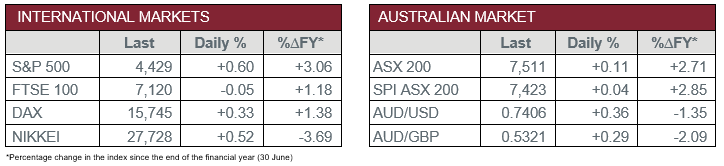

Pre-Open Data

Key Data for the Week

- Thursday – UK – BoE Interest Rate Decision – Its monetary policy remains unchanged, however, the bank warned of more marked inflation in the short-term.

- Thursday – US – Initial Jobless Claims fell by 14,000 to 385,000 last week, slightly higher than expected.

- Friday – US – Unemployment Rate

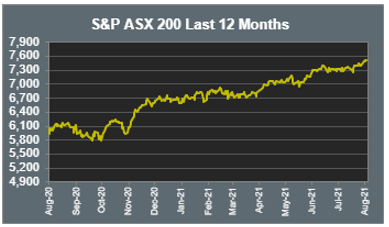

Australian Market

The Australian sharemarket continued its record streak yesterday, as it gained 0.1% by close of trade. The Financials sector had a good session as Commonwealth Bank rose 1.2%, while Westpac, ANZ and NAB all eased between 0.2% and 0.8%. Overall, the sector climbed 0.7%.

Real Estate had a broad, yet moderate, rally yesterday, which pulled the domestic market ahead. The sector closed 1.0% higher. Key advancers included Stockland (1.1%), Charter Hall (1.0%) and Goodman Group (1.8%).

The Materials sector suffered on Thursday as miners lost 1.3% and energy companies dropped 1.2%. The sector fell as the price of iron ore slipped 0.5%. As such, BHP and Rio Tinto both declined 1.7%, while Fortescue Metals Group plunged 3.4%. Energy companies suffered as the price of West Texas Intermediate, the US oil benchmark, tumbled 3.1%, which impacted the local market.

The Information Technology sector performed in line with the overall market, up 0.1%. It marked a fourth consecutive day of gains, led by Afterpay, which has dragged Technology stocks 11.4% higher this week.

Australian futures point to a relatively flat open at 0.04%.

Overseas Markets

European sharemarkets closed ahead on Thursday, as travel and leisure stocks performed well, adding 1.3%. The pan-European STOXX 600 climbed 0.4%, to mark its fourth consecutive day of gains.

The German DAX lifted 0.3%, while the UK FTSE 100 fell 0.1%. The major laggards, dual listed BHP (-3.8%) and Rio Tinto (-4.2%), suffered consequent to concerns surrounding dampened Chinese demand.

US sharemarkets advanced yesterday, despite mixed earnings reports. Key positive reporters included retailer Wayfair (10.0%), Uber (3.0%) and Datadog (15.3%). Meanwhile, among the worst performers were Roku (-4.0%), Etsy (-9.7%) and Cigna (-10.9%), who failed to meet earnings expectations.

Competition in the online streaming market has picked up, after ViacomCBS stated it had signed up the most subscribers in the June quarter. It also made a multi-year deal with Comcast’s Sky to bring Paramount+ to Europe. The company's share price surged 6.7%.

By the close of the session, the S&P 500 edged 0.6%, while the Dow Jones and NASDAQ both gained 0.8%.

CNIS Perspective

Approximately half of all cars sold in the US by 2030 will be electric, under new executive orders announced by the Biden administration.

Several US car manufacturers have stated they support the 40-50% electric vehicle (EV) sales target, however their commitment hinges on government funding for manufacturing and supply-chain development, EV charging infrastructure and purchase incentives for consumers.

The US is the third largest market for EV’s in the world and the target represents an ambitious step toward US car manufacturers becoming the leader in EV’s.

While car manufacturers have increasingly been supportive of EVs, they’ve also been mixed on the upcoming changes in fuel economy regulations, as they attempt to rake in profits from traditional vehicles to fund electric models. EV’s have historically been unprofitable or produce low profit margins.

Americans are buying electric vehicles in record numbers, but the sales targets are far higher than what is currently sold. Electric vehicle sales made up just ~3% of the total US market in 2020.

Such rapid adoption of EV’s faces significant hurdles, however, with it comes enormous opportunities, from both an economic and investment perspective.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.