Morning Market Update - 30 November 2020

Cutcher & Neale

29 November 2020

17 July 2023

minutes

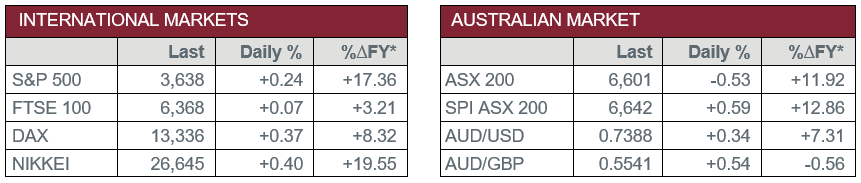

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – AUS – TD Securities Inflation

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Consumer Price Index

- Tuesday – US – Markit Manufacturing PMI

- Wednesday – AUS – Gross Domestic Product

- Wednesday – EUR – Unemployment Rate

- Thursday – AUS – Trade Balance

- Thursday – EUR – Retail Sales

- Friday – AUS – Retail Sales

- Friday – US – Unemployment Rate

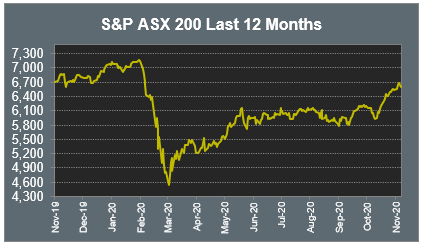

Australian Market

The Australian sharemarket eased 0.52% on Friday, to end the week with two consecutive losses. Sentiment weakened after the Chinese Ministry of Commerce announced that it would apply anti-dumping duties to all Australian wine imports from the weekend. Treasury Wine Estates was the worst affected stock following the announcement, down 11.3% prior to the company entering a trading halt to assess the potential impact of the decision. Australian wine entering China will now face tariffs of up to 212%.

Losses were broad based, with REITs the only sector to end the session higher. The Energy sector was the worst performer; Oil Search fell 3.9% after the company revealed they anticipate underlying monthly losses to be between $1.5 million and $2 million for the remainder of the financial year.

Mining heavyweights BHP and Rio Tinto lost 1.2% and 0.8% respectively to weigh on the Materials sectors, while Financials was dragged lower by the big four banks, which all gave up between 0.5% and 0.9%.

Bega Cheese surged 7.1%, after the dairy company resumed trade after being in a trading halt since Thursday to announce the acquisition of Lion Dairy & Drinks for $534 million. The institutional placement has been completed and raised $284 million, while an entitlement offer for retail investors will open Wednesday.

The Australian futures market points to a 0.59% rise today, driven by broadly stronger overseas markets on Friday.

Overseas Markets

European sharemarkets rose on Friday to post its fourth consecutive week of gains. Talks continued between the European Union and Great Britain regarding a trade deal, though substantial differences still exist. Spanish company BBVA gained 4.2% after the company ended merger talks with fellow lender Banco Sabadell (-13.6%). The merger would have created the second largest domestic bank in Spain. HelloFresh surged 6.0%, while renewable energy giants Siemens Gamesa and Vestas Wind Systems rose 3.5% and 3.9% respectively. The STOXX Europe 600 and the German DAX both rose 0.4%, while the UK FTSE 100 added 0.1%.

US sharemarkets were also stronger in a shortened trading session on Friday. Technology heavyweights Alphabet (+1.2%), Apple (+0.5%), Facebook (+0.8%), Microsoft (+0.6%) and Spotify (+2.8%) all posted gains, while Illumina strengthened 4.3% and Fortinet lifted 3.3%. By the close of trade, the Dow Jones rose 0.1%, while the S&P 500 and the NASDAQ strengthened 0.2% and 0.9%, to both close at fresh record highs.

CNIS Perspective

Microsoft CEO Satya Nadella famously quoted in April that the world has seen two years of digital transformation in two months. The adoption of new technological behaviours in response to the pandemic, from videoconferencing to online shopping, has created usage not expected for several years. The likes of the big tech feel almost made for the situation.

The rapid rate of technological adoption of already existing trends has really forced those reluctant to change to quickly adapt. The enforced experiments of ‘working from home’, online learning and digital health have proven to work and can be more efficient.

While vaccine news has created buoyancy to those oversold sectors that rely on human movement and a return to normal, the world is not going to return to its pre-pandemic state. Some new digital behaviours will fall from their lockdown peaks, but there is no going back to the past. Once you are accustomed to the ease of things such as digital cashless transactions you are unlikely to head to an ATM to withdraw notes.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.