Morning Market Update - 3 December 2020

Cutcher & Neale

02 December 2020

17 July 2023

minutes

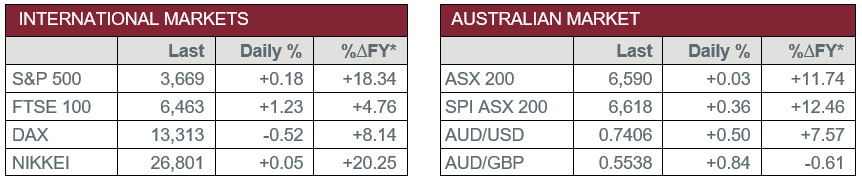

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Wednesday – AUS – Gross Domestic Product rose 3.3% over the September quarter. Consumer spending led the recovery, with household consumption up 7.9%.

- Wednesday – EUR – Unemployment Rate was 8.4% for October, in line with consensus and down from 8.5% in September.

- Thursday – AUS – Trade Balance

- Thursday – EUR – Retail Sales

Australian Market

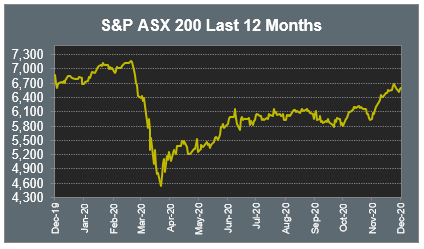

The Australian sharemarket edged 0.03% higher yesterday. The Materials sector outperformed, led by heavyweights BHP and Rio Tinto, both up 2.0%.

Woodside Petroleum lifted 1.0%, while Sydney Airport and Auckland International Airport both added 0.5% to continue their rally following the easing of borders.

The Health Care sector underperformed, weighed down by CSL and Cochlear, which fell 1.2% and 1.5% respectively, while Ramsay Health Care bucked the trend to add 0.5%. Mesoblast gained 7.3% after the US FDA granted fast track designation of its drug to treat critically ill COVID-19 patients.

The Financials sector was weaker as the big four banks were mixed; Commonwealth Bank and NAB both fell 0.2%, while Westpac and ANZ gained 0.1% and 0.7% respectively. Westpac announced the sale of its general insurance business Allianz for $725 million.

The Australian futures market points to a 0.36% rise today, driven by predominantly stronger overseas markets.

Overseas Markets

European sharemarkets were mixed on Wednesday. The UK became the first country to approve a coronavirus vaccine which will be available from next week, BioNTech’s German listed shares lifted 5.4% on the news. Industrials also strengthened, Veolia added 1.2%, CRH rose 1.0% and Vinci added 0.3%, while aircraft manufacturer Airbus lifted 2.2%.

US sharemarkets were also mixed overnight; Energy, Communication Services and Financials sectors outperformed, while Materials, REITs and Information Technology lagged. Spotify outperformed, up 12.6%, to close above US$300 for the first time following the release of new features and premium users ‘2020 wrapped’ personalised experience. Financial services were mixed; PayPal and Visa slipped 1.8% and 0.5% respectively, while MasterCard rose 0.4%.

By the close of trade, the Dow Jones and S&P 500 both added 0.2%, while the NASDAQ slipped 0.05%.

CNIS Perspective

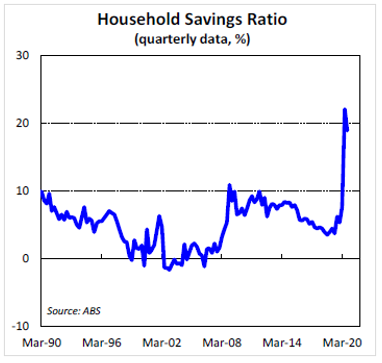

News out yesterday provided a more positive picture of the Australian economy, following a swift bounce back out of the nation’s first recession in 29 years, with GDP for the September quarter jumping 3.3%. It is the biggest quarterly growth rate since early 1976.

The recovery can be put down to increased consumer spending, especially spending on eating out and domestic holidays. A more encouraging fact out of yesterday’s data is the savings ratio remaining elevated, which we have followed closely throughout 2020.

The household savings ratio hit a record high in the June quarter of 22.1%. Importantly, it came down to just under 19% in the September quarter, a far cry from the end of 2019, where it sat at just 5.3%. This is good news for further economic growth.

The benefit of a high savings ratio is money in consumers’ pockets. Overtime, this built up cash will flow back into the economy when consumers feel more comfortable to spend. With state borders open and employment uncertainty reducing, we should see this play out over Christmas and into 2021.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.