Gold As A Safe Haven

Wade Johnson, Partner, Investment Services

09 May 2023

06 March 2024

minutes

Historically, gold has been considered a safe haven asset in times of uncertainty.

It is true that in times such as the Global Financial Crisis the price of the precious metal surged as investors sought to protect their wealth. There is evidence that gold can serve as a hedge against a market meltdown and/or high inflation. However, like most assets, the price of gold is ultimately determined by market forces of supply and demand.

As such, a position taken in gold within a portfolio could be considered imperfect ‘insurance’ against adverse market conditions. However, like all insurance, it can come at a cost.

Let's review the pros and cons:

Points For

- Negative or low correlation to other asset classes, which means it is less exposed to market risk than stocks and bonds.

- Positive correlation to inflation, meaning in the past its value has broadly risen and fallen in tandem with inflation.

- Gold is resistant to purchasing power erosion. The precious metal can only be dug up from the earth, it cannot be ‘printed’ like money, so its relatively fixed supply helps protect its value.

Points Against

- Ultimately, the price and value of gold are driven primarily by speculation; the precious metal is only worth what someone else is willing to pay for it.

- Gold is a non-productive and non-yielding asset. This means there’s an opportunity cost to hold it over other assets. In times of higher interest rates, this opportunity cost is greater, and vice versa.

Like most commodities, gold prices have been positively correlated with inflation and maintained a low/negative correlation to stocks in the short to medium term. There is no economic law that these relationships must hold or will continue into the future. They are likely driven by investor behaviour as, in times of uncertainty (e.g. high inflation), investors sell down stocks and purchase gold.

How To Invest In Gold

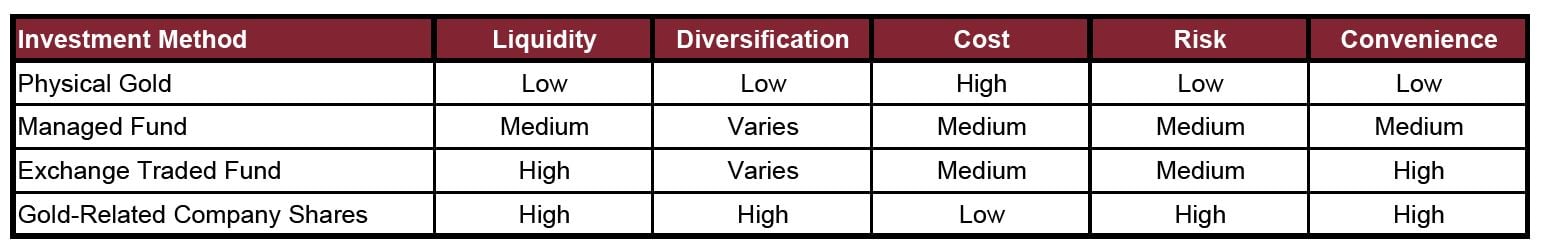

There are several ways to gain exposure to gold within an investment portfolio. See below for a comparison of their relative investment features.

Interested in including gold in your investment portfolio? Speak to one of our Investment Advisors today about your options and how gold could benefit you as an asset.