Morning Market Update - 25 March 2021

Cutcher & Neale

24 March 2021

17 July 2023

minutes

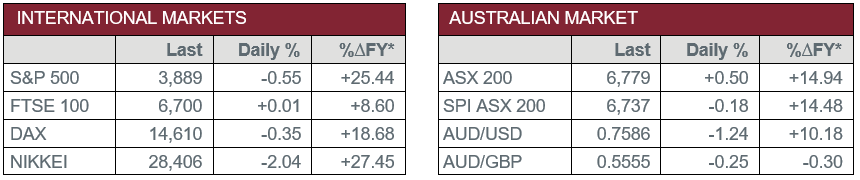

Pre-Open Data

Key Data for the Week

- Wednesday – UK – Consumer Price Index fell from 1.4% in January, to 0.9% in February. The Bank of England’s target for inflation of 2% has not been seen since late 2018.

- Wednesday – US – Durable Goods Orders slipped 1.1% in February, following the 3.5% surge in January.

- Thursday – US – Gross Domestic Product

- Thursday – US – Initial Jobless Claims

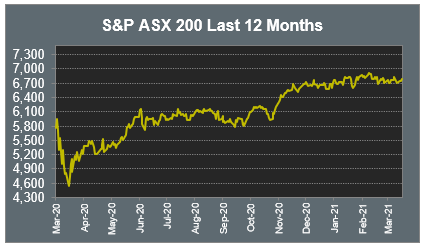

Australian Market

The Australian sharemarket rose 0.5% yesterday, led higher by the Health Care sector and consumer stocks. CSL rose 1.9%, Ramsay Health Care added 1.4% and Sonic Healthcare gained 0.4%.

Consumer stocks rallied; Super Retail Group added 1.2%, while Coles, Wesfarmers and Woolworths all rose between 1.2% and 2.0%.

Property stocks also outperformed; Goodman Group led the gains, up 3.2%, while Dexus, GPT Group, Ingenia Communities and Stockland Corporation all added between 0.4% and 0.9%.

The Energy sector was the worst performer as oil prices were weaker; Woodside Petroleum lost 1.1%, AGL Energy slipped 1.2% and Santos fell 1.5%.

Telstra fell 0.9% to weigh on the Telecommunications sector. Telstra lost ground following recent strength in the share price as the company prepares for a restructure, shares are up 10% year to date.

The Australian futures market points to a 0.18% fall today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets were mixed on Wednesday, as the broad based STOXX Europe 600 closed flat. French supermarket retailer Carrefour rose 2.3% after the company announced it has agreed to buy Brazil’s third biggest food retailer, Grupo BIG, in a deal valued at US$1.3 billion.

US sharemarkets closed weaker overnight, led lower by the Communication Services, Consumer Discretionary and Information Technology sectors. Amazon, Apple, Facebook and Spotify all fell between 1.6% and 3.2%, while Zoom Video Communications slumped 7.3%. Financials were mostly lower; Citigroup lost 1.2% and Wells Fargo slipped 0.3%, while JP Morgan added 0.8%. MasterCard outperformed other financial services stocks to add 1.2%. The Health Care sector was mixed; Johnson & Johnson added 1.0%, while Bristol-Myers Squibb fell 0.5%.

By the close of trade, the Dow Jones was flat, the S&P 500 lost 0.6% and the NASDAQ slipped 2.0%.

CNIS Perspective

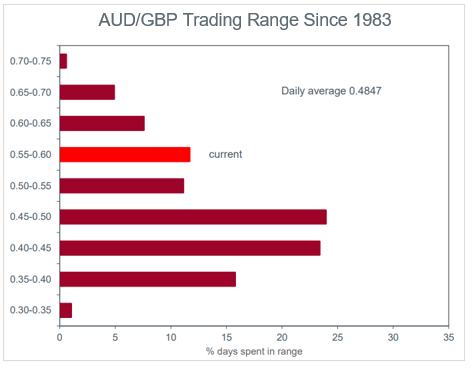

A look at the AUD/GBP exchange rate again highlights the commodity-driven strength of the Australian Dollar relative to other major currencies, not just the US Dollar.

Commodity-based currencies have been the strongest performers so far in 2021 (Australian and Canadian Dollars) and with interest rate settings between the Reserve Bank of Australia and the Bank of England the same, it's logical the AUD would be stronger against the GBP.

The outlook for the AUD on the back of a faster growing Asia region, also adds strength to the AUD.

The graph shows the AUD/GBP exchange rate since 1983 and the percentage of these days the AUD/GBP has traded within various ranges.

It also highlights that the current strength isn't the norm, with an exchange rate between 40 to 50 pence, the zone where the currency has spent most of its time over that 38-year period.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.