Another Strong Year - January 2026 Snapshot

Ryan Thompson

07 January 2026

02 February 2026

minutes

|

|

Quick TakeGlobal markets navigated a volatile but ultimately positive year in 2025: Equities finished higher despite repeated swings in sentiment driven by trade policy, inflation trends and changing interest rate expectations. The sharpest disruption occurred in April following the “Liberation Day” tariff announcement, which triggered a broad sell-off before markets stabilised as implementation was delayed and negotiations progressed. As the year unfolded, resilient economic activity and strong corporate earnings helped restore confidence. Major developed markets delivered solid returns as monetary policy paths became clearer: In the United States, the S&P 500 rose 17.88%, the Nasdaq climbed 21.14% and the Russell 2000 gained 12.81%, supported by AI-related investment and a resilient consumer. European equities also performed strongly, with the STOXX Europe 600 up 20.57% as easing inflation and resilient earnings supported confidence. In Australia, the ASX 200 rose 10.32%, recovering from a sharp April drawdown before conditions became more uneven through the second half as concerns about inflation increased. Overall, 2025 delivered solid equity returns despite recurring bouts of volatility: While markets adjusted at times to shifting expectations around interest rates, trade and inflation, underlying economic resilience and earnings strength helped support confidence into year-end. December reinforced how quickly sentiment can shift as new information emerges, but it also highlighted the market’s ability to absorb uncertainty without a sustained deterioration in conditions. As attention turns to 2026, the focus will remain on the inflation outlook, the direction of monetary policy, and the evolution of global trade arrangements. |

