Morning Market Update - 6 April 2021

Cutcher & Neale

05 April 2021

17 July 2023

minutes

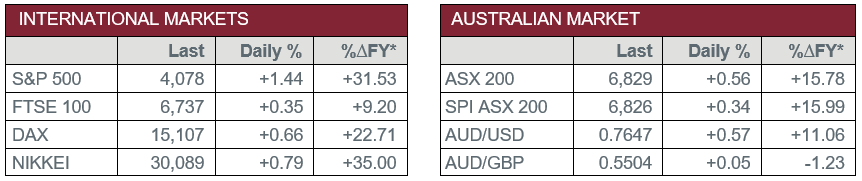

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Unemployment Rate

- Wednesday – US – Goods and Services Trade Balance

- Thursday – US – Initial Jobless Claims

- Thursday – EUR – Producer Price Index

- Friday – US – Producer Price Index

Australian Market

The Australian sharemarket was closed on Friday and Monday for the Easter long weekend.

Last Thursday, the local ASX 200 gained 0.6%, lifted by the Information Technology and Materials sectors, which rose 2.5% and 1.5% respectively. Consumer Staples, Industrials and Health Care were the only sectors to decline.

Gains among buy-now-pay-later providers lifted the Information Technology sector. Zip Co added 4.6% and Afterpay rose 4.0%, while Sezzle closed up 1.8%. Artificial intelligence company Appen lifted 3.4%, while accounting software provider Xero gained 3.4% following completion of the acquisition of workforce management platforms Planday and Tickstar.

The Materials sector was boosted by mining heavyweights; Fortescue Metals added 1.3% and Rio Tinto gained 1.1%, while BHP rose 0.8%. Goldminers also enjoyed strong gains; Northern Star closed up 3.4%, while Evolution Mining and Newcrest Mining lifted 2.9% and 2.6% respectively.

The Health Care sector slipped 0.2%, weighed down by biotechnology giant CSL, which fell 0.6%. Cochlear gave up 0.2% and Ramsay Health Care lost 0.1%, however, Sonic Healthcare bucked the trend to gain 0.6%.

The Australian futures market points to a 0.34% gain today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets were also closed on Friday and Monday. European sharemarkets posted gains last Thursday, as the STOXX Europe 600 rose 0.5%. Semiconductor stocks enjoyed gains; ASML lifted 0.5% and Infineon Technologies rose 1.2%, while ASM International closed up 3.5%. The Financials sector was stronger; Credit Suisse gained 2.6% and Deutsche Bank rose 0.8%, while Lloyds Bank added 0.6%.

US sharemarkets advanced on Monday as investors were optimistic following positive employment data released on Friday. The Information Technology sector was a strong performer; Alphabet jumped 4.1% and Microsoft gained 2.8%, while Fortinet and Apple closed up 2.6% and 2.4% respectively. Financial services stocks also posted gains; PayPal and MasterCard both lifted 1.4%, while Visa rose 1.0%. By the close of trade, the NASDAQ gained 1.6%, while the S&P 500 rose 1.4% and the Dow Jones lifted 1.1%.

CNIS Perspective

Last week President Joe Biden unveiled his plan to redesign the US economy by looking to spend US$2 trillion on infrastructure over the next decade. He plans to fund this investment by returning the corporate tax rate to 28% from 21% put in place by the Trump administration. Additional revenue will be sought by clamping down on international tax havens and end tax preferences for fossil fuel producers.

Coming just weeks after the US$1.9 trillion fiscal stimulus plan was approved to kick start the US economy, the Democrats narrow majority in both houses will still require delicate negotiations in order to pass this new aggressive proposal. The majority of the funding will go towards traditional infrastructure upgrades: roads, public transport, ports and airports and also includes a historic US$174 billion investment into electric vehicles. In a huge turnaround from the climate change scepticism of former President Trump, Biden’s proposal includes US$100 billion in measures to modernise the electricity grid, tax credits for clean energy generation, as well as US$213 billion to make homes more energy-efficient and US$100 billion to do the same for public schools.

Other areas of spending on artificial intelligence, assistance for chip makers and biotech are aimed at improving competitiveness with China, who is currently on target to topple the US as the world’s largest economy by 2028, after their phenomenal recovery from the pandemic, being the only major economy to have expanded in 2020.

Expectedly, the trade unions cheered the announcement, whilst the chambers of commerce suggested the plan will slow the US economic recovery and make the nation uncompetitive with higher corporate tax rates. Prominent business groups oppose the tax hikes but will need to consider whether to put up a fight due to the need for additional US infrastructure investment.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.