Let the Doves Fly and Bulls Run

.jpg)

Wade Johnson, Partner, Investment Services

01 February 2024

06 March 2024

minutes

Snapshot

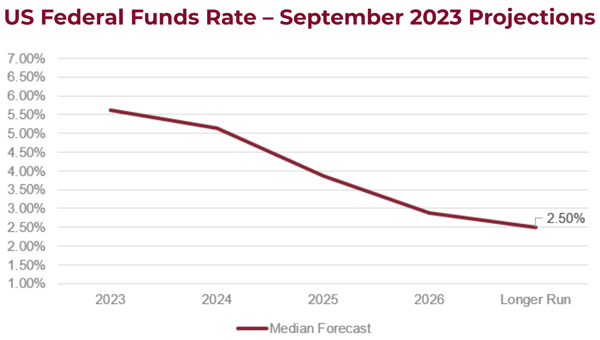

Global financial markets finished higher in December as the US Federal Reserve all but confirmed they are done raising rates and forecast pre-emptive rate cuts during 2024. The ‘Dot Plot’ in the Fed’s latest economic projections suggests rates will be cut three times or by 0.75% this year.

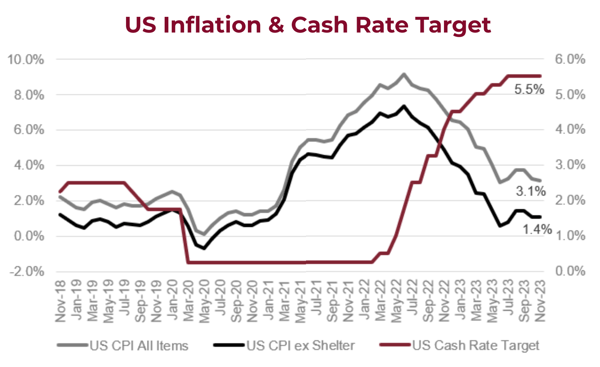

The Fed's decision to pivot was driven by lower inflation readings over the past few months, notably a 3.1% increase in consumer prices in the United States for November. The rise was mitigated by the decline in prices for durable goods such as used cars, furniture, and electronics over the previous year.

This development has fostered optimism among the Fed and global investors that specific inflation measures could return to the Federal Reserve's 2% target in early 2024.

However, interest rate markets may be overly optimistic, having priced in over 1.5% in rate cuts for 2024. Shelter costs, constituting 35% of the Consumer Price Index (CPI), remain a key obstacle to achieving the inflation target. These costs rose by 6.5% in the November to November 12-month period. Excluding shelter costs, inflation would have been a more moderate 1.4% during that period.

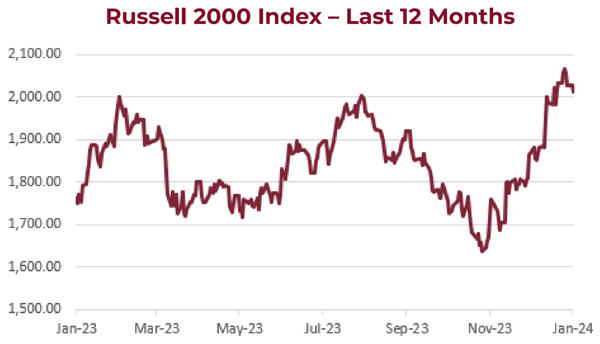

Consequently, shares in small companies (or small caps) experienced a significant increase in December, with the Russell 2000 Index rising by approximately 12%.

Small caps tend to be more economically sensitive than larger firms as their revenue streams are less diversified. Such firms usually hold more debt, and that debt costs more due to its perceived riskiness. This means they benefit significantly from lower interest rate expectations.

Bond yields also underwent notable adjustments. The 10-year Australian Government bond yield dropped from 4.41% to 3.96% and the 10-year United States Government bond yield fell from 4.36% to 3.88%.

Earlier in the month, the Reserve Bank of Australia (RBA) maintained interest rates at 4.35% following a 0.25% increase in November. This decision was attributed to concerns about slower-than-expected progress in returning inflation to the 2-3% target range.

Some market participants have questioned the November rate rise, considering weaker-than-expected retail sales, inflation, and job advertisement data in October and November. The RBA, however, justified it in December by pointing to stronger-than-expected economic growth in the first half of the year, elevated underlying inflation, and a tight labour market.

In conclusion, while the Fed has room to normalise interest rates during 2024 due to falling inflation, the RBA remains firmly on hold until inflation shows more evidence of returning to target. Nevertheless, the monetary policy announcements by each central bank will remain crucial for investors this year.

The Fed’s next meeting is scheduled for 30-31 January, while the RBA’s next meeting is set for 5-6 February.

Key Stocks

.png?width=201&height=60&name=JPMorgan_Chase-Logo.wine%20(1).png)

JPMorgan Chase & Co

Cutcher & Neale International Shares Model

JPMorgan Chase & Co is a global financial services company and is the largest bank in the United States.

The banking giant has over US$2 trillion in assets under management worldwide, offering services ranging from investment and commercial banking to private equity and asset management.

The Investment Committee recently added the company to the Cutcher & Neale International Shares Model. They identified JPMorgan to be a company that will likely benefit from the Federal Reserve's pivot on interest rates and increased economic and investment activity.

James Hardie Industries

Cutcher & Neale Australian Shares Model

James Hardie Industries is an Australian-based manufacturer of building materials specialising in fibre cement products. James Hardie has a strong global presence, being exposed to the United States (74%) and Australia (10%), along with Europe and Asia.

The company is in a strong position for when the property market begins to recover and has been investing in its marketing and brand position in the meantime.

The Investment Committee recently added James Hardie Industries back to the Australian Shares portfolio. This is due to a recovery in housing conditions — especially in the US — as inflation continues its downward trajectory

and interest rates have peaked. These circumstances are expected to lead to renewed building activity and a subsequent increase in the sale of James Hardie building products.

.png?width=201&height=60&name=JPMorgan_Chase-Logo.wine%20(1).png)

JPMorgan Chase & Co

Cutcher & Neale International Shares Model

JPMorgan Chase & Co is a global financial services company and is the largest bank in the United States.

The banking giant has over US$2 trillion in assets under management worldwide, offering services ranging from investment and commercial banking to private equity and asset management.

The Investment Committee recently added the company to the Cutcher & Neale International Shares Model. They identified JPMorgan to be a company that will likely benefit from the Federal Reserve's pivot on interest rates and increased economic and investment activity.

James Hardie Industries

Cutcher & Neale Australian Shares Model

James Hardie Industries is an Australian-based manufacturer of building materials specialising in fibre cement products. James Hardie has a strong global presence, being exposed to the United States (74%) and Australia (10%), along with Europe and Asia.

The company is in a strong position for when the property market begins to recover and has been investing in its marketing and brand position in the meantime.

The Investment Committee recently added James Hardie Industries back to the Australian Shares portfolio. This is due to a recovery in housing conditions — especially in the US — as inflation continues its downward trajectory

and interest rates have peaked. These circumstances are expected to lead to renewed building activity and a subsequent increase in the sale of James Hardie building products.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 15 years of industry experience in accounting and investment advisory roles.

Wade guides his division on the belief that investment portfolios should be built on transparency and flexibility. His expertise focuses on direct portfolio exposure to both Australian and Global Investment markets.

.jpg?width=352&name=Investment%20SnapShot%20Header%20-%20March%202024%20(1).jpg)