|

Snapshot

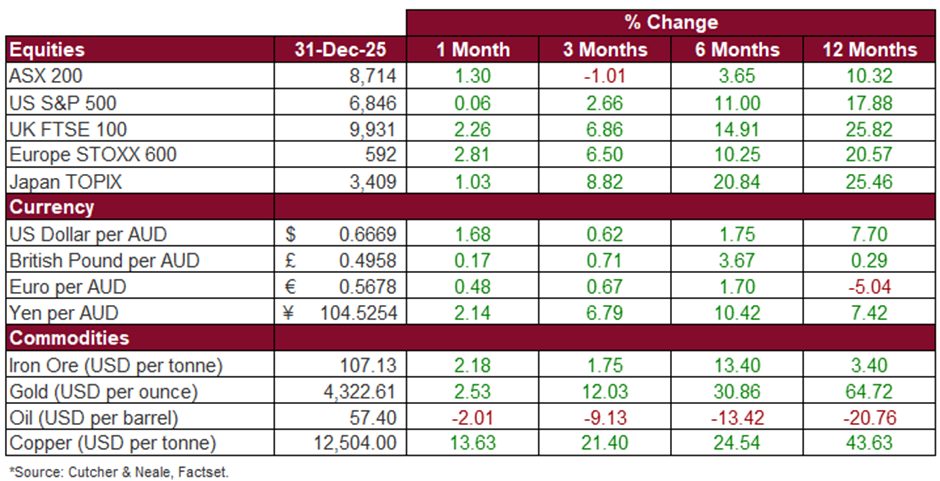

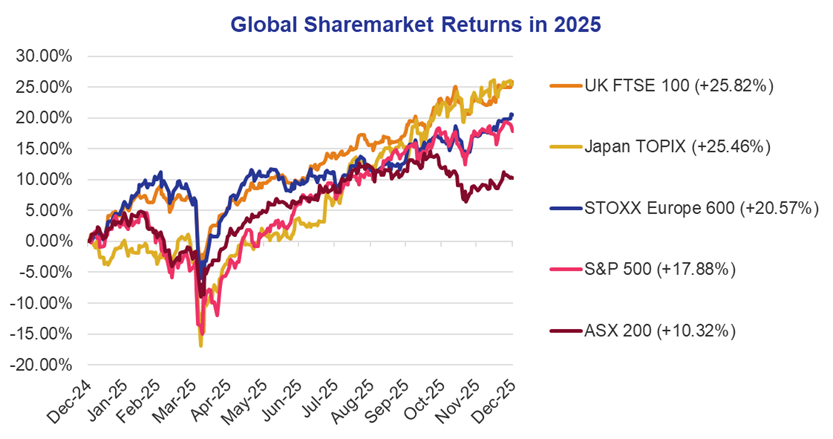

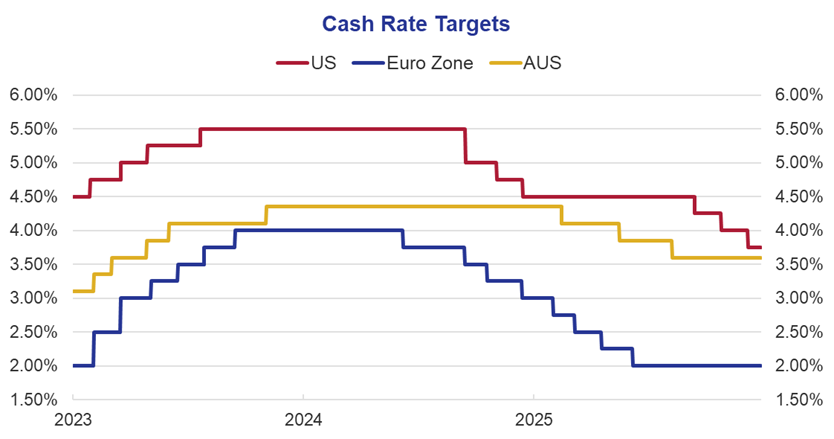

Global markets finished 2025 higher, despite several sharp swings in sentiment driven by trade policy, inflation trends and changing expectations for interest rates. The most significant volatility occurred around April’s “Liberation Day” tariff announcement, which triggered a broad sell-off before markets stabilised as implementation was delayed and negotiations progressed. By year-end, investor confidence had been supported by resilient economic activity and strong corporate earnings. The US Dollar also weakened materially, falling 9.37% against a basket of major currencies over the year. Commodities were a major feature of the tape, with gold rising 64.72% and copper up 43.63%, reflecting a mix of safe-haven demand and ongoing industrial and electrification themes.

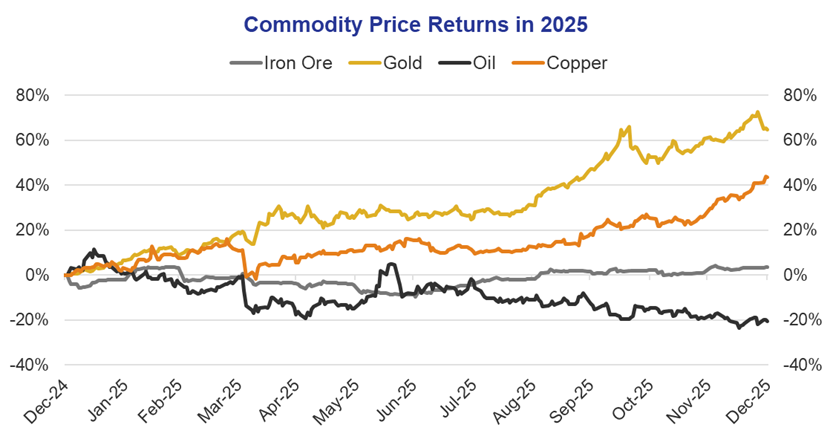

In the United States, equities extended their multi-year advance, supported by AI-related investment and a still resilient consumer. The S&P 500 rose 17.88% in 2025, the Nasdaq climbed 21.14%, and the Russell 2000 added 12.81%. Policy remained a central driver of market moves. The Federal Reserve kept rates on hold for much of the year before cutting by a total of 0.75% across September, October and December, which helped anchor expectations for easier policy into 2026. Trade policy also dominated headlines, with tariff announcements and shifting negotiation timelines repeatedly influencing investor behaviour. December provided a timely reminder that markets can pause even in a strong year, with the S&P 500 rising 0.06%, the Nasdaq declined 0.47%, and the Russell 2000 eased 0.58% as investors digested the December Federal Reserve meeting and a more mixed set of economic signals.

European equities also delivered a strong year as inflation eased, earnings proved more resilient than expected, and policy settings became clearer. The STOXX Europe 600 rose 20.57% in 2025, the FTSE 100 gained 25.82%, Germany’s DAX climbed 23.01%, and France’s CAC 40 added 14.28%. The European Central Bank shifted toward a more stable policy stance through the year, with markets increasingly viewing the easing cycle as largely complete and policy rates likely to remain on hold through much of 2026 absent a material growth shock. December was particularly constructive for the region, with the STOXX Europe 600 up 2.81% as easing inflation trends and stabilising bond yields supported a pro-cyclical rotation. Country-level fiscal dynamics also contributed to performance gaps. Germany benefited from optimism around infrastructure and defence-related spending, while the UK was supported by improved fiscal clarity. In contrast, France lagged due to ongoing budget uncertainty and political fragmentation, which kept investor confidence more cautious.

In Australia, the ASX 200 rose 10.32% in 2025, with returns shaped by a pronounced April drawdown and a recovery that proved resilient but uneven through the second half. The Reserve Bank cut the cash rate three times earlier in the year before adopting a more cautious tone as inflation risks persisted and private demand showed signs of resilience. December saw the ASX 200 rise 1.30%, partially recovering November’s decline and extending a period of choppy trading. Investors increasingly focused on the possibility of higher rates in 2026, with the Australian Dollar strengthening to US$0.6669 and bond yields rising, while the RBA held the cash rate at 3.60% and signalled a higher bar for further easing.

Overall, 2025 delivered solid equity returns despite recurring bouts of volatility driven by policy shifts and geopolitical developments. While markets adjusted at times to changing expectations around interest rates, trade and inflation, underlying economic resilience and earnings strength helped support confidence into year-end. December highlighted how quickly sentiment can shift as new information emerges, but it also underscored the market’s ability to absorb uncertainty without a sustained deterioration in conditions. As attention turns to 2026, the focus will remain on the inflation outlook, the direction of monetary policy, and how global trade arrangements continue to evolve.

