Cutcher's Investment Lens | 26 - 30 May 2025

Wade Johnson & Ryan Thompson

02 June 2025

02 June 2025

minutes

Weekly recap

What happened in markets

The Australian sharemarket managed to climb again last week, despite broadly lower commodity prices, which held our miners back. Key detractors were Mineral Resources (-7.0%), Rio Tinto (-3.7%) and Newmont (-2.6%). Risk sentiment was still on, however, helped along by lower bond yields and positive international developments. Technology and Consumer Discretionary stocks were the main winners, with noteworthy gainers being Block (+6.6%), Life360 (+5.6%), WiseTech (+7.1%) and Webjet (+6.1%).

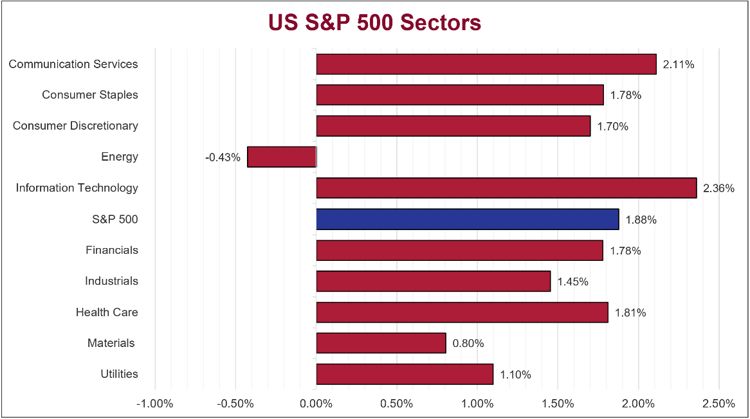

The US sharemarket rebounded last week, driven by gains from big tech, insurers and banks. Risk sentiment improved, evidenced by a lower gold price. Treasury yields fell and the US Dollar strengthened, which also buoyed equities. Unsurprisingly, trade policy dominated headlines. A US court struck down key Trump-era tariffs, but an appeals court kept them in place, prompting the White House to seek alternative legal authorisation. Treasury Secretary Bessent noted US-China talks were stalled, while Trump accused Beijing of violating easing agreements amid delays in rare earth exports. From a corporate news perspective, NVIDIA’s (+2.9%) first quarter 2025 earnings result was the highlight, with better-than-expected results and guidance, even despite a US$2.5 billion hit from China-related embargoes.

The European sharemarket also finished higher last week, as investors became more comfortable with tariff related news. Notably, the STOXX Europe 600 provided its highest monthly gain since 1990, up +4.5% in May. Sectors such as Real Estate and Industrials outperformed, benefitting from lower yields, defense spending optimism and AI-linked demand. The reversal of Trump’s proposed 50% tariff on European Union goods also renewed investor risk appetite and boosted European sharemarkets. Meanwhile, from an economic perspective, Eurozone inflation cooled, with France, Spain and Italy printing CPI below +2.0%, which bolstered expectations for another 0.25% interest rate cut from the European Central Bank this week.

Stock & sector movements

What caught our eye

Few companies command global attention quite like NVIDIA does right now. Many investors were anxious ahead of its Q1 2025 result last week, given the increased focus on company valuations, US tariffs and Chinese export controls.

So how was the result? Much better than feared! NVIDIA kept momentum, with revenue surging 69.2% year-on-year to US$44.1 billion and net income jumping 26.2% to US$18.8 billion. For investors, including Cutcher & Neale clients holding our International Shares Model, where NVIDIA was original purchased in 2020, this latest result was welcome news. Interestingly, as an aside, it was recently reported that Australian billionaire James Packer alone holds around $250 million in NVIDIA's stock.

After a volatile few months, NVIDIA's strong earnings have calmed nerves, especially following the debut of China’s DeepSeek Artificial Intelligence (AI) model earlier this year. That development, combined with escalating US export restrictions, at one point wiped nearly US$1 trillion off NVIDIA’s market cap.

Yet, NVIDIA's charismatic CEO, Jensen Huang, didn’t flinch. He’s been bullish on the future, likening AI infrastructure to utilities like electricity and the internet. The latest driver of excitement? Physical AI, including autonomous machines that can perceive, understand and act in the real world. Huang calls this the ‘next frontier’ and a potential multi-trillion dollar opportunity.

Markets clearly liked what they heard. NVIDIA's share price climbed 3.3% following the results, giving the broader market a nudge higher, despite whiplash from court rulings on Trump-era tariffs. Big-name US tech firms, Microsoft, Amazon, Google, and Meta, are still spending aggressively on NVIDIA hardware, underlining the company’s central role in the AI arms race.

But NVIDIA is not out of the woods yet. The company continues to navigate intensifying scrutiny from US lawmakers. US Senators recently slammed NVIDIA's plans for a new facility in Shanghai, calling it a potential security threat. Their concern is that even without advanced chips being developed there, the office could become a backdoor for Chinese access to cutting-edge AI capabilities.

At the same time, NVIDIA did take a bit of a financial hit from restrictions that were designed to limit China’s tech advancement. It couldn’t ship US$2.5 billion worth of its H20 processors to China and wrote down US$4.5 billion in inventory. With this in mind, it makes the chipmaker’s latest quarterly result beat even more impressive. Though, Huang warned that excluding China may backfire by making its AI developers more competitive abroad, a controversial but increasingly shared view in global tech circles.

So where does that leave us as investors? NVIDIA's growth story remains compelling, particularly in AI and data centres. Its first-quarter sales from this segment alone soared 73% year-on-year. But the geopolitical chessboard adds a layer of complexity that can’t be ignored. We’ll be watching closely to see if regulatory pressures and geopolitical headwinds eventually dampen NVIDIA's momentum.

The week ahead

In Australia, a handful of economic indicators are scheduled to be released. The standouts will be Household Spending in April and the National Accounts data, where we will get the March quarter GDP print.

Internationally, the Bank of Canada and European Central Bank will both meet and are expected to cut their key policy rates by 0.25%. Meanwhile, US non-farm payroll jobs data for May will be a critical gauge to understand how employment is holding up given tariff uncertainty.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 10 years of industry experience in accounting and investment advisory roles.

Ryan is our Portfolio Manager, bringing over 15 years of experience in managing multi-asset investment portfolios with a specialisation in fundamental equity analysis.