Morning Market Update - 2 September 2021

Cutcher & Neale

01 September 2021

17 July 2023

minutes

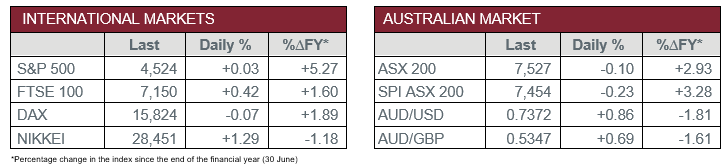

Pre-Open Data

Key Data for the Week

- Wednesday – AUS – Gross Domestic Product grew 0.7% in the June quarter, which represented 9.6% in FY21.

- Wednesday – EUR – Unemployment Rate fell as expected to 7.6%.

- Thursday – AUS – Trade Balance

Australian Market

The Australian sharemarket closed slightly lower, down 0.1%, despite an initial plunge at the start of trade. The market rallied towards the end of the day on the back of stronger than expected second quarter GDP growth. With the reporting season now over, the market has become more sensitive to macroeconomic performance, alongside both business and consumer sentiment.

The Energy sector was the top performer, up 1.3%, followed by Financials (0.9%) and Communication Services (0.8%). On the other hand, Consumer Staples fell 1.5%, followed by Consumer Discretionary, down 1.2%. The Materials and Health Care sectors both lost 0.8%.

The big miners were among the weaker stocks, as BHP, Fortescue Metals Group and Rio Tinto conceded 1.3%, 3.2% and 2.4% respectively. This followed as the price of iron ore continues to weaken. Wesfarmers was another major underperformer, down 3.3%.

Qantas rose 3.1% after NSW Premier Gladys Berejiklian alluded that NSW residents could begin international travel from November if double vaccination rates reached 80%. Other travel stocks also climbed as a result, with Flight Centre and Webjet up 3.0% and 0.9%.

The major banks were strong, all up 0.5%-2.2%, with NAB (2.2%) and Westpac (1.1%) the best performers.

The Australian futures point to a 0.23% decline today.

Overseas Markets

European sharemarkets closed mostly higher, as the STOXX Europe 600 gained 0.5% and the UK FTSE 100 rose 0.4%, while the German DAX fell slightly, down 0.1%. Retail shares performed strongly, ahead 1.8%, alongside Travel and Leisure stocks as COVID-19 vaccination rates rise. A key gainer included online property platform, Rightmove, which strove ahead 2.7%.

US sharemarkets were mixed yesterday as the NADSAQ rose 0.3% to a record high, while the S&P 500 closed flat and the Dow Jones lost 0.1%. The Technology and Utilities sectors were among the best performers, one standout being waste management company, Veolia Environment, up 2.8%. Apple, Amazon, and Alphabet Inc. all edged higher between 0.2%-0.5%. The Real Estate sector was the top performer, ahead 1.7%.

CNIS Perspective

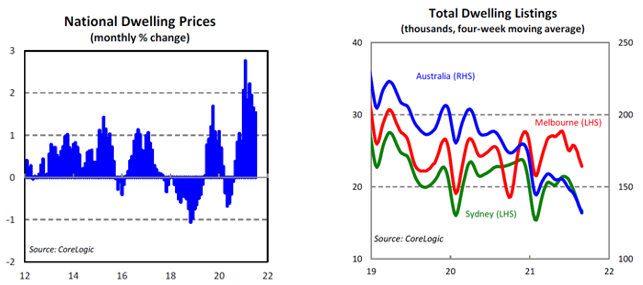

Lockdowns may have dampened property listing activity but it hasn’t impacted prices and sales volumes to the same extent.

CoreLogic’s national home value index increased 1.5% in August. In annual terms, dwelling prices increased 18.4%, which is the strongest growth in over 32 years, since the late 1980s.

Sales volumes over the past three months remain around 30% above their average over the past five years. As a result, the sales volumes to new listings ratio, a measure of how quickly the market is absorbing new stock that is added, has continued to rise.

Lockdowns ultimately translate into lower interest rates for even longer, and this is no doubt helping fuel the property boom, despite the COVID doom and gloom.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.