Morning Market Update - 29 April 2021

Cutcher & Neale

28 April 2021

17 July 2023

minutes

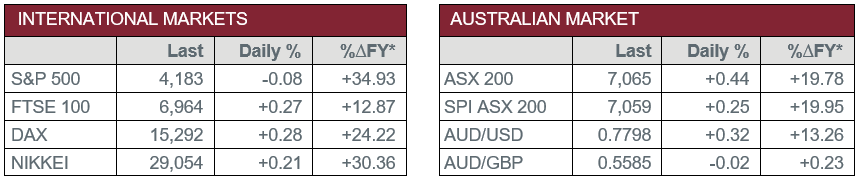

Pre-Open Data

Key Data for the Week

- Thursday – AUS – Consumer Price Index rose 0.6% in the March quarter, with inflation up 1.1% year-on-year.

- Friday – EUR – Gross Domestic Product

- Friday – EUR – Unemployment

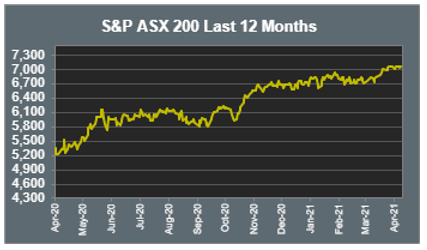

Australian Market

The Australian sharemarket lifted 0.4% on Wednesday, following weaker than expected inflation figures. All sectors, except Materials, closed higher, with REITs the strongest performer, up 1.5%.

Losses among mining heavyweights dragged the Materials sector 0.9% lower. Fortescue Metals gave up 1.5% and Rio Tinto lost 1.2%, while BHP fell 0.3%. Gold miners were also weaker; Northern Star shed 5.2%, while Evolution Mining and Newcrest Mining closed down 3.8% and 3.4% respectively.

Property stocks posted strong gains; Stockland added 2.0% and Cromwell Property Group rose 1.7%, while Ingenia Communities Group and GPT Group closed up 1.3% and 1.1% respectively.

The Financials sector also advanced, lifted by gains among the major banks. Westpac added 1.2% and NAB rose 1.1%, while Commonwealth Bank lifted 1.0% and ANZ closed up 0.5%. Insurers enjoyed strong gains; QBE Insurance Group rose 3.5%, while Insurance Australia Group and NIB closed up 2.7% and 2.5% respectively.

Supermarket giant Coles lifted 1.5% following the release of its quarterly update, which reported a 5.1% drop in quarterly sales, as spending returned to normal after COVID-19 lockdown panic buying.

The Australian futures market points to a 0.25% rise today.

Overseas Markets

European sharemarkets finished relatively unchanged on Wednesday, with the STOXX Europe 600 closing flat, while the German DAX and the UK FTSE 100 both eked out a 0.3% gain. The Financials sector was the strongest performer, following positive bank earnings results. Deutsche Bank jumped 10.7% after the company exceeded first quarter net profit expectations, while Lloyds Bank lifted 3.5% and Barclays rose 1.3%.

US sharemarkets were weaker overnight. The Information Technology sector was the worst performer, with Microsoft down 2.8%, despite reporting higher than expected earnings. However, Alphabet bucked the trend to gain 3.2%, after the company exceeded Q1 revenue expectations. By the close of trade, the Dow Jones gave up 0.5% and the NASDAQ fell 0.3%, while the S&P 500 slipped 0.1%.

CNIS Perspective

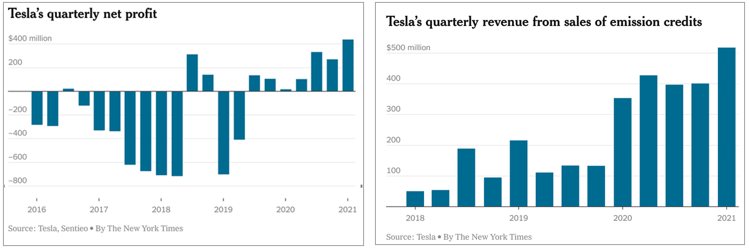

The devil is in the detail sometimes and nothing could be more accurate than that when looking at Tesla’s quarterly financial results announced earlier this week.

The electric vehicle manufacturer posted a record quarterly earnings result, but manufacturing vehicles isn’t the only way Tesla can make money.

While the quarterly profit of US$438 million is its highest ever, it needs to be noted that US$101 million of it came from trading Bitcoin. The company bought and sold US$1.5 billion worth of Bitcoin during the quarter.

Revenue increased by 74% to US$10.39 billion, which included US$518 million generated from selling emissions credits to other carmakers, up from US$354 million a year ago.

Although Tesla is here to stay, supply chain challenges remain, notably the global shortage of computer chips, while safety is an even larger risk, following the fatal autonomous vehicle crash in Texas last month.

Tesla may well be profitable going forward, but it will be interesting to see whether it comes from its ‘core’ operation of making electric vehicles.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.