Morning Market Update - 21 December 2021

Cutcher & Neale

20 December 2021

17 July 2023

minutes

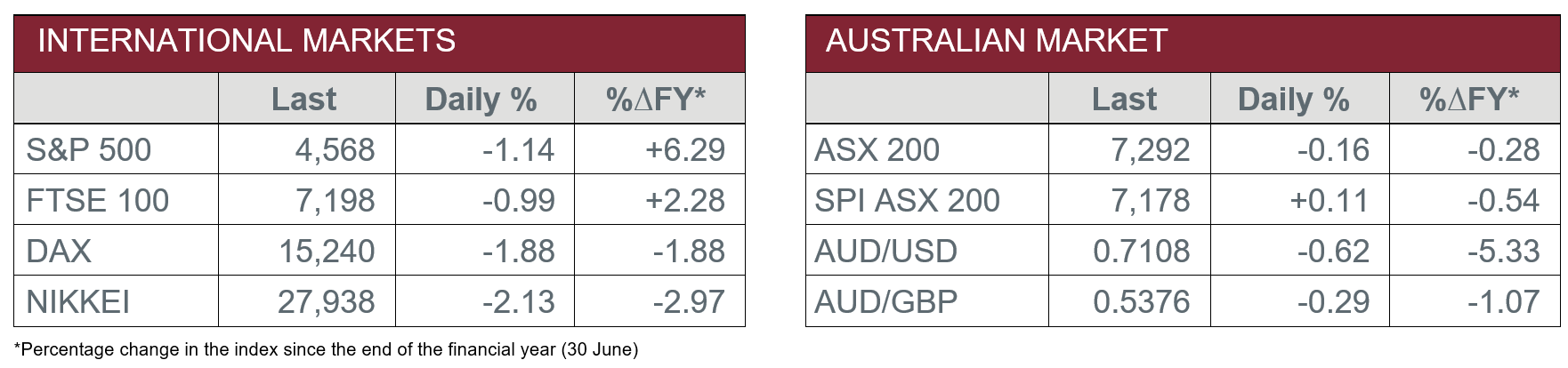

Pre-Open Data

Key Data for the Week

- Monday – UK – Rightmove House Prices dipped 0.7% in December.

- Tuesday – AUS – RBA Board Meeting Minutes

- Tuesday – EUR – Consumer Confidence

Australian Market

The Australian sharemarket lost 0.2% yesterday, as further Omicron fears weighed on overseas markets. Some parts of Europe have re-entered lockdowns, while the US attempts to maintain control of their rising COVID cases.

The Energy sector weighed on the index, as the possibility of further lockdowns will result in a decreased demand for oil. As a result, Woodside Petroleum lost 2.9% and Santos shed 4.8%, while Beach Energy closed the session 4.3% lower.

The big four banks were mixed on Monday, as the Financials sector lost 0.8%. ANZ and NAB conceded 1.4% and 1.0% respectively, while Commonwealth Bank and Westpac were relatively flat. Australian fund manager, Magellan Financial Group, slumped 32.9%, after the company announced it has lost a contract with one of their biggest clients.

The Information Technology sector enjoyed some reprieve and added 0.4%. Buy-now-pay-later provider Afterpay added 1.5%, while Humm jumped 23.0%. This comes after the company announced their long-serving CEO will be stepping down and following several takeover proposals.

The Australian futures market points to a 0.11% gain today.

Overseas Markets

European sharemarkets were lower overnight, as all COVID sensitive sectors lost ground. The Travel and Leisure sector was the worst performer; easyJet lost 0.4% and Airbus dropped 2.0%. The Energy sector also lost ground as the Netherlands re-entered lockdown; BP conceded 2.5% and Royal Dutch Shell closed the session 1.8% lower. By the close of trade, the German DAX fell 1.9% and the STOXX Europe 600 lost 1.4%, while the UK FTSE dropped 1.0%.

US sharemarkets lost ground on Monday, as the S&P 500 marked three days of consecutive declines. The Financials sector declined; Bank of America conceded 1.7%, JP Morgan lost 1.8% and Goldman Sachs shed 2.7%. The Information Technology sector weighed on the indices, as Spotify lost 3.0% and Amazon closed the session 1.7% lower.

By the close of trade, the NASDAQ slipped 1.3% and the S&P 500 fell 1.1%, while the Dow Jones closed 1.2% lower.

CNIS Perspective

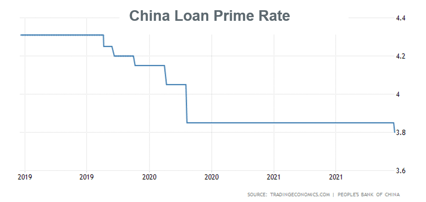

The People’s Bank of China (PBOC) yesterday made the decision to cut its prime lending rate, contrary to the developed world looking to tighten monetary settings.

It is the first time that China has reduced borrowing costs in just under two years, providing support to an economy showing strain from a property slump and virus outbreaks.

The announcement comes as liquidity issues among major indebted Chinese developers, Evergrande and Kaisa, led them to default on debt obligations in recent months, crippling China’s property sector.

It is not the only monetary policy easing taken in recent weeks to sure up the Chinese economy. The move follows the PBOC’s action earlier this month to cut the amount of cash banks must hold in reserve, which freed up 1.2 trillion Yuan (US$188 billion) of cheap funding for banks.

While the Chinese economy seems fragile at present, the benefit for China is they have the capability to ease monetary policy and cut rates, unlike the majority of developed nations with no downside flexibility at present.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.