Morning Market Update - 3 September 2021

Cutcher & Neale

02 September 2021

17 July 2023

minutes

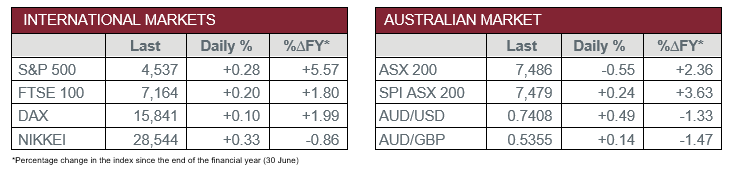

Pre-Open Data

Key Data for the Week

- Thursday – AUS – Trade Balance surplus widened to $12.0 billion in July, higher than estimates of $10.2 billion.

- Thursday – US – Initial Jobless Claims fell by 14,000 to 340,000.

- Friday – US – Unemployment Rate

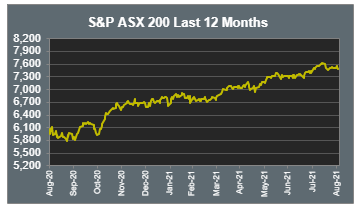

Australian Market

The Australian sharemarket fell 0.6% yesterday, despite a rebound from its initial dip early in the session. Even with the volatile start to the September month, the market has improved 16 out of the last 17 months, which represents its longest monthly winning streak in 78 years.

The Materials sector lost ground again, being the weakest performer, down 2.5%. BHP was the major laggard as it plunged 6.9%. This came on the back of weakened iron ore prices, lower than expected Chinese manufacturing activity and the company trading ex-dividend.

The Health Care, Consumer Staples and Utilities sectors also performed poorly, down 1.1%, 1.0% and 0.8% respectively. The most notable movers being CSL Limited and Coles Group, which both lost 1.3%. The Technology sector performed well on Thursday, ahead 0.8%, joined by the Energy sector, which closed 0.7% higher. All other sectors closed relatively flat.

A major gainer was Rubicon Water, a company which installs and maintains irrigation automation software and hardware worldwide. The company’s share price surged 63.0% as it made its debut on the ASX 200 yesterday. Another strong performer included fund manager, Australian Ethical Investment, which appreciated 2.5%.

The Australian futures point to a 0.24% increase today.

Overseas Markets

European sharemarkets inched higher on Thursday as the STOXX Europe 600, the UK FTSE 100 and the German DAX all rose between 0.1-0.3%. Oil shares were the main contributors as investor confidence in the economy rose. The European Producer Price Index increased by 2.3% in July, alongside an annual GDP growth rate of 12.1%, which both exceeded expectations. Pharmaceutical company, Swedish Orphan Biovitrum, was the top performer, up 25.8%, after it agreed to a US$8 billion takeover by US private equity firm Advent International and Singapore’s sovereign wealth fund GIC.

US sharemarkets closed ahead overnight, to record highs, as an increase in oil prices aided the Energy sector, up 2.5%. The Dow Jones and S&P 500 gained 0.4% and 0.3% respectively, while the NASDAQ edged up 0.1%. Music streaming service Spotify was a major mover, as its US listed share price climbed 6.6%. Digital payment service providers, Visa and Mastercard, were other important movers, down 2.6% and 2.4%.

CNIS Perspective

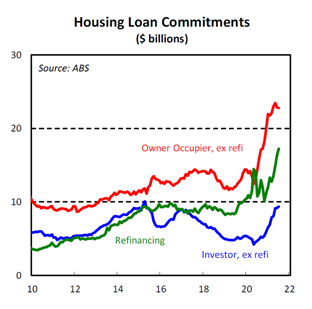

Yesterday we wrote about the strength in house prices and sales volumes, and how quickly the market is absorbing new listings.

New data released shows how this strength in the housing market translates into housing finance.

Despite lockdowns coming back into effect in NSW, and other parts of the country, lending for housing was broadly unchanged in July (+0.2%) and has increased 68.2% in the 12 months to July.

Borrowers have jumped at the opportunity to take advantage of lower interest rates, by increasing the level of refinancing of existing mortgages. Refinancing was up 6.0% in July and reached a record high. Refinancing has increased about 60% on a year ago.

Investors have also continued to return to the market, with lending up 1.8% in July. This is the ninth consecutive month of growth and lending is at its highest level since April 2015.

Looking beyond any immediate effects of lockdowns, monetary policy remains extremely accommodative and property demand remains robust. These factors will continue to support housing finance as restrictions lift.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.