Maximise your super by taking advantage of the benefits of compounding

Cutcher & Neale Accounting and Financial Services

01 March 2022

01 March 2022

minutes

Super will likely be the biggest investment you have in your lifetime, after a house, so it makes perfect financial sense to get started early to build this balance.

Adding to your super early in your career can make a big difference to your final super balance at retirement. The compounding benefit of super helps your balance grow over your working life.

In the context of super, over time, investment returns are generated by your fund. These returns grow your investment balance and then this balance continues to be reinvested. The process occurs repeatedly, continually accumulating over your lifetime - hence the term compounding.

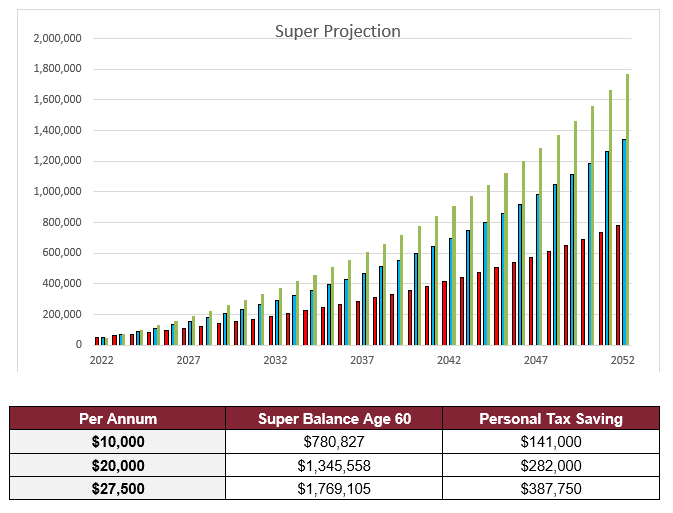

A small regular contribution now could mean a big reward for you at retirement, not to mention the tax savings along the way.

Deductible contributions are taxed at 15% when they are received by your super fund. However, these contributions can be claimed as a deduction in your tax return, resulting in a tax saving at your marginal tax rate (which as you earn more can be as high as 47%).

In addition, your balance steadily accumulates as you get greater returns, primarily because of an ever-increasing capital. While your contributions and rate of return may stay steady, the interest on the interest (or returns on the returns) will enjoy the effects of compounding.

For example, a 30-year-old lawyer who contributes $10,000 per year ($192 per week), will have around $565,000 more in super when they reach age 60 and saved $96,000 in tax overall (assuming 47% tax rate), and personally saved $141,000 in tax assuming 47% tax rate.

Super really is a "no brainer", not only for the compounding benefit on your investment but also the tax concessions available.

If you would like to talk to one of our advisors about how to maximise your super, please do not hesitate to get in touch.