Navigating Your Finances as an International Medical Graduate in Australia

Sav Angi

30 April 2025

30 April 2025

minutes

Starting your medical career in Australia as an International Medical Graduate (IMG) comes with plenty of exciting opportunities — but it also introduces a range of financial considerations that can feel overwhelming at first.

From tax obligations to lending strategies, it's important to have a clear understanding of the Australian financial landscape to set yourself up for success.

Here’s a quick guide to help you get started.

Understanding Your Tax Obligations

- Getting your Tax File Number (TFN):

Before you earn income in Australia, you’ll need to apply for a Tax File Number (TFN). This unique number identifies you in the tax system and is essential for lodging your tax returns.

- Know the Financial Year:

The Australian financial year runs from 1 July to 30 June. This is the period used to calculate your tax obligations each year.

- Medicare Levy & Entitlement Statement:

If you’re in Australia on a visa, such as a subclass 485, you are responsible for your own health costs and you are not eligible for Medicare, unless your home country has a reciprocal healthcare agreement with Australia. You will also need to apply for a Medicare Entitlement Statement via Services Australia.

- Tax resident:

The 183-day test is commonly used to determine whether you’re a resident for tax purposes. If you’re in Australia for more than half the income year, you will be a resident of Australia for tax purposes.

Being classed as a resident affects the rate and scope of your tax obligations.

- Overseas income and deductions:

Foreign income: If you’re a resident for tax purposes, you may need to declare your worldwide income, even if it's earned overseas. You will get a credit for tax paid on the income overseas, but may have to pay additional tax in Australia depending on the rate of tax in your home country.

What you can’t claim: The cost of your Visa, and any money spent on clinical observerships/elective rotations prior to getting a job.

What you can claim: Scrubs and laundering of scrubs, your AHPRA registration, subscriptions to AMA, study courses related to your field of work, work-related usage percentage of items such as mobile phone or internet, equipment such as stethoscopes, donations to DGR Charities, fees for preparing your tax return, and voluntary super contributions.

Health Cover and Superannuation

- Health Insurance:

If you’re in Australia on a working visa, such as a subclass 485, you are responsible for your own health costs and you are not eligible for Medicare. To cover your health costs you should take out Overseas Visitor Health Cover (OVHC). This is usually offered by companies such as Allianz or the usual PHI’s.

- Superannuation contributions:

While working in Australia, your employer must contribute to your superannuation — currently at least 11.5% of your base salary. Some employers, like Qld Health, contribute more (12.75%). You can also boost your super through salary sacrifice or voluntary contributions to reduce your taxable income.

If you permanently leave Australia, you can apply for a Departing Australia Superannuation Payment (DASP). Tax will be withheld — rates vary from nil for tax-free components to 35%, 45%, or 65% depending on the taxable portion.

Lending Strategies Tailored for IMGs

Australia’s lending environment can be complex, particularly for new residents. Thankfully, there are flexible lending options available to IMGs to help build your financial future.

- Lending policies you can access as an IMG:

- Up to 95% Loan-to-Value Ratio (LVR) with no Lenders Mortgage Insurance (LMI)

- Use of 100% of overtime income in borrowing assessments

- 35-year loan terms to maximise affordability

- Cross-securitisation and accelerated property portfolios for savvy investors

- Debt reallocation strategies to improve cash flow and tax outcomes

- Future income projection taken into account by select lenders

- The impact of your visa or residency status:

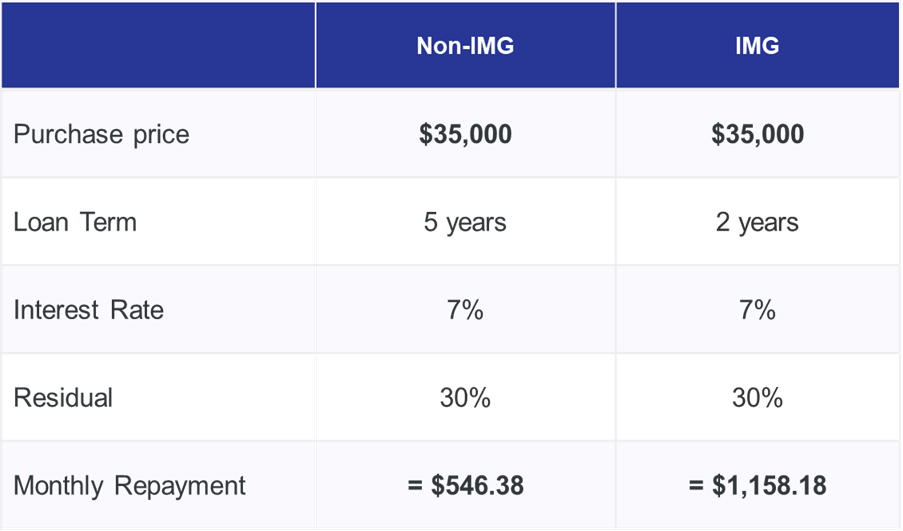

Your visa directly affects your ability to borrow. Some lenders align vehicle loans with the length of your visa, which can impact your repayment terms and future borrowing power. Below is an example of how these terms can affect your repayments.

- Beware of hidden costs:

Small decisions — like taking out a car loan — can reduce your borrowing power by as much as $70,000 when applying for a home loan. It's worth seeking professional advice to understand what you're leaving on the table.

How we can help

As an IMG, you're in a unique position — both professionally and financially. With the right advice and tailored strategies, you can navigate tax, super, and lending with confidence. At Cutcher & Neale, we specialise in supporting medical professionals just like you to make smart, informed decisions at every stage of your journey in Australia.

Sav Angi brings over 35 years of experience in accounting and financial planning, with a focus on wealth creation and asset protection. Trusted, empathetic, and strategic, he works closely with clients to develop tailored financial solutions and provide guidance that aligns with both personal and business goals.