Morning Market Update - 08 March 2021

Cutcher & Neale

07 March 2021

17 July 2023

minutes

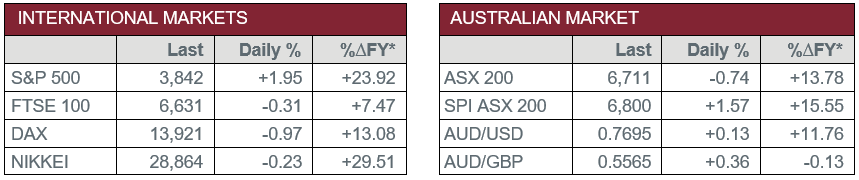

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Confidence & Conditions

- Tuesday – AUS – HIA New Home Sales

- Tuesday – EUR – Gross Domestic Product

- Wednesday – CHINA – Consumer Price Index

- Wednesday – US – Consumer Price Index

- Thursday – EUR – ECB Interest Rate Decision

- Friday – EUR – Industrial Production

- Friday – UK – Gross Domestic Product

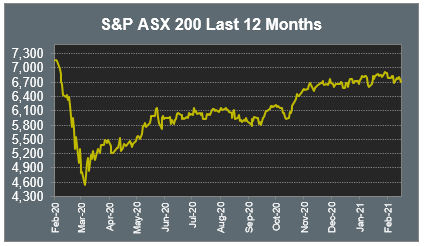

Australian Market

The Australian sharemarket slid 0.74% on Friday, as China’s decision to reinstate its economic growth target was not enough to offset inflation fears in the US. Sector performance was mixed, with Energy and Utilities among the best performers, while Health Care and Information Technology were the major laggards.

Energy stocks jumped in response to higher global oil prices on Thursday night, following OPEC’s decision to keep production unchanged until at least April. Oil Search strengthened 5.0%, Santos climbed 4.7% and Woodside Petroleum lifted 3.1%.

Weaker commodity prices weighed on Materials stocks; mining heavyweights BHP and Rio Tinto dropped 2.2% and 3.3% respectively, while Fortescue Metals slipped 0.7%.

Costa Group slid 1.1%, after the company announced it has agreed to acquire the farming operations of KW Orchards citrus farm, in addition to an associated packing operation, which will be funded from debt facilities.

The Australian futures market points to a 1.57% rise today, being driven by stronger US markets on Friday.

Overseas Markets

European sharemarkets eased on Friday, dragged lower by higher bond yields in response to a lift in inflation expectations on the back of strong US payrolls data. The UK FTSE 100 slipped 0.3% and the broad based STOXX Europe 600 lost 0.8%, while the German DAX dropped 1.0%.

US sharemarkets posted solid gains on Friday in a volatile session of trade, as better than expected jobs data boosted investor sentiment. Technology heavyweights Alphabet (+2.9%), Amazon (+0.8%), Apple (+1.1%), Facebook (+2.6%) and Microsoft (+2.2%) all posted gains, along with payment services companies MasterCard (+3.3%) and Visa (+1.9%). Industrial manufacturing company Trane Technologies strengthened 4.6%, while Sysco Corporation gained 3.0%. By the close of trade, the NASDAQ lifted 1.6%, the Dow Jones lifted 1.9% and the S&P 500 rose 2.0%.

CNIS Perspective

The Biden administration has secured US Senate approval for the US$1.9 trillion stimulus bill, known as the American Rescue Plan, which is aimed at helping America’s recovery from the economic effects of the pandemic. With Democratic-controlled Congress approval for the bill likely due Tuesday, investors are cautiously celebrating the announcement, as a further stimulated economy and better economic growth will further fuel current inflation concerns.

Despite US Treasury Secretary Janet Yellen and US Fed Reserve Chair Jerome Powell being in chorus, dismissing fears around inflation following a sell-off in the US 10-year treasury bonds, which caused yields to rise above 1.5% for the first time in more than year, shock waves were sent through US equity markets, especially the technology heavy NASDAQ.

Technology stocks, which enjoyed an extraordinary run last year, have now lost ground and are almost touching correction territory from February’s high. The current conversation on the negatives of inflation, along with rising oil prices and the likely dispatch of US$1,400 payments to most Americans (individuals making $75,000 or less and couples making $150,000 or less), in addition to a stronger economic outlook, are further concerns.

As the sharemarket is digesting higher bond yields and a positive economic outlook, the rotation from big technology companies into value stocks like banks and commodity firms is a trend we envisage to be a near term rebalance and short-term cooling of some of the stocks that have had a tremendous run during the prior twelve months. Conditions for stocks remain very positive, with the US 10-year bond yield at 1.5% still extremely low historically, while the yield curve remains a long way from what economists would classify as normal.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.