Morning Market Update - 22 March 2021

Cutcher & Neale

21 March 2021

17 July 2023

minutes

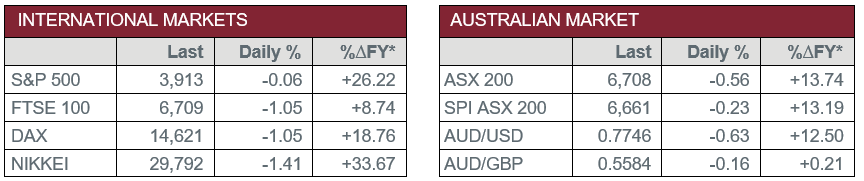

Pre-Open Data

Key Data for the Week

- Monday – US – Existing Home Sales

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – US – New Home Sales

- Wednesday – UK – Consumer Price Index

- Wednesday – US – Durable Goods Orders

- Thursday – US – Gross Domestic Product

- Thursday – US – Initial Jobless Claims

- Friday - UK - Retail Sales

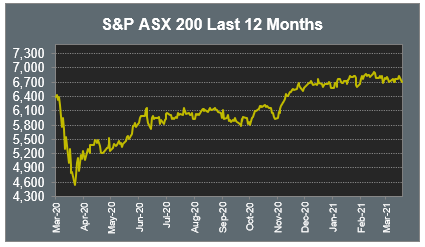

Australian Market

The Australian sharemarket fell 0.56% on Friday to post its first weekly fall this month. Losses were broad based, with REITs, Telecommunications and Utilities the only sectors to post gains.

Energy stocks were the major laggards on Friday; Woodside Petroleum gave up 3.3%, Santos slid 2.5% and Oil Search lost 2.1%. AGL Energy bucked the trend to close up 2.2%, after the company finalised a new supply agreement with a Portland aluminium smelter in Victoria until July 2026.

Materials names fared slightly better; mining heavyweights BHP and Rio Tinto slipped 1.7% and 1.6% respectively, while Fortescue Metals dropped 1.4% after the company completed a US$1.5 billion senior unsecured notes offering, with the funds used to repay existing debt and for general corporate purposes.

The Financials sector was weighed down by a mixed performance from the big four banks, as gains from ANZ (0.3%) and Westpac (0.3%) were offset by losses by Commonwealth Bank (-1.2%) and NAB (-0.3%).

The Australian futures market points to a 0.23% fall today.

Overseas Markets

European sharemarkets fell on Friday. France’s CAC 40 gave up 1.1% after the nation imposed a new four-week regional lockdown in response to another wave of COVID-19 cases. By the close of trade, the German Dax and UK FTSE 100 both dropped 1.1%, while the STOXX Europe 600 gave up 0.8%.

US sharemarkets were mixed on Friday, as trade talks continued between the US and China at a summit in Alaska. Technology heavyweights Alphabet (+0.4%), Amazon (+1.6%), Facebook (+4.1%) and Netflix (+1.5%) all closed higher. US banks slid after the US Federal Reserve allowed a capital break for big banks to expire; Goldman Sachs (-1.1%), JPMorgan (-1.6%) and Wells Fargo (-2.9%) all fell in response. Enphase Energy rose 4.4% after the company received a broker upgrade, while e-commerce giant PagSeguro lifted 2.4%. Visa fell 6.2% on reports it is being investigated by the US Department of Justice over its debit practices. FedEx gained 6.1% after the delivery services company announced profit had soared on strong demand during the COVID-19 pandemic, while Nike dropped 4.0% after their sales missed estimates. The Dow Jones slid 0.7% and the S&P 500 slipped 0.1%, however, the NASDAQ climbed 0.8%.

CNIS Perspective

The US and China ‘talks’ in Alaska (‘talks’ is a polite euphemism for what appears to be a hostile set of exchanges) were what some analysts have suggested, all a display for domestic audiences. While it is still early days, it appears as though both administrations showed no sign of change from the days of Donald Trump’s confrontational policy.

The US issued a list of complaints against China’s repressions and aggressions, including an increasingly militant posture toward Taiwan and the economic coercion of Australia. In response, China accused the US of meddling in its country’s internal affairs and criticised its human rights abuses at home.

Such public confrontation is highly unusual; typically, face to face meetings take place in private with polite snippets to the press of progressive discussions. However, it appears as though the antagonistic tone of the world’s two most important powers is unlikely to change, and the tough talk is not just for show.

The Biden administration has emphasised working with allies to counter and compete with China. It has invested in building up the Quad, a security alliance with Japan, Australia and India that was given new life under Mr Trump. Biden has also maintained the sanctions imposed under Mr Trump for human rights abuses in Xinjiang and Hong Kong.

It is possible that, for all the frank talk in public, some more constructive diplomacy may have taken place in private. However, this may be just wishful thinking.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.