Cutcher's Investment Lens | 5 - 9 May 2025

Wade Johnson & Ryan Thompson

12 May 2025

12 May 2025

minutes

Weekly recap

What happened in markets

The Australian sharemarket experienced its first weekly decline since early April as banks failed to offset deep losses at the start of the week. The ASX 200 rose 0.5% on Friday, however finished the week down 0.1%, driven by underwhelming results from Westpac and ANZ. Optimism returned later in the week, with Macquarie shares gaining 3.8% after reporting a near 6% rise in full-year profit, and Commonwealth Bank rising 0.9%. Energy stocks rallied in line with stronger oil prices, with Woodside up 1.4%, while miners slipped despite firmer iron ore futures, with BHP down 1.0%.

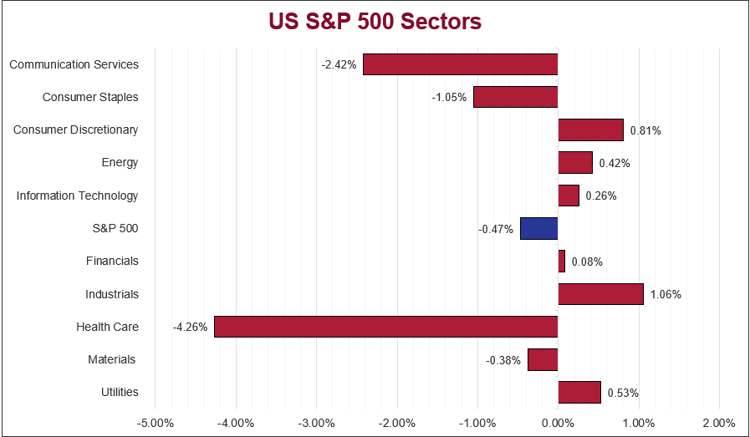

US sharemarkets traded lower last week, with the S&P 500 retreating from recent highs after a nine-day winning streak since the drop following Trump’s reciprocal tariff announcement. Broader market breadth was positive, with the S&P Equal Weight Index outperforming the S&P 500 by 0.9%. Outperformers included Industrials (+1.0%), Consumer Discretionary (+0.8%) and Utilities (+0.4%), while Health Care (-4.3%) and Communication Services (-2.4%) lagged. Sentiment increased due to signs of trade de-escalation, as the US and UK reached a framework deal, while trade discussions with China took place over the weekend. The Fed held rates steady at 4.25 - 4.50%, with Federal Reserve Chair Jerome Powell offering slightly hawkish takeaways on future cuts, despite rising inflation and unemployment risks. Gold rose 2.0%, and oil climbed 0.4% despite an OPEC+ production boost.

European sharemarkets rallied for a fourth consecutive week, with the STOXX Europe 600 advancing and Germany’s DAX setting a new record high. Momentum was driven by easing trade tensions, as the US and UK announced reaching a deal reducing tariffs on British cars and metals, resulting in Autos & Parts leading sector gains (+2.9%). The Bank of England cut rates by 0.25% in a divided vote, citing a cautious approach to the gradual easing of policy framework, while Sweden’s Riksbank signalled future cuts amid easing inflation pressures. STOXX Europe 600 earnings fell 4% year-on-year but remains ahead of consensus by 6% despite 1Q’s earning results. Outperformers also included Banks (+2.4%) and Energy (+2.3%), while Health Care (-3.4%) and Real Estate (-0.9%) underperformed amid sector-specific headwinds and rising bond yields.

Stock & sector movements

What caught our eye

The 1Q 2025 earnings season for US S&P 500 companies is now well underway, with 90% of companies having reported so far, and the results are giving us plenty to think about. Investors entered this earnings season with cautious optimism, and we’re pleased to see the positive trend continuing, with 78% of reports being better-than-expected.

Currently, the percentage of companies beating analysts’ earnings expectations are hovering around recent historical averages. Moreover, companies are delivering earnings results that are about +8.5% higher-than-expected, which exceeds the 10-year average of +6.9%.

This strong performance has boosted the overall earnings growth rate of the S&P 500. At the end of March, the market expected a decent +7.2% earnings growth for 1Q, but as companies reported better-than-expected results, that forecast has increased to an impressive +13.4%. If this holds, it will mark the second consecutive quarter of double-digit earnings growth for US companies.

Health Care, Communication Services, Information Technology, and Utilities sectors have been the standout performers, reporting the strongest year-over-year earnings growth. On the flip side, the Energy sector continues to struggle, showing the most significant decline this quarter.

Despite strong 1Q results, some investors still remain cautious about 2Q 2025, influenced by the continued economic uncertainty caused by tariffs and fears of a broader slowdown. Analysts reduced their 2Q earnings forecasts for S&P 500 companies by a larger-than-average margin of -2.4% during April, exceeding the historical norm of -1.8% across the past 20 years.

The Energy sector has seen the most severe downgrades, followed closely by the Materials sector. It’s worth mentioning that the Investment Committee has been and remains underweight these sectors when it comes to our best international stock ideas.

Looking ahead, the broader expectations for the full year have also declined, however, remain quite healthy. Analysts lowered their calendar year 2025 earnings forecast by -3.1% since the start of the year. Even with these tempered expectations, the earnings outlook for the remainder of the year remains positive, with the market still expecting a full year 2025 earnings growth rate of +9.3% year-on-year.

From a valuation perspective, the S&P 500 trades at a forward price-to-earnings (P/E) ratio of 20.5x, slightly above its historical averages. This is not particularly concerning in our eyes, as the makeup of the market has changed quite dramatically over the past 5 to 10 years. For example, technology companies justifiably command higher valuations for their increased growth potential. The Technology sector made up 22% of the S&P 500 5 years ago and now sits at about 32%! Naturally, this puts upward pressure on the index’s total P/E ratio, which is often overlooked.

As we move deeper into the earnings season, we’ll continue to monitor developments closely, especially given the ongoing tariff challenges. These periods of heightened uncertainty often create investment opportunities and pitfalls for investors. The Investment Committee will remain informed and ready to act if necessary.

The week ahead

Key economic data is scheduled to be released in the coming week in Australia, namely consumer confidence, lending indicators figures, Wage Price Index and unemployment rate, with an expected focus on the Federal election and trade developments.

Markets will be closely monitoring the US’s April inflation data. The April Consumer Price Index figure will be released on Tuesday, with the attention placed on the potential inflationary impact of Trump’s tariffs.

Company Reports

Wade is the head of the Investment Services division at Cutcher & Neale and has over 10 years of industry experience in accounting and investment advisory roles.

Ryan is our Portfolio Manager, bringing over 15 years of experience in managing multi-asset investment portfolios with a specialisation in fundamental equity analysis.