Morning Market Update - 9 August 2021

Cutcher & Neale

09 August 2021

17 July 2023

minutes

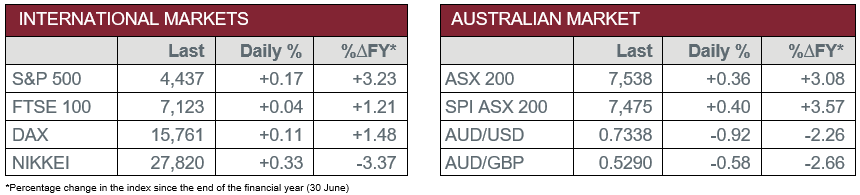

Pre-Open Data

Key Data for the Week

- Monday – CHINA – Consumer Price Index

- Tuesday – AUS – NAB Business Conditions

- Tuesday – AUS – NAB Business Confidence

- Wednesday – US – Consumer Price Index

- Thursday – US – Initial Jobless Claims

- Thursday – UK – Gross Domestic Product

- Thursday – EUR – Industrial Production

- Friday – EUR – Trade Balance

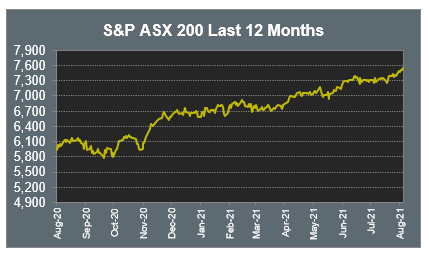

Australian Market

The Australian sharemarket lifted 0.4% on Friday, as most sectors finished higher. The Information Technology sector was the top advancer, up 2.1%, boosted by the announcement of Square’s takeover of Afterpay earlier in the week.

Mining heavyweights weighed on the market following the recent slump in the price of iron ore. Iron ore prices have tumbled approximately 13.0% over the past week, following demand concerns after China proposed steel production cuts. BHP was the main laggard, down 2.0%, while Rio Tinto and Fortescue Metals gave up 1.6% and 1.0% respectively.

The Financials sector added 0.7%, ahead of earnings reports from banks and insurers this week. The major banks all closed stronger; ANZ gained 1.0% and Westpac rose 0.9%, while NAB and Commonwealth Bank lifted 0.6% and 0.3% respectively. Fund managers were mixed; Magellan Financial Group closed up 1.5% and Challenger advanced 1.2%, while Australian Ethical Investment slipped 0.4%.

The Australian futures point to a 0.4% rise today.

Overseas Markets

European sharemarkets were relatively unchanged on Friday, while the STOXX Europe 600 gained 1.8% over the week. Banking stocks were the strongest performers, following positive earnings reports during the week. Barclays added 1.6% and Lloyds gained 1.5%, while Deutsche Bank and HSBC rose 1.4% and 1.1% respectively. Energy stocks were also among the main advancers; Royal Dutch Shell closed up 1.6%, while BP lifted 0.6%.

US sharemarkets were mixed on Friday. The Financials sector was the top performer; Bank of America and JP Morgan Chase both rose 2.9%, while Citigroup added 2.0%. Financial services stocks were mixed; PagSeguro Digital gained 1.3%, MasterCard lifted 0.7% and Visa closed up 0.5%, while PayPal fell 0.4%. The Consumer Discretionary sector was the main laggard; Amazon fell 0.9%, while Shopify gave up 1.3%.

The Information Technology sector was mixed; NVIDIA lost 1.3% and Apple fell 0.5%, while Spotify added 0.4% and Fortinet gained 1.2%.

By the close of trade, the NASDAQ slipped 0.4%, while the S&P 500 and Dow Jones rose 0.2% and 0.4% respectively. Over the week, the Dow Jones added 0.8% and the S&P 500 gained 0.9%, while the NASDAQ advanced 1.1%.

CNIS Perspective

US jobs data released on Friday beat a wide range of estimates, with July’s unemployment rate dropping to 5.4% from June’s 5.9%, its lowest level since the beginning of the pandemic. Consensus expectation was 5.7% from a wide range of estimates, given a complicated backdrop of reopening dynamics, strong demand, labour-supply constraints, enhanced benefits, and Delta variant impacts.

With labour market strength a key focus for policymakers, the debate is whether the economy has made the requisite "substantial further progress" on its dual goals of maximum employment and core inflation target of 2%. The strong jobs report may compel the Federal Reserve to seriously consider the scaling back of its US$120 billion a month bond-buying programme, which would be the first levers pulled before any possible rate rises are considered.

Despite July’s strong employment increase, 5.7 million more Americans remain out of work than in February 2020, before the onset of coronavirus. The rapid spread of the Delta variant is likely to further delay a return to work, with some concerns about enhanced unemployment benefits deterring workers from re-joining the workforce.

Investors will be looking for hints at Powell's Jackson Hole speech later this month, or more likely, the September FOMC meeting. Fierce debate remains about how much support the world’s largest economy needs as it emerges from the COVID-19 shock.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.