Morning Market Update - 2 December 2021

Cutcher & Neale

01 December 2021

17 July 2023

minutes

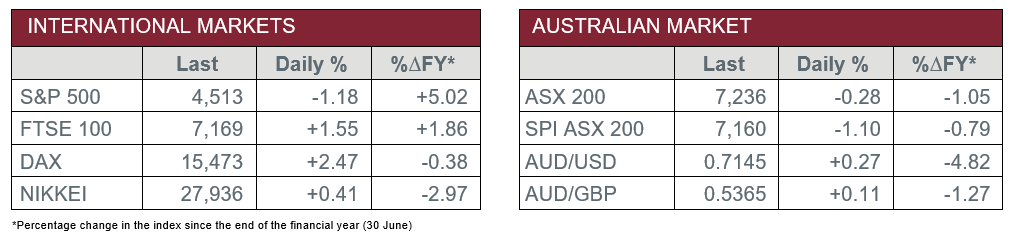

Pre-Open Data

Key Data for the Week

- Wednesday – AUS – Gross Domestic Product contracted 1.9% in the September quarter, less than anticipated.

- Wednesday – US – Markit Manufacturing PMI edged lower than expected to 58.3 in November.

- Thursday – AUS – Trade Balance

- Thursday – US – Unemployment Rate

Australian Market

The Australian sharemarket fell to its lowest level in almost two months on Wednesday, as investor concern grew around the new COVID-19 variant, Omicron, and the US Federal Reserve’s hawkish monetary policy stance. The local sharemarket recovered slightly from losses in the morning, after the release of better than expected September quarter GDP data.

Most sectors closed in the red, paced by the Consumer Staples (-1.9%), Utilities (-1.4%) and Consumer Discretionary (-1.0%) sectors. Meanwhile, the Materials sector was the strongest performer, up 0.6%, despite mixed iron ore and base metal price movements. BHP, Fortescue Metals Group and Rio Tinto advanced 1.4%, 1.5% and 2.4%, respectively. Analysts suggest a key performance driver was lower than expected volume guidance from an important international competitor, Vale.

The Financials sector closed relatively flat, despite modest gains from the major banks. Commonwealth Bank, Westpac and NAB advanced 0.8%, 0.5% and 0.3%, respectively, while ANZ lost 0.2%. Other key movers included Macquarie Group (-0.5%) and Suncorp Group (-0.9%), alongside fund managers Magellan Financial Group (-3.1%) and Australian Ethical Investment (-4.5%).

The Australian futures point to a 1.1% fall today.

Overseas Markets

European sharemarkets had their best session in close to six months on Wednesday, as investors took the opportunity to buy the dip. As markets adjusted to the initial Omicron sell-off, copper and oil prices recovered, which led to strength in mining and industrial stocks. Travel and leisure stocks also performed strongly, up 3.1%. Other important movers in the session included Barclays (3.0%), Airbus (3.2%) and Infineon Technologies (5.4%). By the close of trade, the STOXX Europe 600 and UK FTSE 100 lifted between 1.5-1.7%, while the German DAX surged 2.5%.

US sharemarkets weakened on Wednesday, driven by news of the first case of Omicron in the US. This, coupled with the Fed’s recent abandonment of the stance that inflation was transitory, led to an 11.0% jump in market volatility. Most sectors closed in the red, led by Communication Services (-2.0%), Consumer Discretionary (-1.9%) and Industrials (-1.4%). Gains were few and far between, although some key movers included Taiwan Semiconductor Manufacturing Co. (3.0%), NextEra Energy (1.2%) and Johnson & Johnson (1.4%). By the close of trade, the Dow Jones, S&P 500 and NASDAQ all lost between 1.2-1.8%.

CNIS Perspective

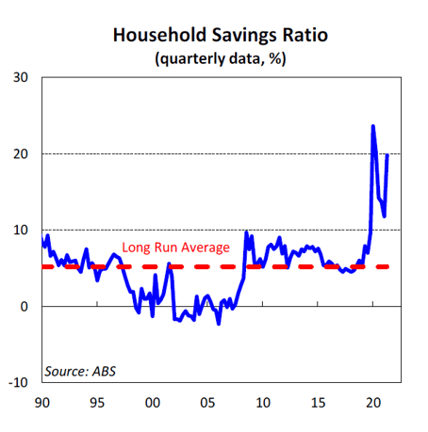

Before yesterday’s September quarter GDP announcement, speculation was centred around how bad it might be, with expectations of a negative 2.7% read.

After yesterday’s announcement it was more a case of how good a result it was, with a contraction of only 1.9%, more a time for celebration.

The fall in economic activity in the September quarter was led by lockdown induced falls in household spending, with the hardest hit industries being accommodation and food services.

Looking forward, the household savings ratio surged nearly 20%, to be just shy of the record posted last year. This suggests 2022 could boast above trend growth as consumers run down these savings to spend more in the economy.

This of course is predicated on a more benign Omicron outcome!

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.