Economic Trifecta

Wade Johnson, Partner, Investment Services

07 December 2023

06 March 2024

minutes

Snapshot

Global financial markets finished higher in November. This was primarily due to growing investor confidence that the US Federal Reserve is nearing, or has completed, its cycle of interest rate hikes in the largest global economy.

This resulted in an 'economic trifecta':

- No further interest rate hikes by the Fed

- Controlled and decreasing inflation

- Growing expectations of a soft economic landing

Consequently, bond yields experienced a decline, with the 10-year Australian Government Bond yield dropping from 4.95% to 4.49%, and the 10-year United States Government Bond yield falling from 4.99% to 4.33% during the month.

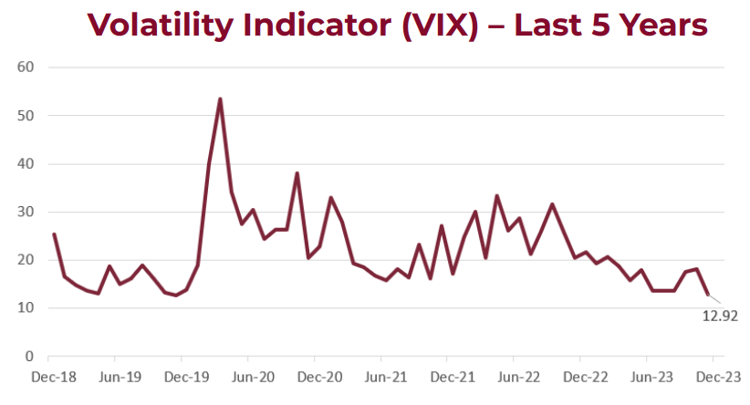

The CBOE Volatility Index (VIX), a measure of market volatility, also saw a significant decrease, reaching levels not seen since January 2020.

In early November, the US Federal Reserve maintained the cash rate at 5.25–5.50%, with Fed Chair Jerome Powell acknowledging the ongoing consideration of rate hikes.

Powell emphasised the possibility of future interest rate increases as the Fed closely monitors economic developments leading up to the next policy meeting on 12–13 December.

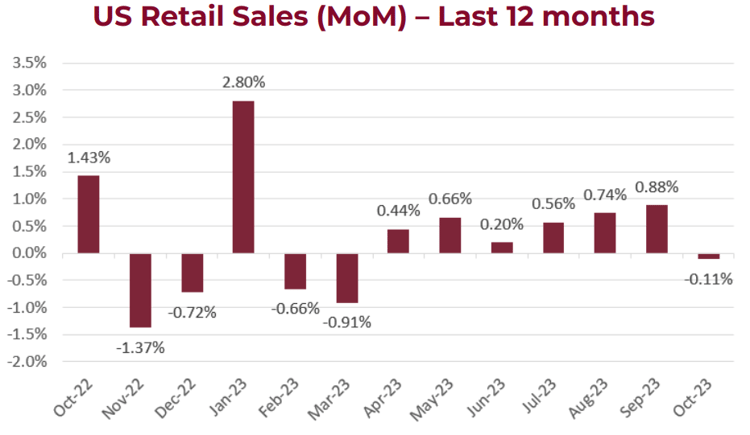

By mid-November, data from the Commerce Department indicated a 0.1% decline in US Retail Sales for October. This suggests a potential economic slowdown influenced by the Federal Reserve's efforts to combat inflation through higher interest rates.

This downturn affected various sectors, including department, hardware, and furniture stores. Major retailers such as Target and Home Depot reported declining sales, reflecting changes in consumer behaviour amid economic pressures.

Additional data, such as weak purchasing manager surveys, a slight uptick in the unemployment rate, and increased credit card balances and delinquency rates, painted a less optimistic economic picture.

Towards month-end, in response to declining inflation and weaker-than-expected economic data, investor anticipation increased for the Fed to initiate interest rate cuts. There is a 60% probability of a 0.25% cut priced into markets by March 2024.

While concerns about an impending recession still exist, most investors now expect the Fed to implement modest rate cuts to facilitate a soft economic landing.

This shift in market sentiment contrasts with the preceding three months when longer-term bond yields rose, expectations for rate cuts diminished, and stocks declined. Despite Fed officials asserting that rate cuts are not imminent and they're adhering to a "higher for longer" approach, the market is currently pricing in lower rates, even without a recession.

The key question now is, who will make the first move — the Fed or the economy?

Key Stocks

Uber Technologies

Cutcher & Neale International Shares Model

Uber is a well-known, multinational ride-sharing and transportation platform that connects users with drivers through a mobile app. Founded in 2009, Uber revolutionised the transportation industry by offering a convenient and on-demand alternative to traditional taxis. The platform operates in numerous cities worldwide, providing a range of services, including ridesharing, food delivery, and freight transportation.

The company has experienced significant growth over the last couple of years and is becoming a part of its customers' everyday lives. The company continues to gain traction in more markets, and its recent earnings reports showed an increase in gross bookings and deliveries, ultimately placing Uber as a core holding in the Cutcher & Neale International Shares Model.

Boston Scientific

Cutcher & Neale International Shares Model

Boston Scientific is a global medical technology company that specialises in the development and manufacturing of medical devices. Established in 1979, the company is known for its innovations in areas such as cardiovascular, neuromodulation, and endoscopy technologies. Boston Scientific's products are designed to improve patient outcomes and enhance the efficiency of medical procedures across a wide range of healthcare disciplines.

This company continues to see revenue growth, with an 11% increase year-over-year and most of its product categories seeing double-digit growth. The Investment Committee added this healthcare sector company to the portfolio in prior months to take a more defensive stand within it as volatility across global markets continues.

Uber Technologies

Cutcher & Neale International Shares Model

Uber is a well-known, multinational ride-sharing and transportation platform that connects users with drivers through a mobile app. Founded in 2009, Uber revolutionised the transportation industry by offering a convenient and on-demand alternative to traditional taxis. The platform operates in numerous cities worldwide, providing a range of services, including ridesharing, food delivery, and freight transportation.

The company has experienced significant growth over the last couple of years and is becoming a part of its customers' everyday lives. The company continues to gain traction in more markets, and its recent earnings reports showed an increase in gross bookings and deliveries, ultimately placing Uber as a core holding in the Cutcher & Neale International Shares Model.

Boston Scientific

Cutcher & Neale International Shares Model

Boston Scientific is a global medical technology company that specialises in the development and manufacturing of medical devices. Established in 1979, the company is known for its innovations in areas such as cardiovascular, neuromodulation, and endoscopy technologies. Boston Scientific's products are designed to improve patient outcomes and enhance the efficiency of medical procedures across a wide range of healthcare disciplines.

This company continues to see revenue growth, with an 11% increase year-over-year and most of its product categories seeing double-digit growth. The Investment Committee added this healthcare sector company to the portfolio in prior months to take a more defensive stand within it as volatility across global markets continues.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 15 years of industry experience in accounting and investment advisory roles.

Wade guides his division on the belief that investment portfolios should be built on transparency and flexibility. His expertise focuses on direct portfolio exposure to both Australian and Global Investment markets.

.jpg?width=352&name=NEW%20TEMPLATE%20-%20Investment%20SnapShot%20Header%20-%20January%202024%20(2).jpg)