Morning Market Update - 24 March 2021

Cutcher & Neale

23 March 2021

17 July 2023

minutes

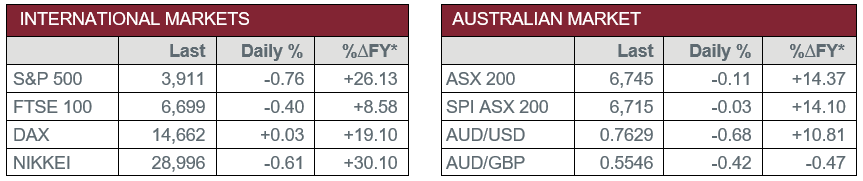

Pre-Open Data

Key Data for the Week

- Tuesday – UK – ILO Unemployment Rate fell to 5.0% in January, from 5.1% in December.

- Tuesday – US – New Home Sales fell more than expected to 775,000 in February, from 923,000 in January.

- Wednesday – UK – Consumer Price Index

- Wednesday – US – Durable Goods Orders

Australian Market

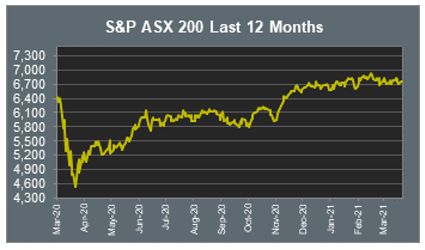

The Australia sharemarket slipped 0.1% on Tuesday in a mixed session of trade. The Telecommunications and Utilities sectors led the gains, up 1.0% and 0.8% respectively, while Energy and Consumer Discretionary were the weakest performers.

The Information Technology sector fell 0.9% yesterday, weighed down by buy-now-pay-later providers. Splitit tumbled 6.8% and Sezzle lost 3.9%, while Afterpay and Zip Co fell 2.2% and 1.7% respectively. However, accounting software provider Xero lifted 1.2%, while artificial intelligence company Appen gained 1.0%.

Losses among all major banks dragged the Financials sector 0.5% lower. ANZ led the losses, down 1.3%, and Westpac fell 0.9%, while NAB and Commonwealth Bank lost 0.7% and 0.4% respectively. Asset managers were mixed; Magellan Financial Group added 1.8%, while Australian Ethical Investment slipped 1.5% and Challenger gave up 2.6%.

The Materials sector lifted 0.2%, as most mining heavyweights improved; Fortescue Metals gained 1.3% and BHP rose 1.0%, however, Rio Tinto finished flat. Goldminers were mixed; Evolution Mining slipped 0.5%, while Newcrest Mining and Northern Star lifted 0.5% and 0.4% respectively.

The Australian futures market points to a 0.03% fall today.

Overseas Markets

European sharemarkets eased overnight, as extended COVID lockdowns in Germany raised fears of a slow economic recovery. Travel and leisure stocks were weaker; Ryanair slipped 2.2% and International Airlines Group gave up 4.4%, while German travel agency company TUI Group tumbled 6.1%. Automaker stocks fell following their recent rally; Volkswagen Group lost 4.7%, while Volvo and Porsche both gave up 7.0%.

By the close of trade, the STOXX Europe 600 slipped 0.2% and the UK FTSE 100 fell 0.4%, while the German DAX closed flat.

US sharemarkets were also weaker on Tuesday. The Energy sector underperformed as oil prices fell 6.0%; ExxonMobil gave up 1.3% and Chevron lost 0.6%. The Health Care sector eased 1.0%; Johnson & Johnson slipped 0.1% and Bristol-Myers Squibb fell 1.2%, while biotechnology company Moderna tumbled 6.2%. Information Technology stocks were mixed; Spotify lost 3.0% and Facebook closed down 1.0%, while Microsoft and Alphabet both lifted 0.7%.

The Financials sector gave up 1.4%; JP Morgan Chase fell 1.0% and Citigroup slipped 1.5%, while Bank of America fell 2.0%. Financial services were also weaker; PagSeguro Digital lost 1.0%, MasterCard fell 0.9% and PayPal eased 0.3%.

By the close of trade, the S&P 500 and Dow Jones fell 0.8% and 0.9% respectively, while the NASDAQ eased 1.1%.

CNIS Perspective

Recent data on Overseas Arrivals and Departures for January has confirmed that net migration into Australia is currently negative.

With Australia closed to the rest of the world, migration has stalled. There have been 20,800 net permanent and long-term departures since the pandemic hit in March 2020.

Our country’s birth rate has been waning in recent years and is not sufficient to support a growing population. When combined with a lack of immigration, the Australian population has actually shrunk, which marks the first time since 1916.

However, with vaccine rollouts playing their part from here, borders are likely to begin to re-open to select countries in the back half of the year. This should see a boom in international students and skilled migration into Australia, which may result in a reverse of these statistics.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.