Cutcher's Investment Lens | 2 - 6 June 2025

Wade Johnson & Ryan Thompson

10 June 2025

10 June 2025

minutes

Weekly recap

What happened in markets

The Australian sharemarket rose 1.0% last week, with Financials (+2.0%) and Banks (+2.0%) outperforming. Gains were driven by growing expectations of interest rate cuts following weaker-than-expected economic data from the release of Q1 GDP. CBA hit a record high and became the first ASX-listed firm to surpass $300B in market cap. Falling bond yields and growing expectations of easier monetary policy boosted investor confidence, even as concerns lingered around Trump’s tariffs and soft consumer spending. The OECD cut Australia’s 2025 growth forecast to 1.8% amid tariff concerns, leading to markets expecting RBA to cut rates to 3.6% in July.

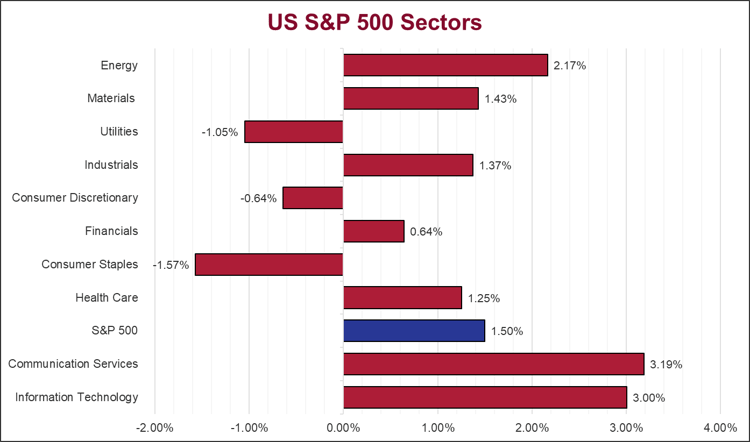

The US sharemarket extended gains for a second week, with the S&P 500 now just 3% below its February record. Tesla shares dropped sharply (-14.8%) amid a Trump-Musk spat, while Broadcom beat earnings expectations. Treasury yields rose after initial dovish moves faded following trade talks between Trump and Xi Jinping, which agreed on further negotiations but left some scepticism. Inflation data showed mixed signals, and markets now expect slightly smaller interest rate cuts this year. Outperformers were Communication Services (+3.2%), Technology (+3.0%), Energy (+2.2%), while Consumer Staples (-1.6%) and Utilities (-1.1%) lagged.

The European sharemarket finished higher last week, with the STOXX 600 up 0.9% and the DAX reaching new highs despite rising US tariffs on steel and aluminium to 50%. The European Central Bank cut rates 0.25% after inflation eased to 1.9%. Germany unveiled a €46 billion tax relief package to boost growth amid tariff uncertainties. Technology (+2.4%) and Healthcare (+2.2%) led gains, while Autos (-1.9%) and Real Estate (-1.8%) lagged due to trade tensions and rising yields. US-EU trade talks continue amid threats of retaliatory tariffs, keeping investors cautious.

Stock & sector movements

What caught our eye

Australian economic growth got off to a slow start in 2025, with real GDP expanding by just 0.2% in the March quarter. This represented a meaningful slowdown from the December 2024 quarter, where our economy grew 0.6%. On the surface, the latest result suggests the economy is running out of steam, however, after digging deeper, its clearly more nuanced. For instance, temporary factors, such as wild weather and supply disruptions, played a big part in holding things back.

Private demand helped hold things together, with consumer spending growing 0.4%, driven largely by promotional activity and discounted goods and services. However, household spending per capita slipped slightly again, a sign that people are still cautious, perhaps understandably so, with inflation easing but cost-of-living pressures still biting. One glimmer of relief? Housing debt servicing costs finally fell for the first time since 2022, thanks to lower interest rates flowing through to repayments. While the cash savings may be modest, for many mortgage holders, it’s a psychological shift back towards some breathing room.

On the business side, however, investment was flat, barely budging with just a 0.1% rise. There’s still a cloud of uncertainty hanging over future plans, not helped by global economic jitters and stubbornly high input costs.

Meanwhile, the export story was a bit of a tug-of-war. While resource exports (such as coal and gas) and services exports like education performed well, the gains were offset by increased imports of capital goods and weaker performance in other service areas. As a result, net exports made no overall contribution to growth.

The farm sector, however, continues to punch above its weight. GDP for the sector jumped 4.8% in Q1, bolstered by strong global demand and elevated prices. But employment in the sector is not keeping pace, pointing to increasing mechanisation or simply fewer human hands needed.

What was notable, and something that has received increased attention, was public spending. The public sector has arguably propped up our economy over the past year or so. In the March 2025 quarter, it didn’t. In fact, public demand actually detracted -0.1% from the overall economy.

Overall, the Australian economy continued to squeeze out below trend growth. While some transitory effects muddied the result, it’s clear that low productivity and uncertainty weighed on the economy. The good news being that this may give the RBA even more ammunition to cut interest rates further and more quickly in the second half of 2025.

The week ahead

The Australian market is set to digest key economic indicators, including the Westpac Consumer Confidence Index and NAB Business Confidence figures, both scheduled for release today (10 June). These data points will offer insights into household and business sentiment, and may influence expectations around future interest rate decisions by the RBA.

Overseas, markets are focused on key economic data, including the US jobs report and China’s trade and inflation figures, both of which could shape monetary policy outlooks. Investors are also watching a corporate update from Oracle, which is set to report Q4 earnings on Wednesday.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 10 years of industry experience in accounting and investment advisory roles.

Ryan is our Portfolio Manager, bringing over 15 years of experience in managing multi-asset investment portfolios with a specialisation in fundamental equity analysis.