Key Stocks

Comfort Systems USA

Cutcher & Neale International Shares Model

Comfort Systems USA is a leading provider of mechanical and electrical contracting services, with deep expertise in complex heating, ventilation, air conditioning, plumbing and modular construction solutions.

What sets Comfort Systems apart is the scale of its operations and the strategic tilt toward data centre and industrial infrastructure, two of the strongest end-markets in the current environment.

The company recently delivered another record result, with 3Q 2025 earnings per share of US$8.3, up more than 100% year-on-year, and revenue growth of 35% to US$2.5 billion. The group’s backlog also climbed to a record $9.4 billion, driven by surging demand from technology and healthcare clients. Notably, technology customers, including data-centre related work, represented 42% of the business’ revenue, up from 31% last year.

What we like about Comfort Systems is its disciplined execution and long-term demand visibility. Despite rising labour costs and a tight contractor market, the business continues to grow margins, reflecting strong project selection. Management aims to deliver low to mid-teens revenue growth in 2026, with further upside from its latest acquisitions Feyen Zylstra and Meisner Electric, which add over $200 million in revenue and expand electrical capabilities.

The Investment Committee added Comfort Systems USA to the Cutcher & Neale International Shares Model during the December quarter.

NEC Corporation

Cutcher & Neale International Shares Model

NEC Corporation is a Japanese technology conglomerate with a growing presence in digital government services, AI infrastructure, biometrics and network solutions.

The company recently reported strong 2Q 2026 earnings, with operating income of ¥87.5B well above expectations. The result was driven by continued profit margin expansion across its core businesses. The Digital Government and Digital Finance segments continue to grow strongly, underpinned by rising public sector investment in cyber-resilience and identity systems. NEC’s biometric authentication platforms, already used in over 70 countries, remain a standout growth engine.

What we like about NEC is its focused exposure to critical technologies that sit behind national digital infrastructure. With long-term contracts and rising demand from governments, telcos and utilities, NEC offers greater visibility and resilience than other more traditional tech peers. Its submarine cable business is also benefiting from the AI-led data connectivity boom.

The Investment Committee added NEC Corporation to the Cutcher & Neale International Shares Model during the December quarter.

Comfort Systems USA

Cutcher & Neale International Shares Model

Comfort Systems USA is a leading provider of mechanical and electrical contracting services, with deep expertise in complex heating, ventilation, air conditioning, plumbing and modular construction solutions.

What sets Comfort Systems apart is the scale of its operations and the strategic tilt toward data centre and industrial infrastructure, two of the strongest end-markets in the current environment.

The company recently delivered another record result, with 3Q 2025 earnings per share of US$8.3, up more than 100% year-on-year, and revenue growth of 35% to US$2.5 billion. The group’s backlog also climbed to a record $9.4 billion, driven by surging demand from technology and healthcare clients. Notably, technology customers, including data-centre related work, represented 42% of the business’ revenue, up from 31% last year.

What we like about Comfort Systems is its disciplined execution and long-term demand visibility. Despite rising labour costs and a tight contractor market, the business continues to grow margins, reflecting strong project selection. Management aims to deliver low to mid-teens revenue growth in 2026, with further upside from its latest acquisitions Feyen Zylstra and Meisner Electric, which add over $200 million in revenue and expand electrical capabilities.

The Investment Committee added Comfort Systems USA to the Cutcher & Neale International Shares Model during the December quarter.

NEC Corporation

Cutcher & Neale International Shares Model

NEC Corporation is a Japanese technology conglomerate with a growing presence in digital government services, AI infrastructure, biometrics and network solutions.

The company recently reported strong 2Q 2026 earnings, with operating income of ¥87.5B well above expectations. The result was driven by continued profit margin expansion across its core businesses. The Digital Government and Digital Finance segments continue to grow strongly, underpinned by rising public sector investment in cyber-resilience and identity systems. NEC’s biometric authentication platforms, already used in over 70 countries, remain a standout growth engine.

What we like about NEC is its focused exposure to critical technologies that sit behind national digital infrastructure. With long-term contracts and rising demand from governments, telcos and utilities, NEC offers greater visibility and resilience than other more traditional tech peers. Its submarine cable business is also benefiting from the AI-led data connectivity boom.

The Investment Committee added NEC Corporation to the Cutcher & Neale International Shares Model during the December quarter.

Ryan joined Cutcher & Neale as a Portfolio Manager in January 2023, bringing nearly 20 years of financial markets experience to the firm. Specialising in fundamental equity analysis and multi-asset strategies, Ryan holds the Chartered Financial Analyst (CFA) designation. He is responsible for the risk and return outcomes of the firm’s Managed Discretionary Account (MDA) portfolios on the Mason Stevens platform.