Morning Market Update - 8 April 2021

Cutcher & Neale

07 April 2021

17 July 2023

minutes

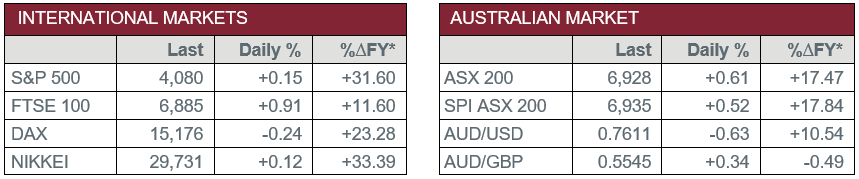

Pre-Open Data

Key Data for the Week

- Wednesday – US – Goods and Services Trade Balance deficit grew to a record US$71.1 billion in February, as a decline in exports largely offset the slight dip in imports.

- Thursday – US – Initial Jobless Claims

- Thursday – EUR – Producer Price Index

Australian Market

The Australian sharemarket rose 0.6% yesterday, as all sectors posted gains, as the local index closed at its highest level since the coronavirus pandemic was declared. The Energy, REITS and Information Technology sectors led the gains, all up between 1.0% and 1.4%.

Travel related companies continued to strengthen following Tuesday’s announcement of the opening of the Trans-Tasman bubble; Flight Centre and Webjet added 1.5% and 1.1% respectively, while Qantas rose 2.7%.

The big four banks all rose between 0.3% and 0.6% to help lift the Financials sector. EML Payments added 5.5% after the company said it will buy European payments provider Sentenial for $108.6 million to enter the open banking market in the region.

The Materials sector was lifted by lithium miners Pilbara Minerals and Galaxy Resources, which lifted 6.4% and 5.8% respectively, while mining heavyweights Rio Tinto rose 1.2% and BHP added 0.1%, while Fortescue Metals slipped 0.2%.

Cleanaway Waste Management eased 4.7% after Tuesday’s 15.9% rally, caused by the announcement of their takeover of Suez R&R Australia.

The Australian futures market points to a 0.52% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets were mixed on Wednesday. Tesco added 1.3% and HelloFresh lifted 6.1% to recover from recent weakness, while Barclays rose 1.0% as it continues to strengthen. The export heavy UK FTSE 100 lifted 0.9% as it benefitted from a weaker pound, while the broad based STOXX Europe 600 closed down 0.2%.

US sharemarkets were also mixed overnight, with the Communication Services, Information Technology and Energy sectors the best performers. Alphabet, Amazon and Apple all rose between 1.1% and 1.7%, while payment providers PayPal, MasterCard and Visa all added between 0.3% and 1.0%.

By the close of trade, the Dow Jones rose 0.1%, the S&P 500 added 0.2% and the NASDAQ slipped 0.1%.

CNIS Perspective

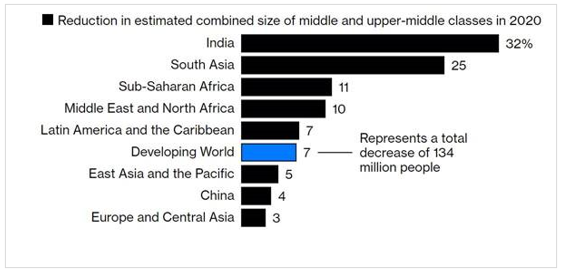

The growth of the middle class around the world, particularly in developing countries, has been a significant economic trend for the past few decades, and a trend that was thought would continue to grow indefinitely.

Rising incomes and standard of living was a theme behind many investment strategies as millions of essentially younger populations emerged from poverty.

However, COVID-19 has reversed this multi-decade trend, with the global middle class shrinking last year for the first time since the 1990s.

India and South Asia were the hardest hit, with the largest number of people falling out of the middle and upper-middle classes in 2020. It is estimated these classes are made up of 2.5 billion people, or one third of the world’s population.

No doubt the trend out of poverty will recommence as soon as life returns to ‘normal’. These people have had a taste of the finer things in life and it is only a matter of time before they resume the previous trend out of poverty into the middle class.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.