Indexation of the general transfer balance cap and how this may affect you

Cutcher & Neale Accounting and Financial Services

08 March 2021

08 March 2021

minutes

The transfer balance cap (“TBC”), introduced on 1 July 2017, limits the total amount of superannuation assets that a member can transfer to the tax-free retirement phase via an account-based pension.

It has now been confirmed that from 1 July 2021, the general TBC will be indexed to $1.7 million which will result in there no longer being a single cap that applies to all individuals. An individual’s entitlement to the indexation and ultimately their personal TBC will be dependent on their highest recorded transfer balance account. It is important to note this is different to an individual’s current or 30 June 2021 transfer balance account. An individual’s ability to increase their personal TBC will work in the following manner:

- If you start an Account Based Pension for the first time on or after 1 July 2021, you will have a personal TBC of $1.7 million;

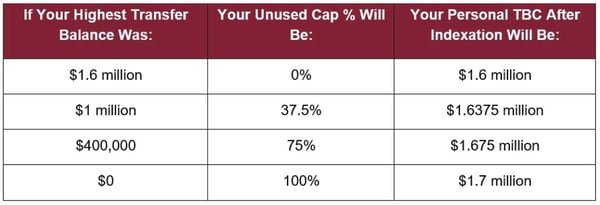

- If you have partially utilised your cap before 1 July 2021, you will only have a proportional entitlement to the $100,000 increase and this will be based on the highest ever balance recorded in your transfer balance account. Your personal TBC will fall somewhere between $1.6 million and $1.7 million;

- If you had a transfer balance account balance of at least $1.6 million at any time prior to 1 July 2021, you will not be entitled to any of the $100,000 increase i.e. your personal TBC will remain at $1.6 million.

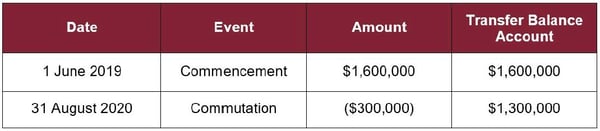

Example:

Mark commenced an account based pension (ABP) in his SMSF on 1 June 2019 with $1.6 million. On 31 August 2020, he partially commuted his ABP for an amount of $300,000.

As seen in the above table, although Mark’s transfer balance account is $1.3m at 30 June 2021, he will not be entitled to any increase in his personal TBC as the highest recorded transfer balance account was actually $1.6m in 1 June 2019.

The below table outlines what an individual’s personal TBC after indexation will be, based on their highest recorded transfer balance:

The complex nature of the calculation of the proportional TBC indexation means that extra care must be taken when calculating your personal TBC and starting new account based pensions after 1 July 2021, otherwise you might inadvertently trigger an excess transfer balance determination from the Australian Taxation Office (ATO).

If you would like to discuss this further with one of our superannuation specialists, please contact the Superannuation team.